2025-12-26 17:00 |

The high tide of liquidity that has recently supported Bitcoin prices appears to be receding rapidly. The market is now grappling with significant net outflows, as data confirms that investment flows have turned decisively negative. This shift represents a stark turnaround in market dynamics, where selling pressure is currently overwhelming buying interest across major platforms.

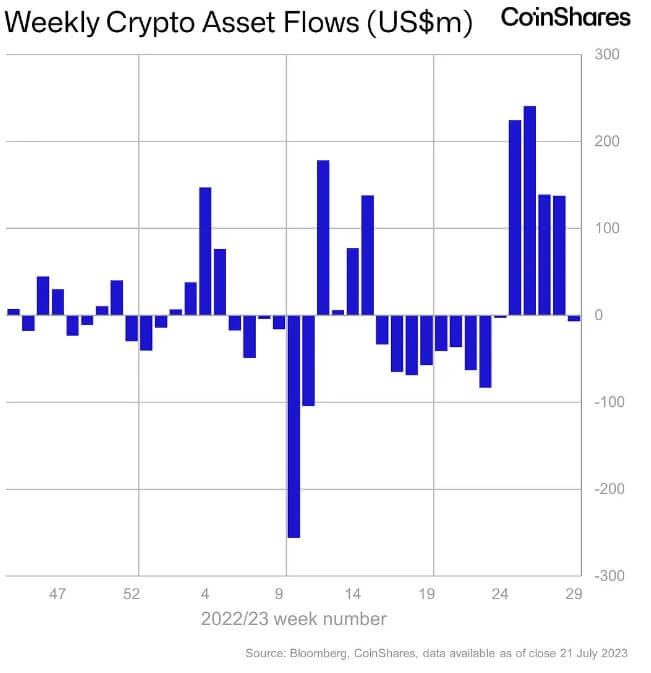

Why Markets Move Before Narratives Catch UpIn an X post, a trader and investor in stocks and crypto, WealthManager, revealed that since December 8th, Bitcoin has recorded approximately $716 million in net outflows. Over the past two weeks, flows have been dominated almost entirely by outflows, reflecting a market that has lost momentum rather than conviction.

Currently, the cryptocurrency market is not the preferred destination for momentum-driven capital. That momentum has rotated into gold, silver, and broader metals, but the rotations are temporary by nature. However, the opportunity remains in crypto, and the momentum will shift back into the sector at some point. “The lower BTC goes, the bigger the opportunity would become,” WealthManager noted.

Analyst Cipher2X has offered an insight into why he is accumulating Bitcoin ahead of 2026. According to Cipher2X, BTC has never waited for perfect conditions to do its most important work. It builds its foundations when liquidity is tight and expectations are low. At this stage, price action is misleading, but the structure is not.

On-chain data has shown that supply is increasingly locked up with long-term holders, while access to BTC through regulated channels is becoming routine rather than exceptional. At the same time, micro uncertainty continues to reinforce BTC’s role as a hedge against policy risk, not as a speculative bet on growth.

This setup is the kind of environment where BTC intends to move sideways, frustrate the traders, and quietly shift ownership from impatient hands to committed ones. Cipher2X explains that the purpose of accumulating BTC isn’t a short-term catalyst, but because the next regime tends to reward those who have positioned early, not those who have reacted late. 2026 isn’t about the hype; it’s about who was already holding the asset.

What Falling Volatility Says About Bitcoin’s MaturityThe Bitcoin chart has shown the implied volatility on the BTC options over the past few years. A full-time crypto trader and investor, Daan Crypto Trades, pointed out that aside from a few short spikes of volatility, there’s a clear trend down on this part. BTC is maturing as its market cap is growing over time, and the market is becoming more institutionalized.

Daan concluded that the days of seeing multiple 10%+ candles in a row are behind us. Presently, if a single 10% move in one day happens, it would already be considered a big exception.

origin »Bitcoin (BTC) на Currencies.ru

|

|