2024-4-30 09:24 |

MicroStrategy, a business intelligence firm, has intensified its investment in Bitcoin by purchasing an additional 122 BTC this April.

The company solidifies its position as a major stakeholder in the digital asset market.

MicroStrategy Continues Bitcoin ShoppingThis acquisition, totaling $7.8 million, increases MicroStrategy’s holdings to a substantial 214,400 BTC, now valued at over $15.2 billion. Since its initial $250 million investment in August 2020, MicroStrategy has consistently expanded its Bitcoin portfolio. It has strategically accumulated about 1% of the total Bitcoin supply.

This deliberate buildup of Bitcoin is central to MicroStrategy’s treasury strategy, reflecting its strong commitment to the crypto asset as a core investment.

In 2024, the company’s strategic initiative continued unabated. According to its first-quarter earnings report, MicroStrategy acquired approximately 25,250 BTC for $1.65 billion at an average price of $65,232 per BTC. Remarkably, this marks the 14th consecutive quarter that the company has added Bitcoin to its balance sheet.

Read more: Who Owns the Most Bitcoin in 2024?

Despite a downturn in overall revenue, which dropped 5.5% to $115.2 million in the first quarter, MicroStrategy’s focus on crypto assets remains unwavering. The revenue decline was even more pronounced when adjusted for constant currency, showing a 5.7% decrease.

Nevertheless, the firm persisted in its Bitcoin investments despite a net loss of $53.1 million for the quarter. This loss was significantly affected by a $191.6 million impairment loss on its Bitcoin holdings.

Operating expenses for the company surged by 152.8% to $288.9 million, largely driven by costs associated with its Bitcoin investments. Despite these challenges, MicroStrategy’s subscription services revenue demonstrated growth and resilience, climbing 22% year-over-year to $23.0 million.

This increase highlights a positive market response to its cloud-native software solutions.

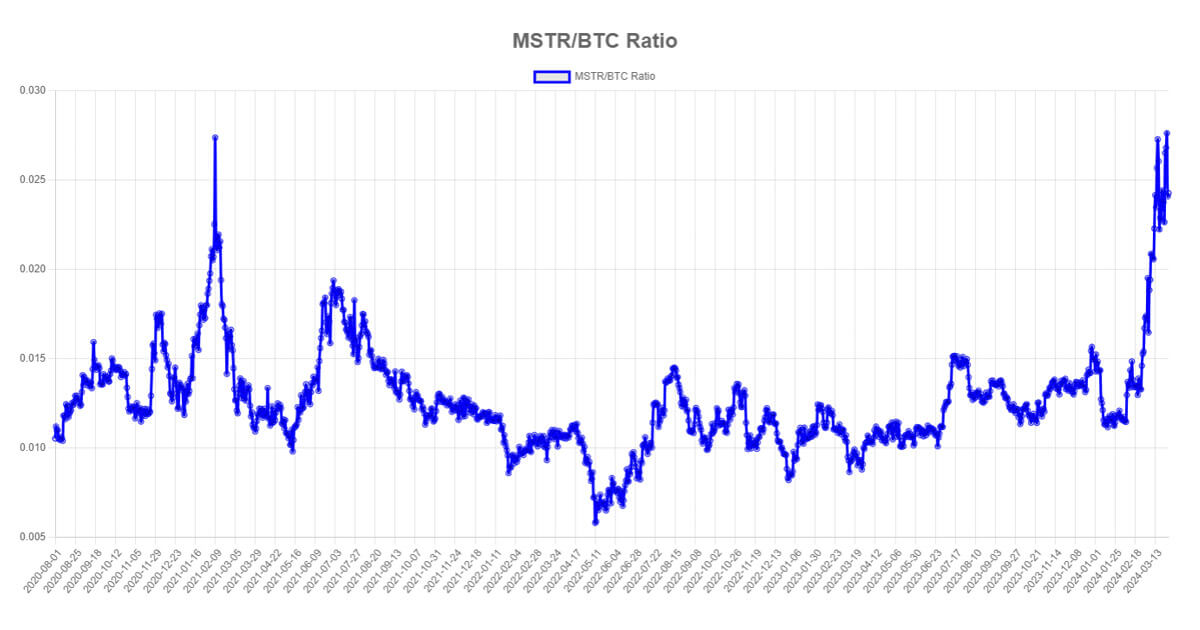

MicroStrategy’s aggressive Bitcoin acquisition strategy is frequently highlighted by its executive chairman, Michael Saylor. Supporting his strategy with data, Saylor notes that MicroStrategy stock (MSTR) has seen a 937% price growth since the company adopted its Bitcoin-focused approach in 2020.

By comparison, Bitcoin itself has grown 435% in value over the same period, while the S&P 500 has only appreciated 52%.

Read more: Bitcoin Price Prediction 2024/2025/2030

MicroStrategy (MSTR) Stock Outperforms Other Mainstream Assets. Source: X (Twitter)Chief Financial Officer Andrew Kang emphasized the firm’s robust capital strategy.

“We believe that the combination of our operating structure, Bitcoin strategy, and focus on technology innovation provides a unique opportunity for value creation for our shareholders. Year to date, the price of Bitcoin appreciated significantly, spurred notably by the approval of the spot Bitcoin exchange traded products which has increased institutional demand and resulted in further regulatory clarity,” Kang said.

The post MicroStrategy Invests in 122 More Bitcoin, Totaling Over $15.2 Billion in Holdings appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|