2019-10-2 18:45 |

This article was originally published by 8btc and written by Lylian Teng.

Amid the recent bitcoin price crash, Mao Shixing, founder of F2Pool, currently the world’s largest bitcoin mining pool, published a list of the “shutdown price,” below which cryptocurrency mining machines have to be shut down due to lack of profitability.

According to Mao, at the current mining difficulty, older mining models including Whatsminer’s M3 and Avalon A741 have already reached the shutdown price. And the Ebit E9+, Antminer T9+, Avalon A821 and Antminer S9 machines, once the most efficient cryptocurrency miners, are on the verge of shutting down if the bitcoin price drops to $7,500.

Because the calculation above does not include hardware purchasing costs, mining pool fees or maintenance fees, the actual shutdown prices should actually be much higher.

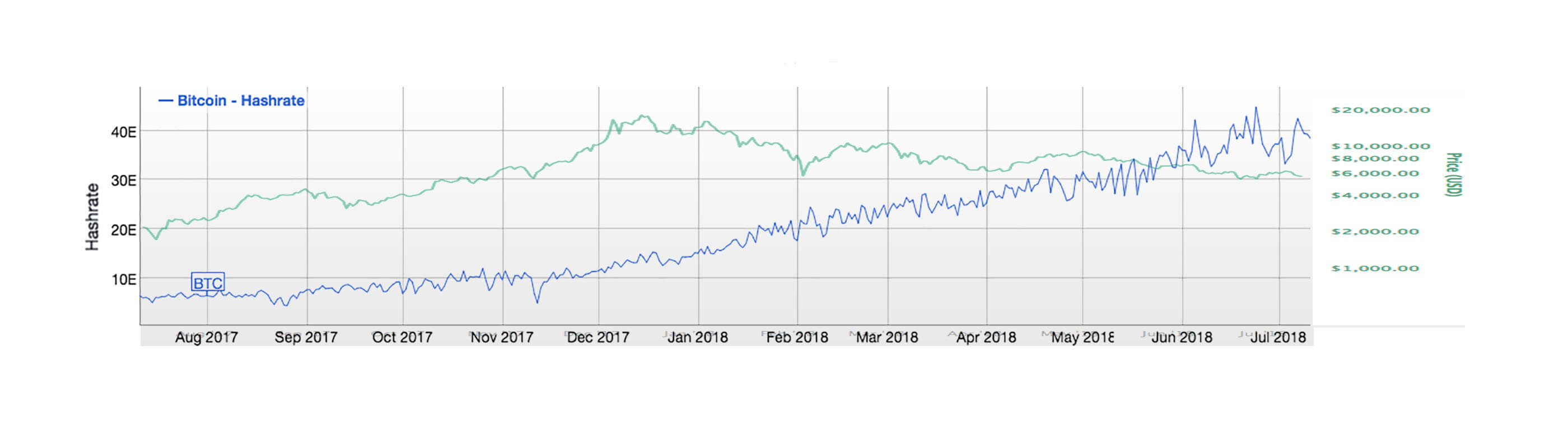

This shutdown price update from F2Pool is reminiscent of a time in 2018 when the bitcoin price dropped from the $6,000 range to the $3,000 range, rendering a huge amount of mining machines unprofitable and leading them to be dumped like scrap as the regional Chinese rainy season (when cheap electricity is guaranteed thanks to abundant hydropower) came to an end. As a result, the Bitcoin hash rate plunged by almost half from a year high of around 60 exahashes per second (EH/s) in the final two months of 2018.

Source: CoinMarketCapHowever, the latest price plummet has not seemed to influence the Bitcoin hash rate. Data has shown that that hash rate metric remains on an upward trajectory after a temporary dip, which many guessed was the result of new mining machine upgrade. This indicates that miners are remaining confident in a bitcoin price rally.

After all, they are more likely to dedicate more resources to the computer-intensive process that secures the network and processes transactions if they are bullish on the price. Miners would likely scale back operations if a price slide is expected. That explains why many believe prices follow hash rate and an increasing hash rate might hint at price gains.

Source: BitInfoChartsThe hash rate surge over the past few months points to more mining machines operating on the network. With the delivery of a huge amount of 50T+ miners by the end of 2019, Bitcoin is expecting another hash rate spike. But will the bitcoin price rally along with it?

The post F2Pool Predicts Bitcoin Mining “Shutdown Price” But Hash Rate Steady appeared first on Bitcoin Magazine.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|