2018-6-18 15:10 |

LONDON – A Wall Street analyst

known for his bullish stance on bitcoin has flagged the

possibility that bitcoin futures contracts could be hurting the

cryptocurrencies price.

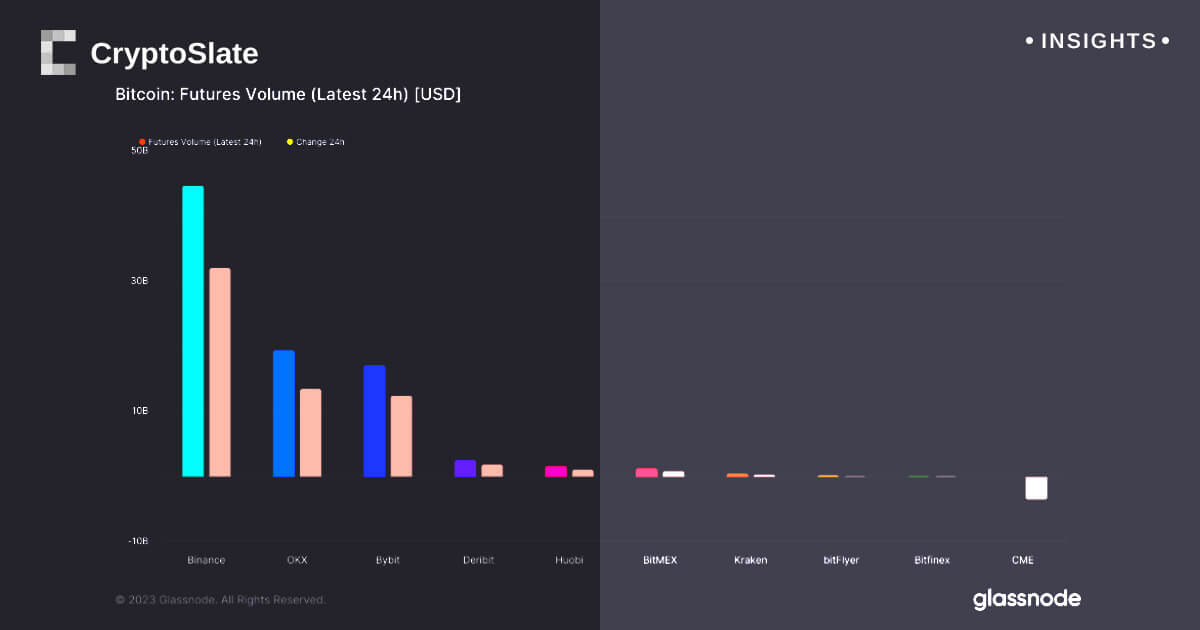

CME Group and CBOE both launched bitcoin futures products in

December when bitcoin was trading close to record highs around

$20,000.

Bloomberg reports that Lee wrote that traders who are long

bitcoin and short futures could sell bitcoin during the price

auction to cause the price to drop and leave their futures

contracts “with a handsome profit.”

The Commodity Futures Trading Commission, which has oversight of

bitcoin futures, is

said to be involved in a US Justice Department probe into market

manipulation of bitcoin.

Coinfloor, a UK-based bitcoin exchange operator,

announced plans for a physically settled bitcoin futures contract

in March.

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|