2024-2-19 15:45 |

Quick Take

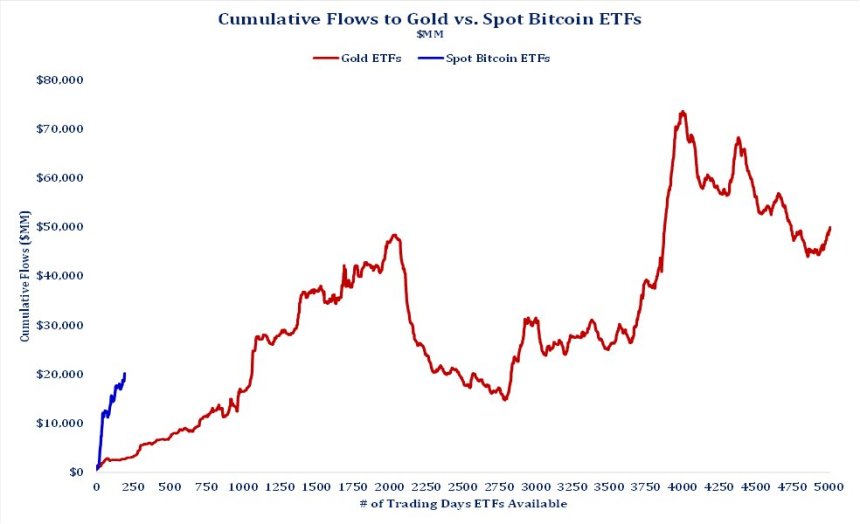

BitMEX’s data analysis presents a clear picture of the recent Bitcoin inflows and outflows into the ETFs. The Bitcoin ETFs experienced a significant inflow of $331 million on Feb. 16, contributing to a weekly net flow of $2.273 billion. This robust inflow marks a continued trend since Jan. 11, with the total net flow reaching a substantial $4.926 billion, according to BitMEX data.

BlackRock IBIT has been a core player leading these inflows, contributing $191 million on Feb. 16 and bringing its total inflows to a hefty $5.4 billion. Conversely, GBTC experienced outflows of $150 million, pushing its total outflows to $7 billion, according to BitMEX data.

In Bitcoin terms, BitMEX reports a net inflow of 6,376 BTC on Feb. 16, 44,865 BTC for the week of Feb 12. to Feb 16, and a total of 102,888 BTC since Jan. 11, 2024.

Meanwhile, according to Bytetree, the global ETPs hold approximately 947,000 BTC. Over the past seven days, ByteTree data indicates an addition of 47,500 BTC.

Fund Inflows: (Source: Bytetree)The post Despite $7 billion GBTC outflow, Bitcoin ETFs net $4.9 billion since January appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|