2018-9-19 01:00 |

According to research by Sam Doctor, a quantitative analyst at Fundstrat, Bitcoin mining costs have doubled since May.

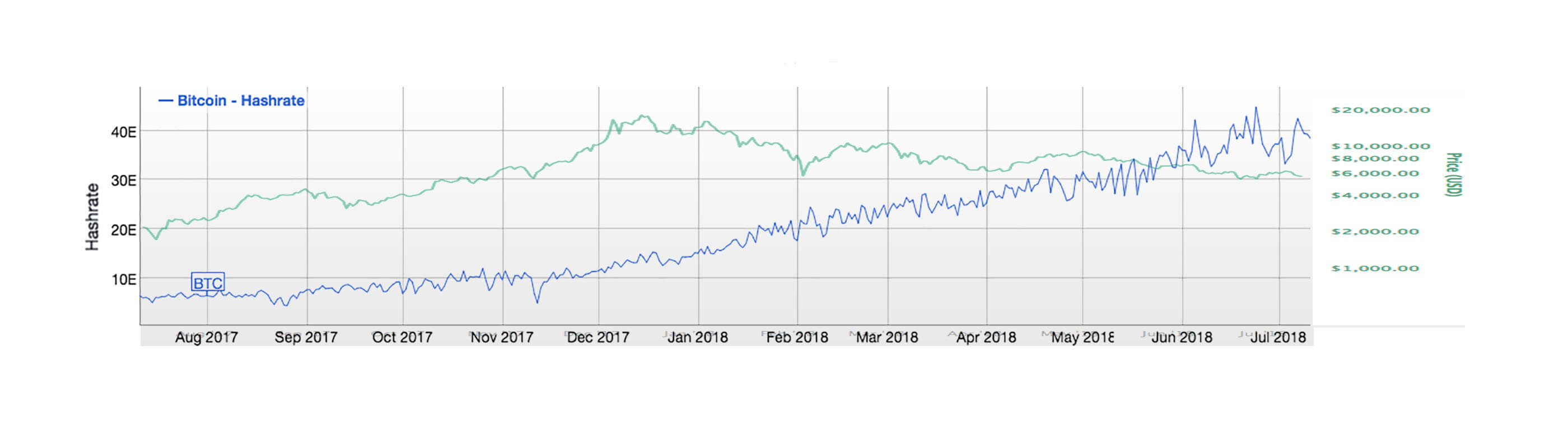

Increasing Hash RateLate last week, Doctor released a cost analysis of the notoriously expensive Bitcoin mining process that supports the pioneer cryptocurrency. His research concluded that Bitcoin’s requisite hash power of 57 exahash per second, or energy required to confirm transactions, now costs more than $4,000 per BTC in terms of average electricity cost.

The figure, however, excludes individual overheads and machinery wear-and-tear, which could drive costs up to $7,000 per coin to sustain a profitable mining venture.

Despite the astronomical costs, Bitcoin remains the most valued cryptocurrency, as per daily traded volume, and has not lost favor among industry enthusiasts. The pioneer established a 56 percent dominance as of writing, with BTC daily trade volumes exceeding the total market cap of more than 90 percent of all altcoins.

Despite $BTC bear market, hashpower doubled since May to 57 EH/s – Even with upgrades to existing equipment, implies almost 1GW of new power consumption vs 5.2GW in May '18. Breakeven now $7300 ($5300 cash BE) vs. $6000 in May – Mining becoming FCF -ive @fundstrat #Crypto pic.twitter.com/pTTWJWlrz0

— Sam Doctor (@fundstratQuant) September 14, 2018

Bitcoin continues to be the topic of conversation for Exchange Traded Funds and other financial products, meaning institutional investors are treating the currency similarly to fiat-based financial securities, with no regard to the former’s underlying issues.

While Bitcoin may appear to be a poor investment for some, based on its rising mining costs, several reports suggest the digital asset is the first crypto investment for a large part of the population.

Related: Why Bitmain is Purposely Losing Money in its Bitcoin Mining BusinessThe infamous congestion issue of December 2017, which saw transaction fees reach over $100, is unlikely to affect the market until the next retailer frenzy. The much-awaited Lightning Network, however, may be the solution to this issue.

While high mining power could mean individual miners seek mining lesser-known altcoins, the incentives for large entities like Antpool and BTC.com to stay honest remain high.

For one, creating a 51 percent attack on the Bitcoin network would result in a flash-price drop, causing investors to panic over centralization fears and China-controlled crypto markets. Without long-term price stability and unprecedented volatility, companies depending on the asset class may face extinction.

Chinese Conglomerates Dominate Bitcoin MiningPer publically-available data, 81 percent of Bitcoin’s hashing power comes from Chinese territories, where electricity is relatively cheaper than global averages and technology adoption is significantly higher.

With all the aforementioned costs, Fundstrat’s research pegs mining costs-per-coin at $7,300, a substantially higher amount than the current Bitcoin price of $6,268 (as of writing). And while $4,300 of this amount is variable, overhead costs remain constant and have to be paid regardless of mining.

Related: Bitcoin Hash Rate Rapidly Growing Despite PriceLong-term, however, the amount of mining being done will adjust the direction of Bitcoin’s market price; mining operations will slow down or the bleed will continue until some miners run out of funds, allowing the process to once again become profitable for the survivors.

Interestingly, hashing power is not standing still or decreasing–it’s rising. At the time of writing, Bitcoin mining measured an astronomical 57 exahash, or 57,000,000,000,000,000,000 hashes per second.

Lower Bitcoin prices are more profitable for retail miners, who don’t allow the network to face a slow demise or give way for conglomerates to dominate the market or give way for conglomerates to dominate the market.

It must also be noted that Doctor’s calculations assume an average electricity cost of $0.06/kWh for these operations. Still, mining pools are notoriously secretive about their cash flows and it is possible that some of these companies are paying less. For these companies, bleeding prices in the short-term may be less than an issue, especially if it takes out the competition when the market recovers.

The post Bitcoin Hash Rate Doubles in Three Months, Mining Now Costlier Than Buying One BTC appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|