2020-12-5 18:30 |

Today, Bitcoin went as low as $18,700, and the volume remains around $3 billion as Bitcoin struggles to find a direction.

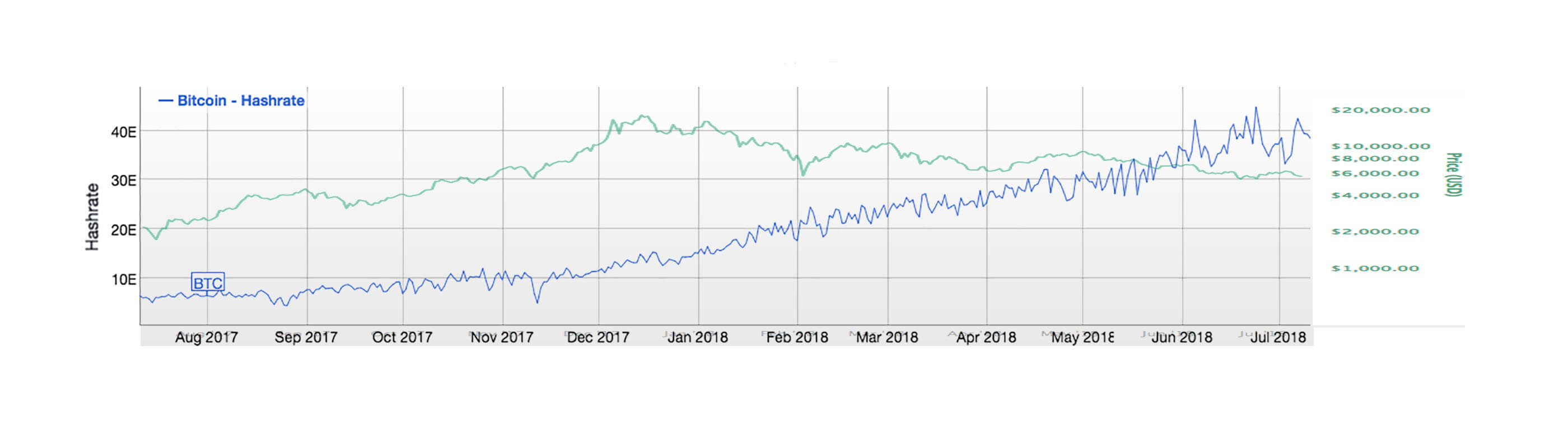

Interestingly, Bitcoin Hash Ribbon gives a buy signal that flashes when the hash rate has recovered (30d MA crosses above 60d MA). BTC price momentum is positive, as per Glassnode data.

According to HRXO Labs, Bitcoin’s high range is $19,915, above which both BTC and ETH will rally higher, and range low is $16,200 below, which is “death.” But it is the sideways trading around $18,000, where altcoins live.

In the short-term, the leading digital asset is expected to show some weakness as in 4Q20; bitcoin has rallied 80%. Besides the correction to $17,300 last week, we haven’t had any meaningful pullback yet.

But given that this time is different, it is anyone's guess where BTC will go next.

The good thing about it all is, once we are above $20k, the sky’s the limit with no barriers holding BTC as noted by analyst Ceteris Paribus, “after 20k there's no resistance to 1m.”

Once we break $20k (imminent and inevitable), we can throw valuation and fundamentals out of the window. It’s all going to be one giant momentum trade. The best performers will be the ones with the largest distribution channels, lowest price, and the best memes.

— Qiao Wang (@QwQiao) December 3, 2020

The thing is, “Timing the macro top will be extremely difficult this time, with institutions potentially muting extreme moves. There will still be a lot of retail, but IMO institutions are in charge of the market this time. So macro narratives (e.g., inflation) are important to pay attention to,” said quant trader and entrepreneur Qiao Wang.

It’s an Institutional play2020 is all about institutions in the bitcoin market. Just yesterday, Grayscale bought yet another 7,188 BTC.

“BTC whales are changing from Bitcoin OGs to inst. Investors,” responded Ki-Young Ju, the CEO of data provider Crypto Quant. This can also be seen in the 1% of BTC’s total supply that moved out of the long-term storage during the November price run-up.

Young Ju is actually bearish in the short term, as we reported, but goes on to say that the Grayscale institutional investors holding BTC on Coinbase Custody are why Bitcoin is currently going sideways rather than having a correction.

$BTC Institutional Growth

The number of transactions of over $100,000 recorded on the Bitcoin blockchain on a daily basis has more than doubled from a year earlier

Furthermore, the total volume transferred in these has experienced even larger growth with 6x over the same period pic.twitter.com/5ddxZlVWKq

— IntoTheBlock (@intotheblock) December 4, 2020

Institutional investors have actually accumulated more than 100k BTC, and they aren’t selling.

But despite just over 3% of BTC supply getting scooped off, the number of Bitcoin supply in circulation has remained relatively stable, as per ByteTree.

Amidst this, the adoption curve of Bitcoin is growing faster than any other global infrastructure rollout before it that involves the Internet, mobile phones, and easily faster than “virtual banking” players like PayPal.

With the network strong and people continuing to buy any dips and adoption surging, it seems to be just a matter of time that Bitcoin price moons. Analyst PlanB, based on his stock-to-flow cross-asset model, said,

“If BTC doesn't break it's historical path: BTC market cap will approach gold market value $5-10T in 2021-2024 and approach real estate market value $10-100T in 2024-2028, after 2028 we can no longer interpolate and enter uncharted waters.”

Bitcoin (BTC) Live Price 1 BTC/USD =18,836.1667 change ~ -2.68Coin Market Cap

349.64 Billion24 Hour Volume

32.44 Billion24 Hour Change

-2.68 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); The post Bitcoin Buy Signal Flashes; Institutional Investors Focused on Accumulation, Becoming Whales first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|