2020-8-26 13:00 |

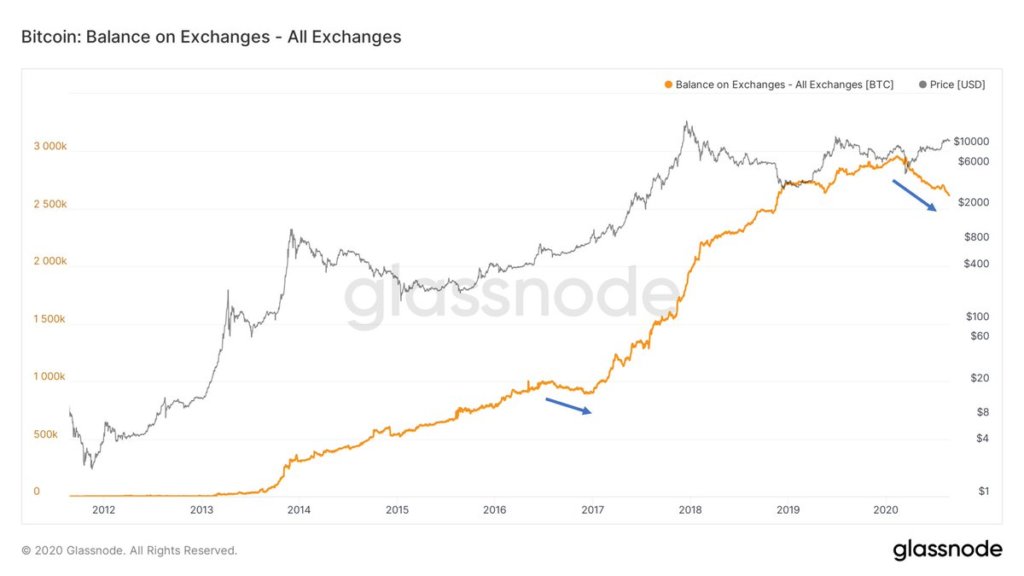

Exchanges have been seeing massive Bitcoin outflows in recent months, which has been a rapidly unfolding development seen by many as being bullish for the benchmark cryptocurrency.

A reduced supply of the crypto on exchanges is a positive sign, as it suggests that investors are adopting a long-term approach to their investments, while also reducing the supply of BTC readily available to users on exchanges.

One on-chain analyst believes that a combination of fears surrounding centralized platforms, increased “hodling” behavior, and the rise of decentralized finance are the primary factors that are fueling this trend.

If this is the case, then exchange Bitcoin outflows may not slow down anytime soon.

Exchange outflows ramp up despite Bitcoin’s uptrendThroughout 2020, investors have been moving their Bitcoin off of exchanges at a rapid pace.

The vast majority of these Bitcoin are likely being directed to offline storage, signaling that investors aren’t interested in selling their holdings at the cryptocurrency’s current price levels.

This trend is a bit surprising, as exchange outflows historically tend to increase during periods of stability or weakness in the market, whereas investors move their crypto into exchanges during uptrends in preparation for taking profits.

Throughout 2020, BTC’s price has been seeing relatively consistent growth, climbing from $7,000 at the start of the year to highs of $12,400 just over a week ago, before declining slightly to its current price of $11,400.

Throughout this entire period, investors have been regularly pulling Bitcoin off of exchanges.

Image Courtesy of Philip Swift. Data Source: GlassnodeAs seen in the above chart, this trend began picking up steam following the mid-March meltdown.

Here are the factors behind growing exchange outflowsPhilip Swift – a data analyst – spoke about this trend while referencing the data from Glassnode, explaining that he sees three primary factors behind this trend. These factors include:

The BitMEX liquidation cascade in March sparking fears about centralized exchange platforms Increased “HODLing” rates due to recent price action DeFi trend causing investors to convert their BTC to Wrapped Bitcoin (WBTC)He further added that these factors are in chronological order, with each one fanning the flames that have been driving the trend.

“Interesting to see continued decline of funds on centralised exchanges. Likely 3 reasons in chronological order: 1. Bitmex incident spooked a lot of people about holding funds on exchanges 2. Increased HODL’ing due to early bull cycle 3. Rise of DeFi and the DEX’s.”

Wrapped Bitcoin is an ERC-20 token that is backed 1:1 by actual Bitcoin held by a custodian.

Investors looking to utilize Bitcoin to tap into various DeFi incentives have been converting their BTC to WBTC at a rapid rate in recent times, potentially being one of the primary factors behind recent exchange outflows.

The post Here are the 3 trends causing exchanges to see massive Bitcoin outflows appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|