2020-11-21 19:00 |

As the crypto economy sets its sights on half of a trillion in USD value, digital currency derivatives markets are swelling significantly. Bitcoin futures have surpassed a six-month high at $52 billion, while the crypto asset’s options markets have jumped massively too. Additionally, bitcoin options markets indicate that traders wager there’s a 29% chance the price of BTC will be above $20,000 by December 25, 2020.

At the time of publication, the entire cryptocurrency economy is hovering just below the 500 billion-dollar mark. While cryptocurrencies like BTC and ETH have seen solid spot market gains, crypto derivatives have skyrocketed with significant interest.

Data from the website Coinalyze indicates that global BTC futures have spiked over $52 billion, which is the highest derivatives markets have seen in over six months. The bitcoin futures momentum touched an all-time high (ATH) and the researchers from Skew.com tweeted about the milestone.

“All-time high for BTC futures daily volumes yesterday, exceeding the previous record by more than 20%,” the Skew analytics team said on Thursday.

The top three Bitcoin futures market leaders in late 2020 include exchanges like Okex, Binance, and Bybit, as the exchange Bitmex trails behind in the fourth position. As far as futures open interest is concerned, Okex captured $1.1 billion on Wednesday, November 19.

Skew noted that there is strong demand for the three to six month upside sharing a perspective from the BTC volatility surface. Skew.com also highlighted bitcoin options markets and the probability of the crypto asset reaching the $20k handle.

“The probability of bitcoin [at] $20k at year-end [equals] 25% according to the options market,” Skew also noted on Thursday.

The leading options exchange Deribit, the trading platform that commands a lion’s share of the world’s bitcoin options, discussed the recent demand for bitcoin derivatives. Deribit, said on Wednesday afternoon (EST), that there is “a lot of speculation about BTC reaching a new ATH by the end of the year.”

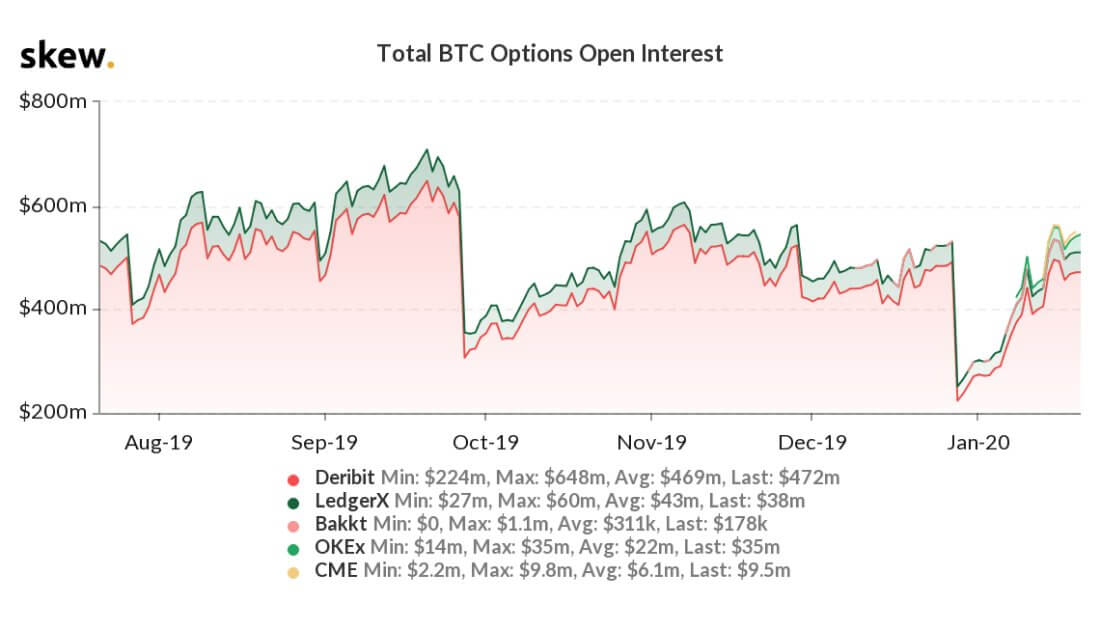

“Options markets indicate a 29% chance BTC’s price could be above $20,000 by December 25, 2020,” the exchange Deribit said. The exchange has seen new trading records as far as options action is concerned, and total Deribit open interest is over $4.5 billion between both bitcoin and ethereum markets. Deribit stats also show 194,797 bitcoin options contracts with a notional metric at $3.49 billion and ETH options notional is at $581 million.

With anywhere between 25% to 29% of options swaps predicting the price will be above the $20k handle in late December, it doesn’t mean the bets guarantee the price will come to fruition. However, it does mean those traders are willing to bet money that BTC will reach that point at that particular time.

Traders tend to believe derivatives markets like bitcoin futures and options can help forecast future market sentiment. Oftentimes many traders leverage the futures basis indicator or the bitcoin futures annualized rolling 3-month basis to gauge market sentiment. As of right now according to the futures basis indicator optimism is still quite high.

What do you think about the recent bitcoin derivatives markets touching all-time highs and the probability of bitcoin reaching the $20k handle? Let us know what you think about this subject in the comments section below.

The post Bitcoin Derivatives See Record Highs, Year-End BTC Options Show 29% Chance Price Crosses $20K appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|