2026-1-13 01:00 |

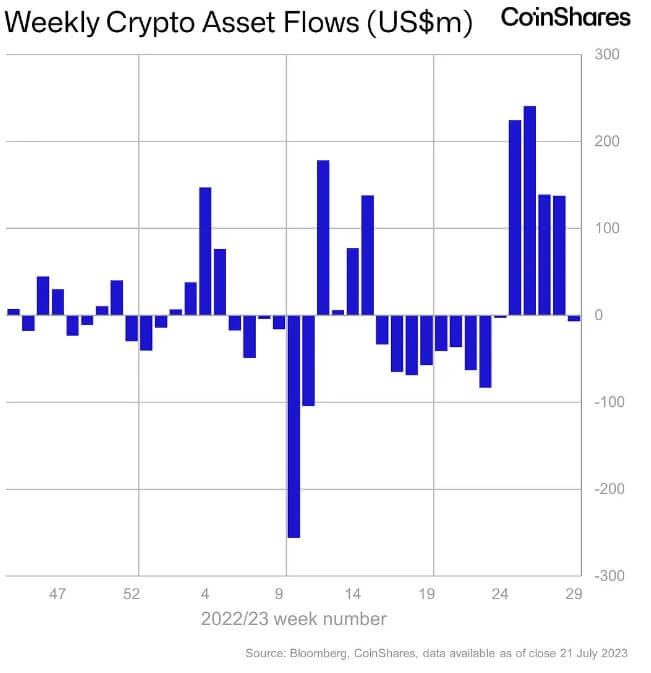

The digital asset landscape has gone through a shocking development over the past week. Particularly, the digital asset flows have seen $454M in cumulative outflows during the past seven days. As per the data from CoinShares’ new report, this development takes place amid the fading hopes for likely Fed rate cuts. The respective swift reversal also indicates the significant impact of the wider monetary developments.

Diminishing Fed Rate Cut Expectations Result in $454M 7-Day Digital Asset OutflowsWith the weekly digital asset outflows hitting $454M, the market participants are having huge concerns. Particularly, the diminishing hopes for the potential Fed rate cuts have played a crucial role in this scenario. Interestingly, this followed a sheer 4-day spree of outflows hitting $1.3B, which almost erased up to $1.5B in inflows witnessed at the beginning of this year.

As the primary catalyst triggering these digital asset outflows, the minimized probability of monetary easing in the near term has prompted investors to decrease digital asset exposure. Such a shift highlights the rising correlation between the conventional macro indicators and crypto markets. Because of this, the caution that prevails across diverse key crypto funds has replaced early-year optimism.

When looking from a local perspective, the U.S. emerged as the single market seeing negative sentiment. Thus, it has posted massive outflows of almost $569M. Contrarily, the rest of the regions displayed resilience as Germany added $8.9M. Additionally, Canada and Switzerland recorded $24.5M and $21M in inflows. This divergence clarifies that the investor sentiment in the case of digital assets is becoming more and more fragmented throughout the worldwide markets. While U.S.-based digital asset investors reacted solidly to the uncertainty related to the Fed, Bitcoin ($BTC) became the key victim of outflows.

Despite Heavy Outflows of $BTC and $ETH, $XRP and $SOL Attracting CapitalAccording to CoinShares’ report, the leading cryptocurrency lost $405M in outflows over the past week. Importantly, short Bitcoin products shed $9.2M, pointing out that the $BTC investors are decreasing leverage as well as speculative positioning. Additionally, Ethereum’s ($ETH) outflows hit $116M. Nevertheless, irrespective of this broadly negative outlook, some altcoins kept attracting capital, with $XRP, $SOL, and $SUI attracting $45.8M, $32.8M, and $7.6M. Keeping this in view, despite the persistent uncertainty, the digital asset industry is showing resilience with mixed results.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|