2020-1-23 22:40 |

The global markets company Chicago Mercantile Exchange (CME) has seen considerable demand since launching its options contracts in the wake of the firm’s bitcoin futures. On the first day of swaps, CME’s bitcoin options saw 55 contracts ($2.3 million). By the end of the week, the firm’s bitcoin options volume more than doubled with 122 contracts ($5.3 million) sold.

Also read: Bitcoin Futures Hit 3-Month High in Frenetic Tuesday Trading

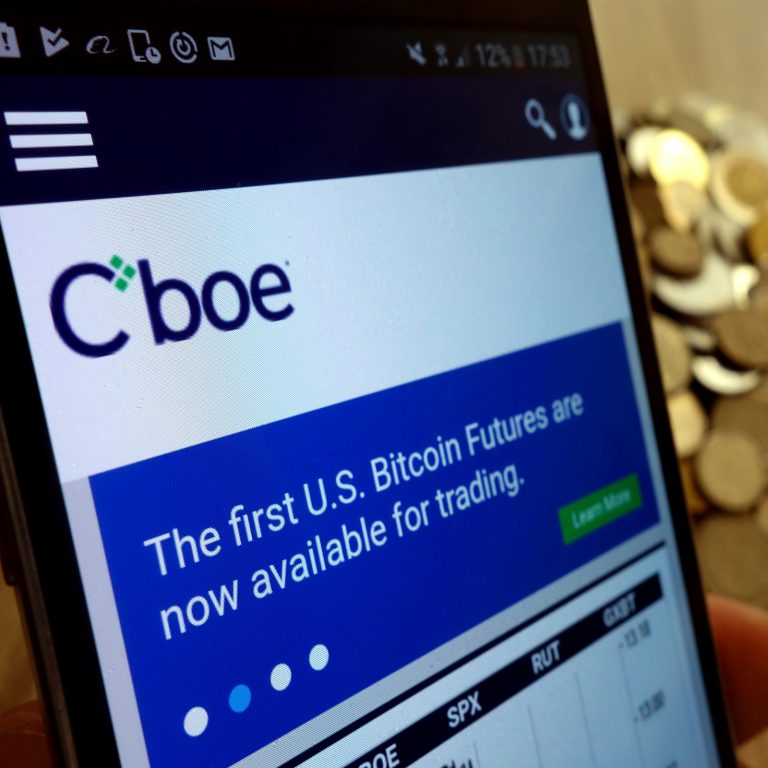

CME Bitcoin Options See Steady GrowthRegulated crypto derivatives products have seen strong demand and just recently the forex marketplace CME launched options on the firm’s bitcoin futures contracts. The foreign exchange company announced its bitcoin options offering in mid-September as CME executive Tim McCourt said there was “increasing client demand” for such products. McCourt also remarked that the options would provide “clients with additional flexibility to trade and hedge their bitcoin price risk.”

Following the announcement, the ICE-owned Bakkt derivatives marketplace launched bitcoin options in the U.S., alongside opening cash-settled bitcoin futures in Asia. CME’s options started trading on January 13 and the marketplace saw a grand total of 55 options contracts or $2.3 million sold that day. As news.Bitcoin.com’s CME options report mentioned in November, each contract represents 5 BTC.

The derivatives markets researchers from Skew.com have also recorded the options action on CME since the day the products launched. “Just added CME to our bitcoin options open interest radar,” the researchers tweeted. On January 17, Skew wrote that CME’s open interest for bitcoin futures was “up 100% since the start of the year.” Following the 55 contracts on opening day, CME bitcoin options saw 122 contracts worth $5.3 million on January 17.

“[The] first week of CME options closed on a strong note with 610 bitcoin options trading on Friday,” Skew researchers noted on January 20. In addition to the strong CME options start, demand for crypto derivatives has been steadily climbing. A few days before CME launched the bitcoin options, Skew tweeted that global open interest in bitcoin derivatives has spiked 15% to roughly $3.5 billion on January 15. This includes institutional marketplaces like CME and Bakkt but also Okex, Deribit, Bitfinex, Ledgerx, FTX, Huobi, Kraken, Binance, and Bitmex.

Bakkt’s Bitcoin Options Flounder and Retail Derivatives Volumes SkyrocketAs CME records a steady climb from 55 contracts to 122 on January 17, open interest has also risen from 55 to 219. On January 21, the Twitter account Ecoinmetrics explained that Bakkt’s BTC futures were dealing with low trade volumes. “Low trading activity on the Bakkt futures,” the researchers detailed. “At the same time the Bakkt BTC options market is completely dead — Not looking very good when compared to the CME markets,” Ecoinmetrics added. With CME’s bitcoin derivatives products, the story is different. “Open interest is still high on BTC futures,” Ecoinmetrics explained the following day. “Slow increase in activity on the May’20/Jun’20 contracts after the halving — On the options side: 27 contracts traded and open interest climbing to 244 contracts.”

There were 1,039 ($9.15 million) Bakkt bitcoin monthly futures traded on Tuesday. The volume is far less than the all-time high Bakkt saw on December 18, 2019, with 6,601 physically-settled monthly futures traded. At 10:20 a.m. EST on January 22, Bakkt’s volume is around 386 BTC.

Despite the recent rise in CME-based bitcoin futures products, the volumes are still minuscule compared to the crypto derivatives giants who deal with retail customers. During the last week, Bakkt’s physically traded bitcoin futures volume has been much lighter but demand has grown since the product launched. CME and Bakkt have a long way to go before they catch up to the massive volumes Bitmex, Bitfinex, and Coinflex process on a daily basis.

What do you think about the growing demand for CME Group’s cash-settled bitcoin options? What do you think about Bakkt volumes slowing down last week? Let us know what you think about the crypto derivatives industry in the comments section below.

Disclaimer: This article is for informational purposes only. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any ideas, software, bitcoin futures contracts, bitcoin options, crypto derivatives products, manufacturers, websites, concepts, content, goods or services mentioned in this article. Price articles and futures market updates are intended for informational purposes only and should not be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader.

Image credits: Shutterstock, Skew Research, Bakkt Volume Bot, Fair Use, and Pixabay.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.

The post Demand for Crypto Derivatives Swells as CME’s Bitcoin Volume Rises appeared first on Bitcoin News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|