2022-8-23 06:00 |

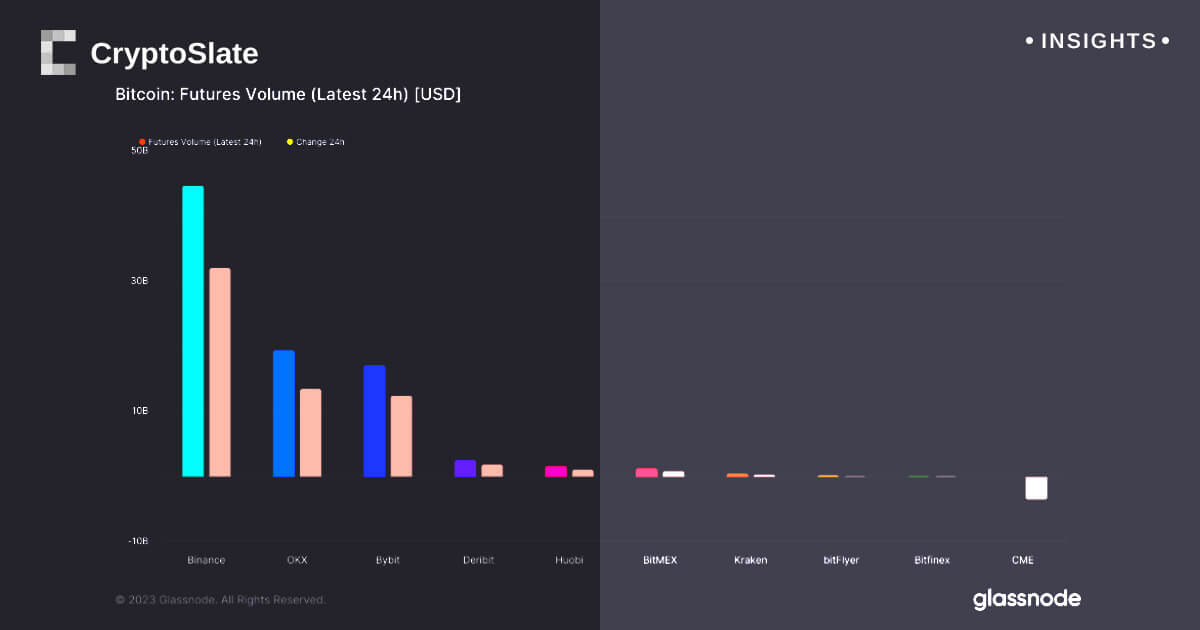

An analysis of Bitcoin and Ethereum futures volume showed that both had re-established themselves over spot volume.

In spot markets, traders can buy and sell tokens for immediate delivery. Spot volume refers to the total amount of coins transferred on-chain with only successful transfers counted.

By contrast, futures traders buy and sell derivatives contracts representing the value of a specific cryptocurrency. Experienced traders prefer futures trading as profits can be made in either market direction.

As experienced traders use leverage and are generally better capitalized than retail spot traders, under “normal” conditions, futures markets tend to turn over more volume relative to spot markets.

Ethereum spot and futures marketsThe chart below shows the general trend being Ethereum spot volume lagging behind the futures market. However, spot markets were particularly prevalent at the end of 2021 going into the new year.

From late June 2022 onwards, the disparity between futures and spot is becoming increasingly prevalent. Analysts wager this is due to mounting speculation over the Merge, in which Ethereum’s existing execution layer will integrate with its Proof-of-Stake (PoS) consensus layer.

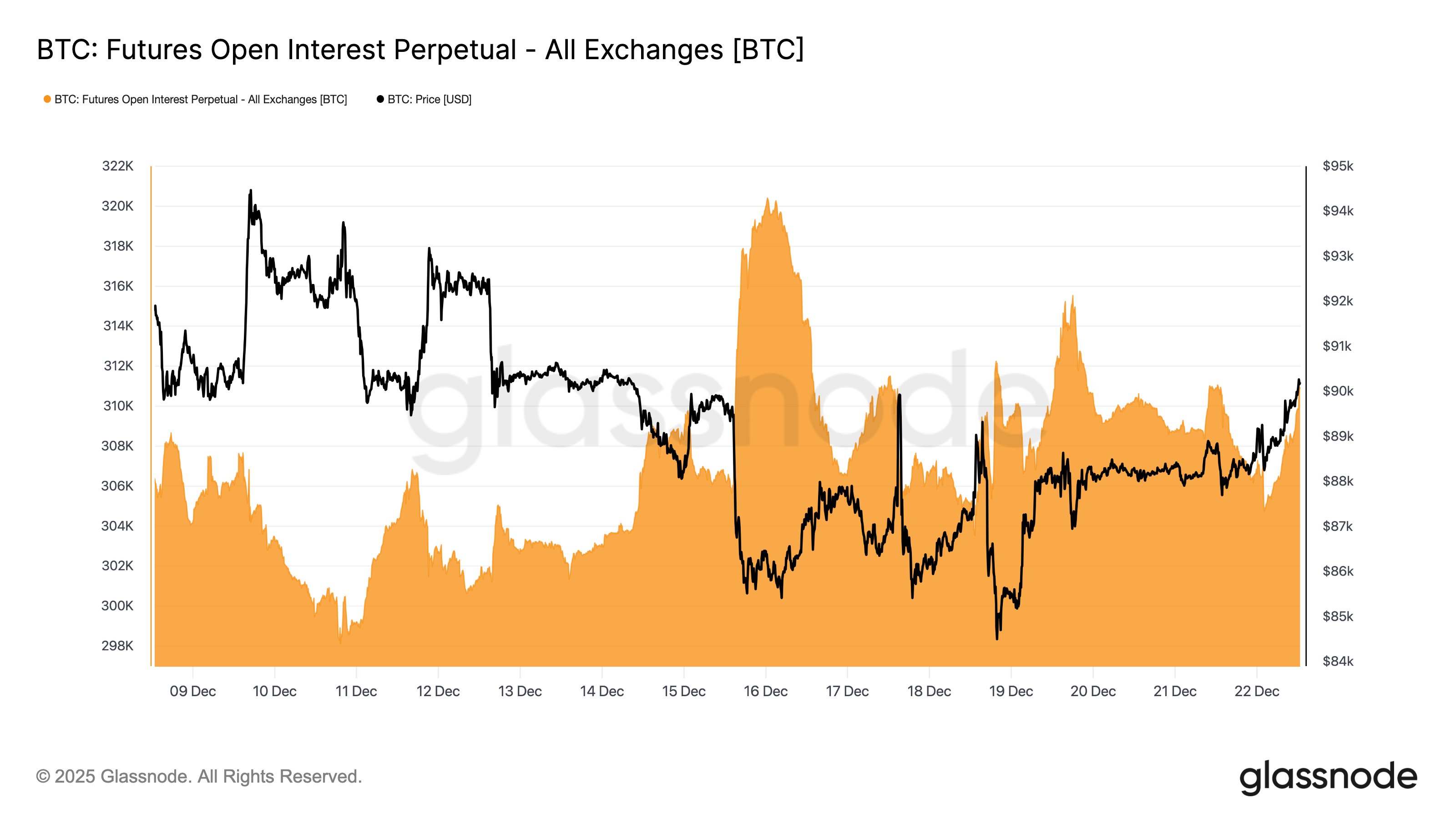

ETH Futures Volume vs. Transfer Volume (Source: Glassnode) Bitcoin spot and futures marketsAn analysis of Bitcoin spot and futures markets paints a different picture. The chart below shows futures volume holding a significant lead going into the 2021 bull run. However, as the price of BTC peaked in Q4 2021, this scenario flipped with spot volume taking over.

Since June 2022, futures traders have re-asserted their position, leading to a resurgence in futures volume over spot volume.

Futures to Spot Ratio BTC (Source: Glassnode) BTC and ETH ratiosThe futures/spot ratio depicts the above as a line chart. The Bitcoin futures/spot ratio was considerably higher than Ethereum’s through the first half of 2021.

A lull followed in which both ratios sunk and moved in close correlation. However, the Ethereum futures/spot ratio took off, relative to the BTC ratio, from June 2022 onwards due to price speculation on the upcoming Merge event.

Futures to Spot Ratio, BTC and ETH (Source: Glassnode)The resurgence in BTC and ETH futures volume suggests that derivatives traders have returned to speculating on risk assets once again. This would indicate that derivatives traders assume that the leverage wound to the Terra collapse has left the market.

The post Bitcoin and Ethereum futures are re-exerting dominance over spot markets appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|