2019-9-11 00:00 |

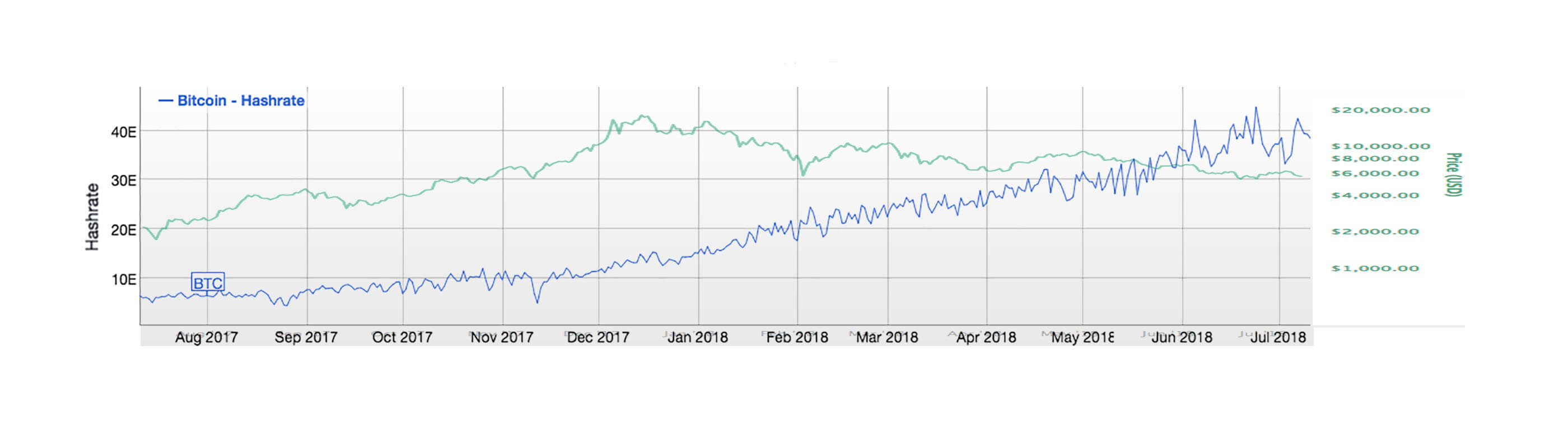

Blockchain startup Bitcoin SV is losing its hash rate profile to rival projects, according to data provided by Coin Metrics.

Where Are All the Miners?The data analysis firm found that Bitcoin SV’s hash rate market share touched its all-time low as of September 9, 2019. At its peak, Bitcoin SV occupied almost 9 percent of the total hash rate against Bitcoin and Bitcoin Cash. Nevertheless, the current statistics show a significant drop in Bitcoin SV’s market share – now close to 1 percent.

Bitcoin SV hash rate share touches record low against Bitcoin and Bitcoin Cash | Image credits: Coin Metrics

Hash rate typically signifies the speed at which a miner finds the block on a blockchain. For miners, a drop in hash rate means less competition – since there is less number of participants in the network. Meanwhile, for users and system, it means less security, congestion, and transaction delays. While Bitcoin SV claims it is a robust network idiosyncratically, data from Coin Metric shows it is less healthy than the blockchains of Bitcoin and Bitcoin Cash.

A separate data provided by Blockchair shows that Bitcoin SV’s mining difficulty has also dipped in the last 30 days, reflecting that there are fewer machines at work to support the BSV network.

Bitcoin SV Price High, NeverthelessCoin Metrics noted that a drop in Bitcoin SV’s hash rate share didn’t hurt its spot market bias. The blockchain’s native asset, BSV, hit a record realized market capitalization of $1.016 billion on September 8. That reflected in BSV’s weekly price action as well; the coin trended in positive territory, albeit lazily. In comparison, other alternative cryptocurrencies suffered losses, with Bitcoin Cash’s BCH slipping by 3 percent.

As of this time of writing, the BSV/USD exchange rate had dropped by circa 3.5 percent to $126.53. The volatility, too, dropped by 2 percent over the past week.

Which means there is not enough hashpower growth. There's room for more miners.

— David DeSantis (@PilotDaveCrypto) September 7, 2019

On the other hand, bitcoin continued to rule the charts, registering up to 4 percent profits over the past week, with its volatility up by 2 percent. The benchmark cryptocurrency is stealing the limelight from rival coins, including BSV, as it gears up for institutional adoption after the scheduled launch of Bakkt’s physically-settled futures this September 23. Global investors are also looking into bitcoin as they look for alternative hedging assets to safeguard capital from a gloomy macroeconomic outlook.

Do you think Bitcoin SV’s hashrate will recover soon? Add your thoughts below!

Images via Shutterstock, BlockChair, Coinmetrics

The post Blow to Bitcoin SV as Hash Rate Market Share Nears All-Time Lows appeared first on Bitcoinist.com.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|