2021-4-27 00:00 |

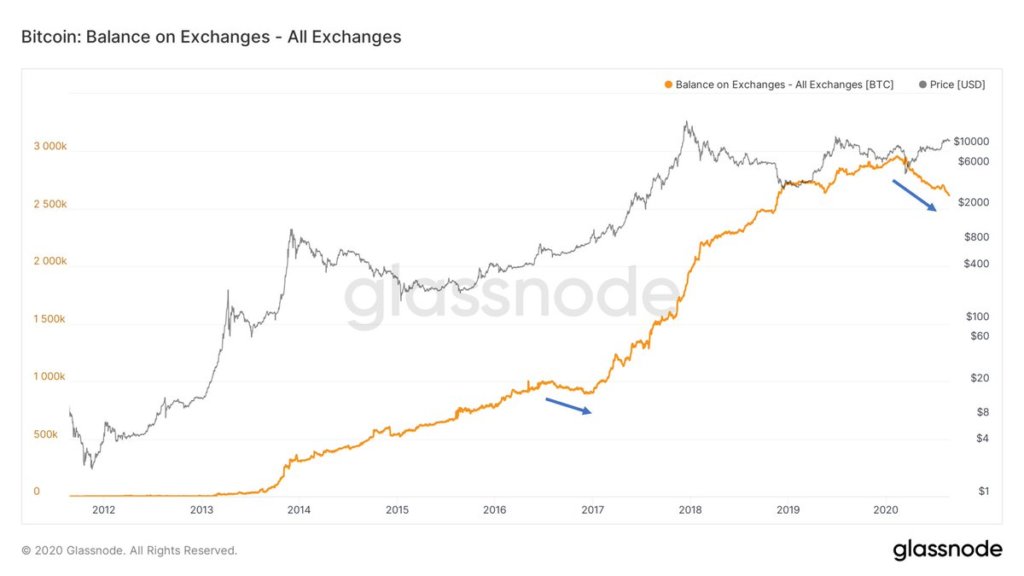

Bitcoin outflows saw its highest week ever following a 25% decline in price as inflows hit a six month low.

Following a volatile week that saw bitcoin experience one of its biggest corrections of 2021, the effects could be felt across the market as outflows soared to new highs.

According to CoinShares, $21 million in bitcoin outflows occurred. Making it the largest weekly outflow on record. The total weekly inflows hit $1.3 million. Making it the lowest week for BTC inflows in six months.

The new record of weekly outflows totaled 0.05% of the crypto markets assets under management.

BTC flash crash credited with outflowsThe record outflows for BTC could be credited to the steep decline in price over the last week. Bitcoin saw an entire week of bearish sell-offs. Dropping the price to under $50,000. The $10,000 drop over the past week saw bitcoin reach a new seven week low following six weeks of bullish momentum.

Crypto traders also experienced the biggest single liquidation event as the market liquidated over $10 billion worth of funds. Including positions on ETH and XRP.

Global Head of Market Research at Forex.com, Matt Weller commented on the BTC outflow, crediting the outflow to “investors shifting funds away from bitcoin amid some idiosyncratic developments last week”. Weller also explained the BTC price drop being linked to a recent power outage in Xinjian, China. Which was likely one of the catalysts for the bitcoin flash crash.

Ethereum benefits from BTC dumpWhile bitcoin may have seen record outflows over the last week. Ethereum saw the opposite, as traders shifted focus to other projects. Ethereum recorded $34 million in inflows over the same period.

Weller attributed the increase in ethereum inflows to the upcoming July launch of EIP-1559, saying “Cryptoasset investors continued to accumulate ethereum as the highly-anticipated July launch of EIP-1559, which will cut the new supply of ETH dramatically”.

Ethereum also recently experienced a new record high in price. As well as a new record in the amount of active ethereum wallets, totalling 771,000.

Bitcoin had since seen an impressive 9% rise in price on Monday, touching $55,000 as ethereum jumped nearly 7% nearly reaching its previous all-time high as it broke $2,500.

The post Bitcoin Price Drop Sees Record Weekly Outflows of $21M appeared first on BeInCrypto.

origin »Bitcoin (BTC) на Currencies.ru

|

|