2024-6-27 12:41 |

Quick Take

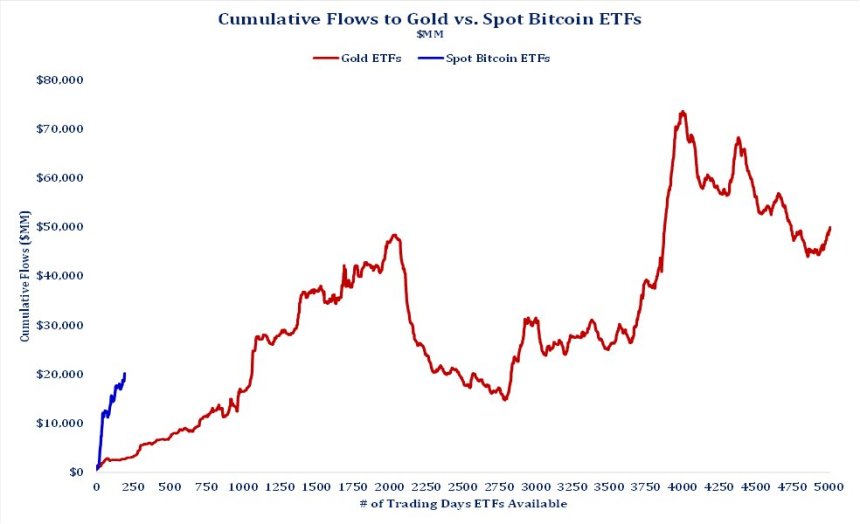

Recent data from Farside indicates a slight resurgence in Bitcoin (BTC) exchange-traded funds (ETFs), with a further inflow of $21.4 million on June 26. This marks consecutive days of positive inflows for these ETFs, suggesting renewed investor interest.

Fidelity’s FBTC led the pack, receiving an $18.6 million inflow, bringing its total inflows to an impressive $9.2 billion. Meanwhile, Grayscale’s GBTC saw a $4.3 million inflow, reducing its total outflows to $18.5 billion and marking its first inflow since June 5. BlackRock’s IBIT remained stable with no new inflows or outflows, maintaining its $17.6 billion inflow. Cumulatively, Bitcoin ETFs have attracted $14.4 billion in total inflows.

This trend may indicate that BTC continues consolidating around the $60,000 mark, leading to a resurgence in inflows that could signal the end of the current Bitcoin correction.

The implications of these inflows were discussed by the lead analyst at CryptoSlate, James Van Straten, senior editor Liam Wright, and Jim Bianco, head of Bianco Research, on the social platform X. The debate highlighted the significance of these inflows for the future trajectory of Bitcoin.

Bitcoin ETF Flow Table: (Source: Farside)The post Bitcoin ETFs experience 2 consecutive positive inflow days appeared first on CryptoSlate.

origin »Bitcoin (BTC) на Currencies.ru

|

|