2021-6-22 16:40 |

The crypto market remains in “extreme fear,” with the Crypto Fear and Greed Index having a reading of 23, albeit still better than 10 from last month.

The latest reason for fear in the market came after the Bitcoin price dropped to about $31,750, and Ether went to $1,890.

The fall in BTC price below $33,000 has social sentiments on Twitter in a downturn and at its lowest level in the past year, as per Santiment data.

Funding rates are negative all around as 173,602 traders got liquidated in the last 24 hours.

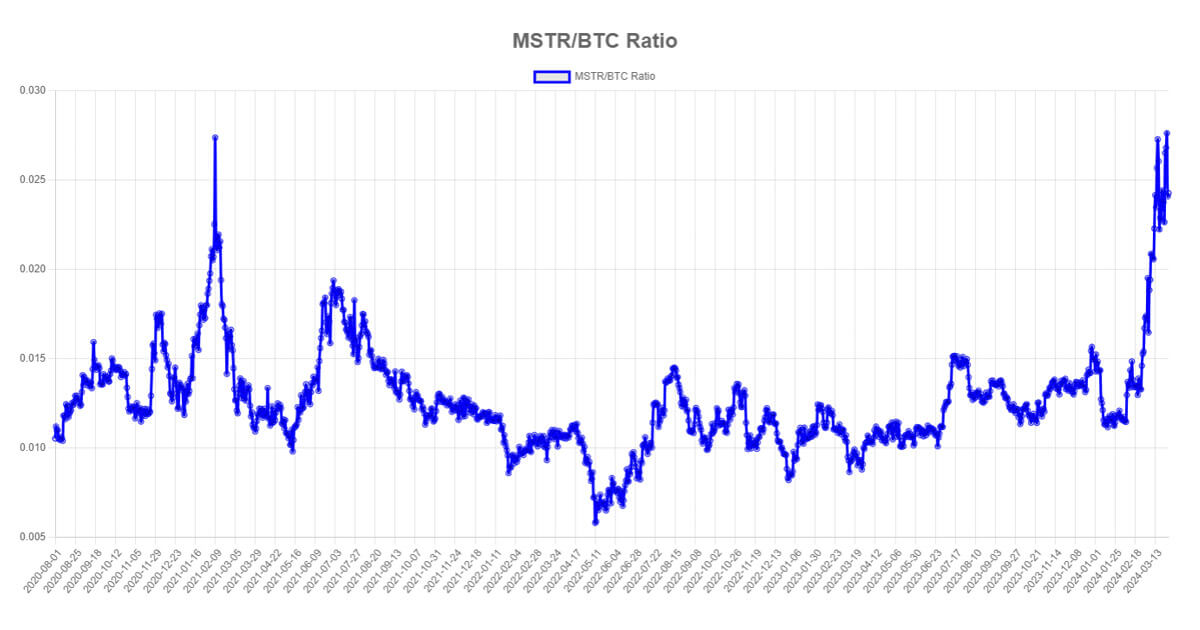

And with the latest sell-off, the “extreme divergence between basis on CME futures and futures on crypto native exchanges, which has now pretty much reconverged,” noted trader CL of eGirl capital.

The annualized yield on Bitcoin futures on BitMEX is -8.2%, -3.42% on OKEx, -2.47% on Huobi, -2.01 on Binance, and -1.68% on Bybit, as of writing.

CL actually expects “a lifetime buy opportunity in bitcoin dip” with September futures to get “nuked to backward soon,” which are already 0.1% APR on FTX.

Backwardation is back as CME #bitcoin futures basis turns negative in three-months bucket pic.twitter.com/iai8w0NYMP

— skew (@skewdotcom) June 21, 2021

Over the past couple of months, the market has been seeing a lot of ups and downs, and it has sent Bitcoins’ realized volatility to 116, the highest since April 2020, and for ETH, it’s 260, the highest since July 2019.

Given that “volatility *always* reverts to the mean,” the price action is expected to subside; however, trader and economist Alex Kruger notes that direction-wise, the price can go either way, especially given the market deciding the Fed is going hawkish.

In the meantime, inflows are still almost nowhere to be seen in Bitcoin funds but outflows are no more occurring either.

The number of BTC held by various funds has started to see an uptick after falling for more than a month, ever since May 12 when the sell-off started, but it is barely visible yet.

At their peak, about 817,000 in mid-May were held by these funds, which reduced to almost 782,600 on June 18, a level last seen in late February — representing a drop of more than 4.2%.

As of writing, 782,674 BTC are now accumulated by Bitcoin funds, as per ByteTree.

The uptrend in Bitcoin holdings of these funds started last year when only about 335,300 BTC were being held by funds which gained momentum in the last quarter of the year where they added about 200k BTC.

For Ether held by funds, there has been barely a drop, remaining just under 4.1 million, only 11,000 ETH below peak two weeks ago, after starting 2021 at 3.6 million.

Bitcoin BTC $ 32 897.95 -6.00% Ethereum ETH $ 1 969.01 -9.49% Tether USDT $ 1 -0.04% The post No Major Inflows Yet But Outflows in Bitcoin Funds Stopped for Now, ETH Holdings ‘Quite Stable’ first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|