2019-7-2 13:15 |

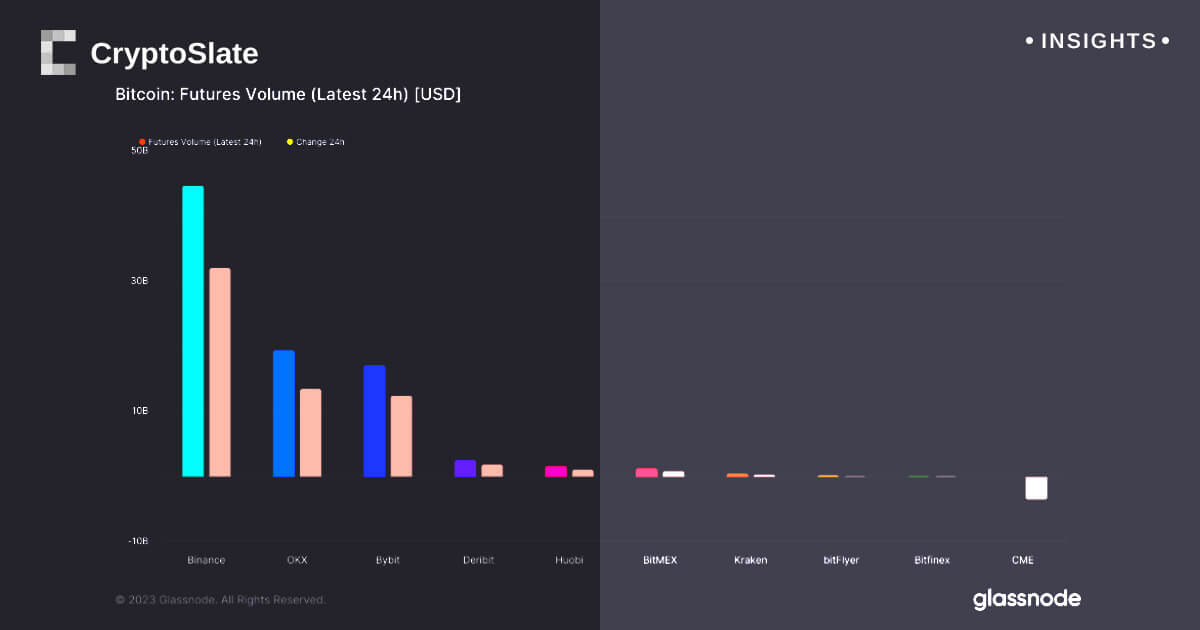

Bitcoin figures are eyeing the potential for a massive institutional investment boost in Q3, as Binance, ErisX and Bakkt get ready to launch their own bitcoin derivative platforms.

Binance, ErisX To Offer Bitcoin FuturesAs BTC comes off its record-breaking trading volumes and the price settles below $10,000, derivatives clearing house ErisX and cryptocurrency exchange Binance have both announced plans for futures trading.

The companies follow last week’s news that LedgerX had received permission to offer futures from US regulators, something ErisX will now also be able to do.

CEO Thomas Chippas commented in an accompanying blog post,

ErisX is unique in that for our digital asset market, we have divided the trading and settlement functions using traditional DCM (exchange) and DCO (clearing) models

This reflects the structure that institutional investors expect from other asset classes and will help drive these markets toward greater relevance and accessibility.

ErisX gained approval from the US Commodity Futures Trading Commission (CFTC) to offer physically-delivered futures, in which participants take delivery of actual Bitcoin, rather than the cash equivalent.

A more ‘hands-on’ option than traditional futures models, commentators hope physical futures will aid understanding of the crypto space as investors take on the responsibility of storing their coins.

Bakkt, the institutional investment ecosystem geared to crypto by New York Stock Exchange operator Intercontinental Exchange, will begin rolling out its own physical futures in the third week of July.

Now, it has emerged a source from within the crypto industry itself will compete in the form of Binance, which will offer its product in the coming months.

CEO Changpeng Zhao confirmed the plans at the ongoing Asia Blockchain Summit, Binance set to compete with longstanding market heavyweight BitMEX in the derivatives market.

Legal Hurdles Remain For RetailThe multiple market entries represent something of a coming of age for Bitcoin among institutional traders, who have until now kept a low profile in the face of uncertain regulatory landscapes.

In the US, the picture remains mixed, with Binance likely set to exclude the market from its offering.

Overall, however, the picture for proponents remains positive. “More sophisticated products. More liquidity,” Morgan Creek Digital co-founder, Anthony Pompliano, known as Pomp, tweeted in response to the news.

Beyond institutions, retail on-ramps, such as Tether-based buy-ins via over-the-counter trades in China, are contributing to Bitcoin’s ongoing bull run.

The knock-on effect from the launch of Facebook’s Libra cryptocurrency will provide more publicity in future, say commentators, but its introduction could be tricky. Once again, as Bitcoinist reported, it is the US which is demanding regulatory dialog before any tokens see a release.

What do you think about the latest Bitcoin futures announcements? Let us know in the comments below!

Images courtesy of Shutterstock

The post Bitcoin Set For Massive Growth as New Futures Platforms Enter the Market appeared first on Bitcoinist.com.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|