2020-5-8 15:26 |

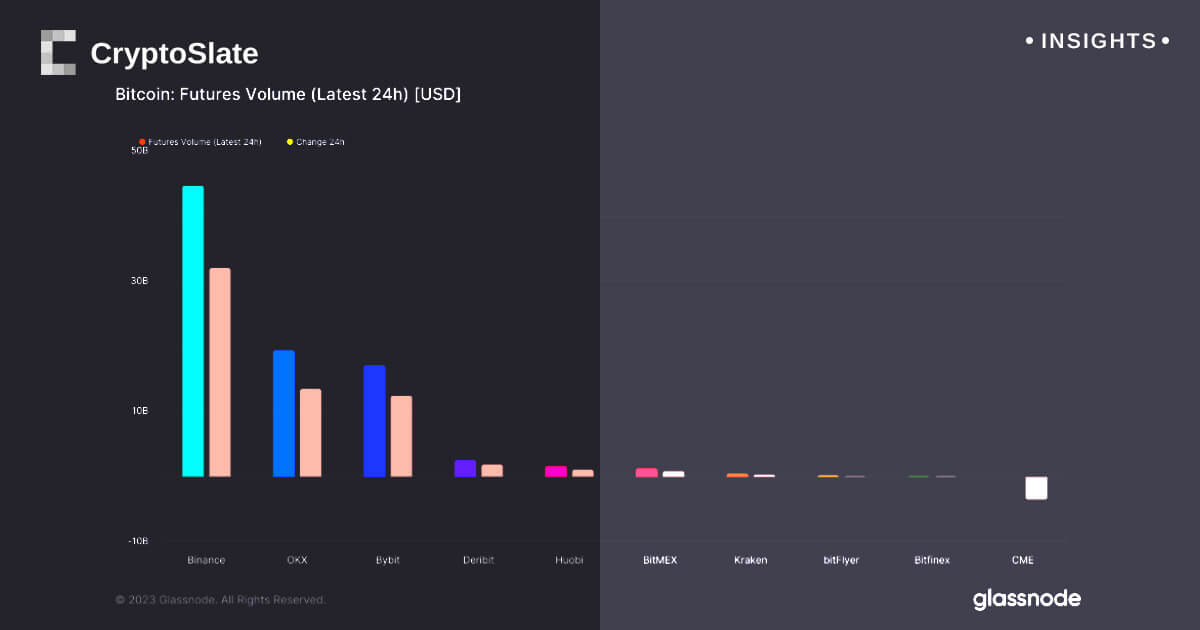

As bitcoin starts to take off to new levels, one financial instrument has already broken $10,000. Bitcoin futures offered by the CME Group reached this milestone on May 7, and it is currently trending higher past $10,045.

The market appears to be reacting strongly to the halving event which is due to occur in a matter of days. The futures contract broke out in record volumes to create a new all-time high, while previous rallies to the upside were also significantly strong.

The price has since broken out into a steep upwards travel that looks to be eying the first resistance level at $10,110. Although the momentum is certainly in the bull’s favor, the angle of the channel might be too difficult for buyers to sustain over the long-term, so a pullback is possible from this level before it moves higher.

One major technical development for the futures contract is that it is trading above the VWAP, which is an indicator that measures the strength of a financial instrument by factoring in volume as well as price movements. The break above $10,000 solidified the futures contract beyond this crucial level, which is used as a technical indicator by many stock and currency traders.

The relative strength index, which is used in this case for measuring overbought and oversold conditions, is currently in the significantly overbought zone, which could mean trouble for those on the way up. Although the coin is not yet showing signs of slowing down, the contract could be seen as a risky long position and may encourage short-sellers to go against the trend of the contract.

Bitcoin (BTC) Live Price 1 BTC/USD =$9,872.3552 change ~ 5.71%Coin Market Cap

$181.34 Billion24 Hour Volume

$16.4 Billion24 Hour VWAP

$9.77 K24 Hour Change

$563.2858 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|