2020-6-15 19:26 |

The Bitcoin futures daily trading volumes hit a low of $5.81 billion this weekend representing the lowest futures volume since Jan 1, 2020. The price of Bitcoin (BTC) has since dropped to $9,100 for the first time in two weeks, representing a 5% slide over the weekend.

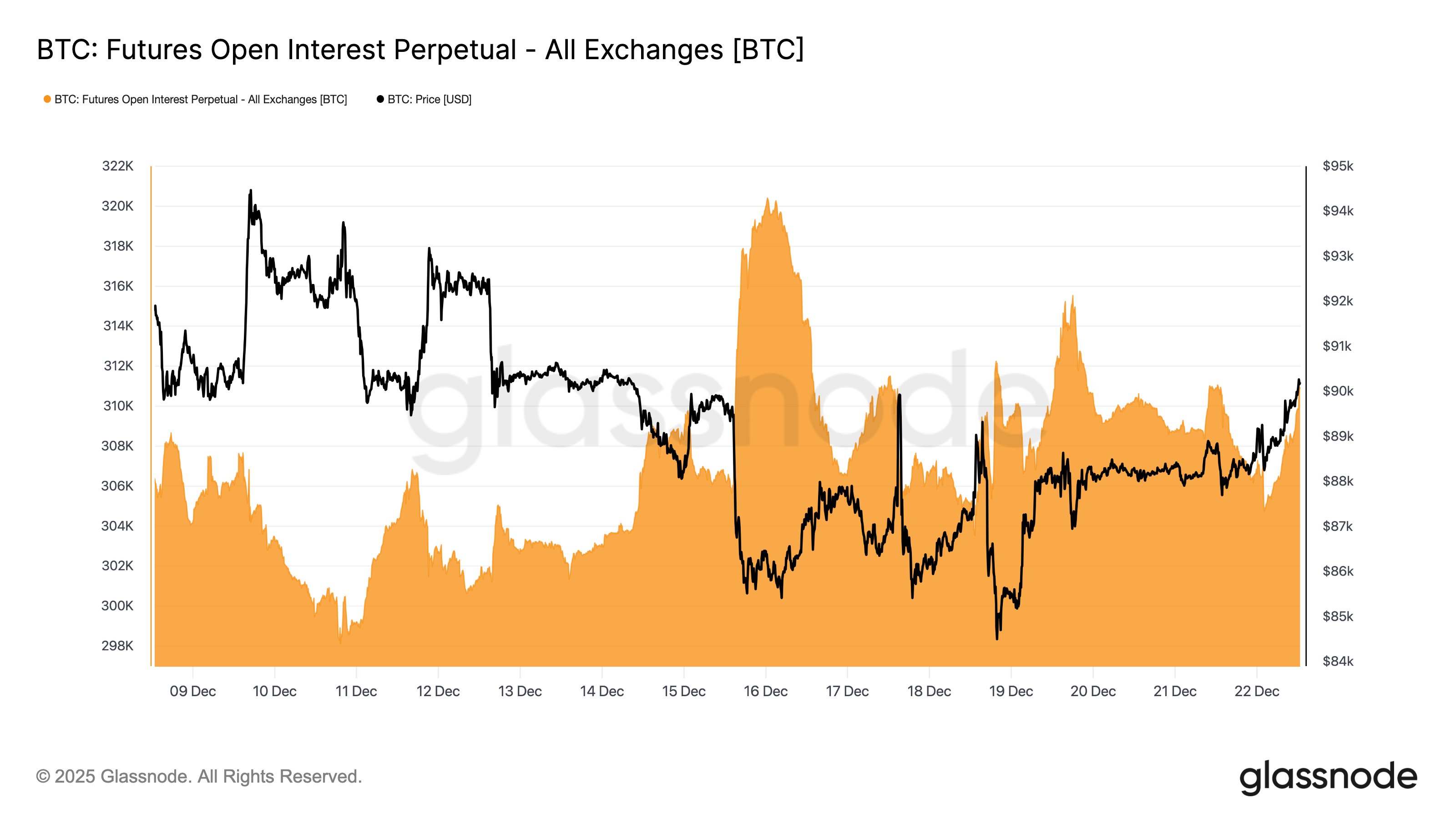

Despite the weakening futures volume market and plummeting BTC’s price, the growing open interest volumes on BTC derivatives gives off a bullish signal in the near future.

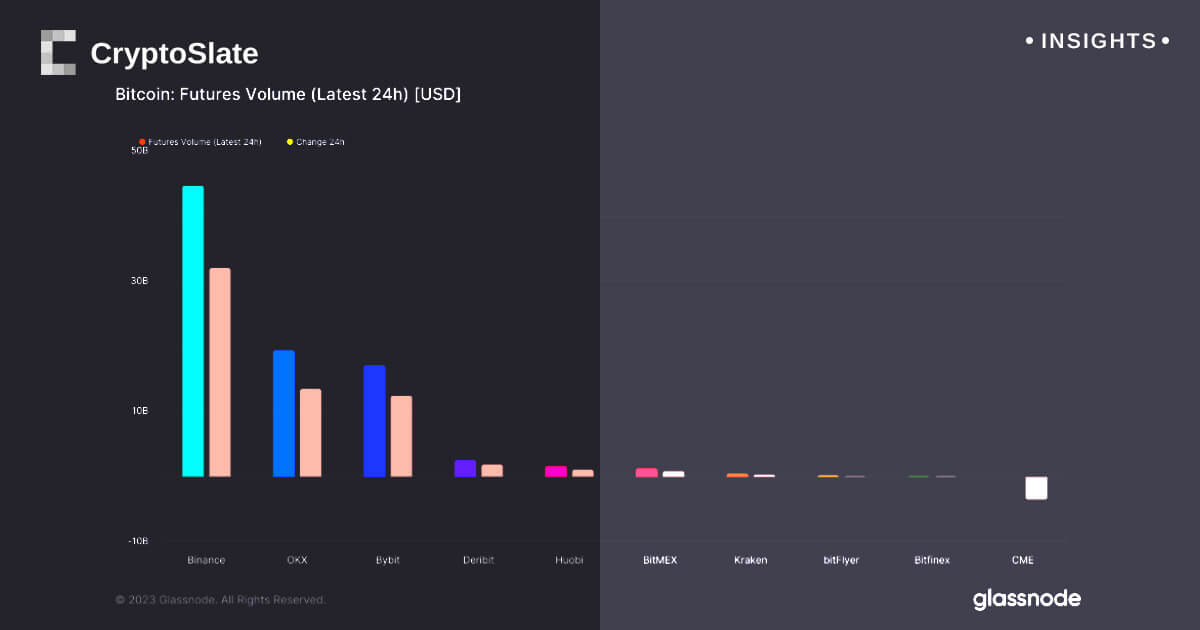

Bitcoin futures volume dips to yearly lowsAccording to Skew Markets, a crypto derivatives data aggregator, the volume of BTC futures traded on Saturday, June 13, 2020 set its year-to-date low. Despite institutional drivers of the market –Intercontinental Exchange’s Bakkt and CME BTC futures – being locked for the weekend, the slip from $20 billion in futures volumes traded on Thursday, to less than $6 billion 24 hours later raises doubts on a potential recovery in price.

OKEx, Huobi and Binance exchange markets represented the biggest losers in volumes traded on Saturday.

OKEx lost 73% of its total volumes in two consecutive days, Huobi lost 70%, Binance lost 72% and BitMEX lost 75% of its total futures volume in the same time frame. The four top crypto exchanges however, still controls over three-quarters of the Bitcoin futures market.

Despite the futures dipping, the open interest in both BTC futures and options contracts is moving back towards pre-March crash levels.

Open interest the savior?Bitcoin’s open interest is heading back to pre-March 12th crash that saw the price of BTC skim below the $4,000-mark. At the height of BTC’s price in 2020, in mid-February, Bitcoin futures OI shot up to all-time highs of $5.5 billion before crashing back to a yearly low of $1.7 billion on March 12, 2020.

Bitcoin futures OI market is finally getting back to pre-crash levels, testing the $4 billion dollar mark at the start of the month. The OI currently stands at $3.6 billion.

Bitcoin options OI surpass pre-crash levelsBitcoin options volumes were not sparred over the weekend with a 75% drop in two days culminating on Saturday, June 13. As of time of writing, on Monday, June 15th 0900 hours EAT, the volumes traded have barely crossed the $40 million mark. Deribit exchange, the leading crypto options platform led the drop over the weekend as buying pressure eases.

Bitcoin options OI at all-time highs as institutional investors come into the market

Nonetheless, the options open interest has not faltered, similar to the futures. The total options open interest is currently ballooning – seeing over 440 percent growth over the course of 2020 – despite the March crash. The spike in BTC options OI is mainly influenced by the entry of institutional players in the market.

According to Arcane Research, the overall market share of Bitcoin options OI has grown from less than a percent at the start of May to over 22% six weeks later.

(Images from Skew Markets)

Bitcoin (BTC) Live Price 1 BTC/USD =$9,421.4073 change ~ 0.43%Coin Market Cap

$173.41 Billion24 Hour Volume

$5.78 Billion24 Hour VWAP

$9.19 K24 Hour Change

$40.0701 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|