2020-10-16 15:52 |

The Rothschild Investment Corporation has bought 27 bitcoins in share form through Grayscale Bitcoin Trust (GBTC).

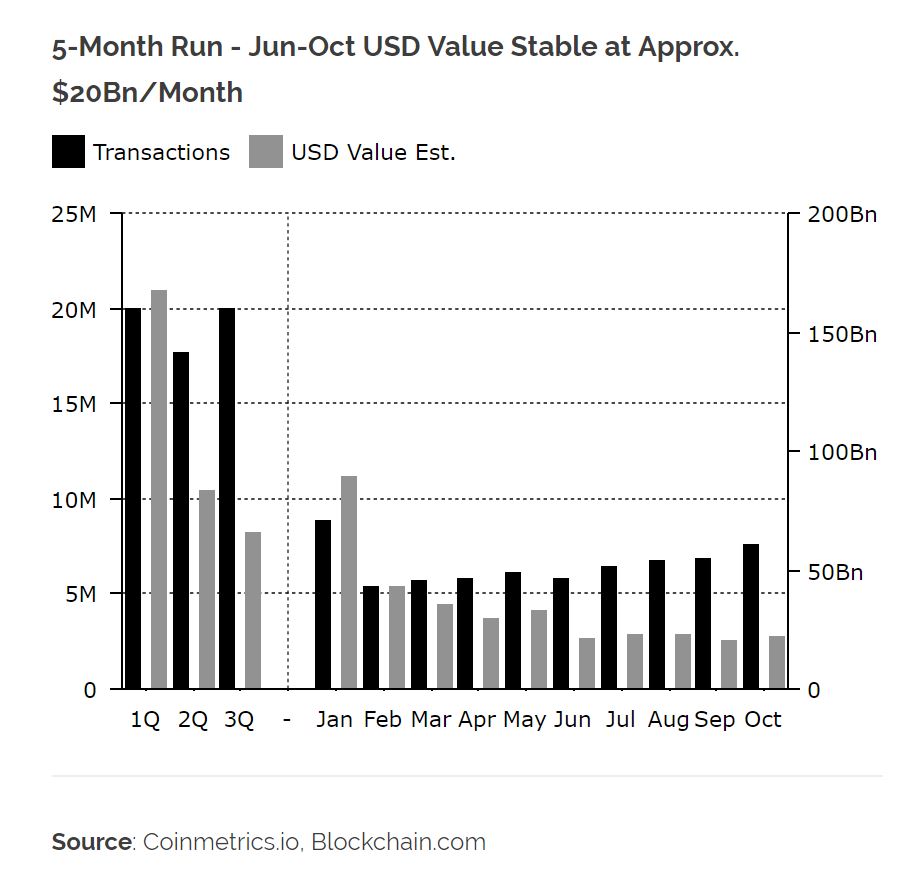

GBTC itself added another 6,937 BTC (worth $72 million) in the past few days after reporting the third straight record quarter with inflows reaching $1 billion.

As of Sept. 2020, Grayscale’s bitcoin holdings reached 450k BTC, representing nearly 2.5% of all Bitcoin supply, as per YCharts.

Rothschild reportedly has $1.4 billion in assets under management, with $235,000 of it held in Bitcoin. This makes them one of the most prominent investment banks to get into bitcoin, which is most likely for their clients.

Other big names like Rockefellers began investing in blockchain and crypto startups back in 2018. Blackrock, with $6.3 trillion assets under management, also started considering diversifying into crypto the year following the bitcoin price top.

It is no surprise given that more and more big money is moving into crypto. The trend has only intensified in 2020 as we saw the likes of legendary investor Paul Tudor Jones buying Bitcoin and companies like Square, MicroStrategy, and Stone Ridge, making it part of their Treasury.

From institutional investors to family offices, company savings, and pension funds, bitcoin is becoming strongly appealing to them as fiat currency continues to devalue.

Bitcoin (BTC) Live Price 1 BTC/USD =11,377.6681 change ~ 0.36Coin Market Cap

210.7 Billion24 Hour Volume

29.58 Billion24 Hour Change

0.36 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD");The post Even The Rothschild's Are Buying Bitcoin; Grayscale’s Holdings Surpass 450k BTC first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|