2018-8-23 04:15 |

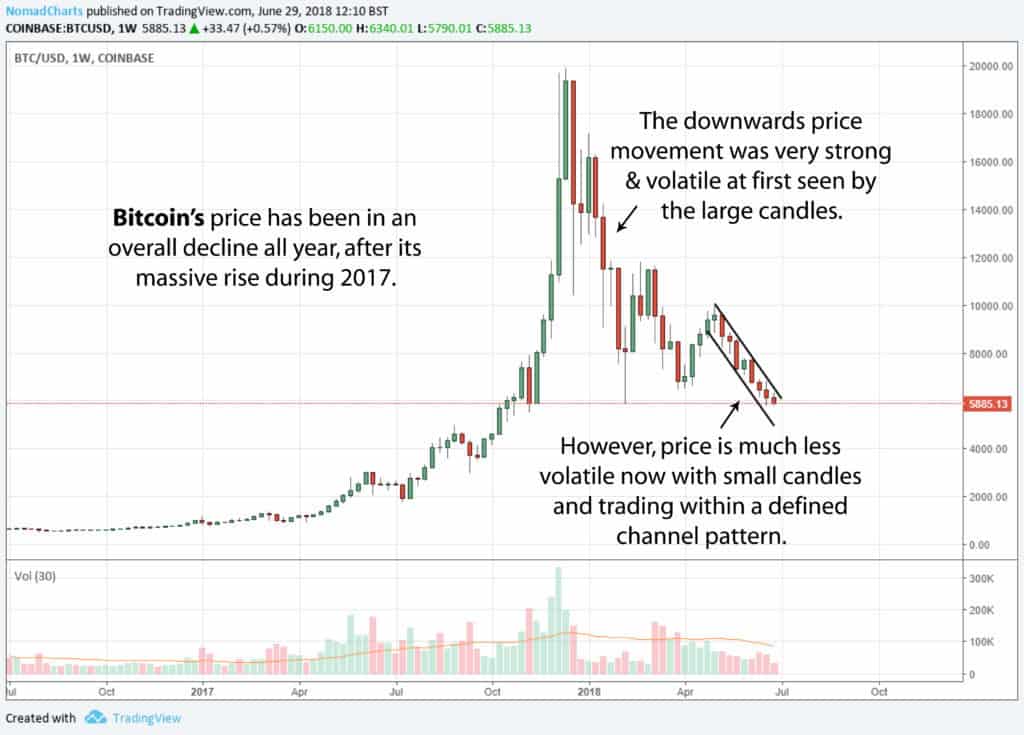

Bitcoin continues to trend higher even as it sold off from the recent sharp rally. Price is testing support at the bottom of its ascending channel on the 1-hour time frame, and the Fib extension levels show upside targets.

The bottom of the channel lines up with a former resistance level that appears to be adding to its strength as a floor. This is also around the moving averages’ dynamic inflection points, although bitcoin has dipped below these levels slightly.

Still, the 100 SMA is above the longer-term 200 SMA to signal that the path of least resistance is to the upside. In other words, the uptrend is more likely to resume than to reverse. Then again, the gap between the indicators is narrow enough to suggest that a bearish crossover is also possible.

RSI is making its way out of the oversold area to indicate a return in bullish pressure. Stochastic is also pointing up to reflect that buyers are in control and could push bitcoin back up to the next upside targets. The closest one is the 38.2% extension at the $6,500 mark.

Stronger bullish pressure could take bitcoin up to the mid-channel area of interest near the 50% extension at $6,600 or the 61.8% extension at $6,664.70. The 78.6% extension is near the swing high at $6,800 and the full extension is at the top of the channel past $6,900.

Anticipation for the SEC decision on the ProShares bitcoin ETF application boosted price earlier on, but the rejection led to a swift retreat. The regulator disapproved two ETFs filed by ProShares that would track bitcoin futures contracts, another from GraniteShares, and five leveraged and inverse ETFs from Direxion.

This comes a few weeks after the SEC rejected the applications filed by the Winklevoss twins and ahead of another set of rulings due later in September. Many believe that this rejection is an indication of how their next decisions might turn out.

The post Bitcoin (BTC) Price Analysis: New Channel Forming! appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|