2018-8-22 06:49 |

Bitcoin bulls have charged past the $6,600 near-term resistance to push price to the $6,900 mark before pulling back. Applying the Fibonacci retracement tool on the latest swing high and low shows where more buyers could be waiting to join in.

In particular, the 61.8% Fibonacci level lines up with the broken resistance and the rising trend line connecting the lows since August 14. This is also just above the dynamic inflection points at the moving averages.

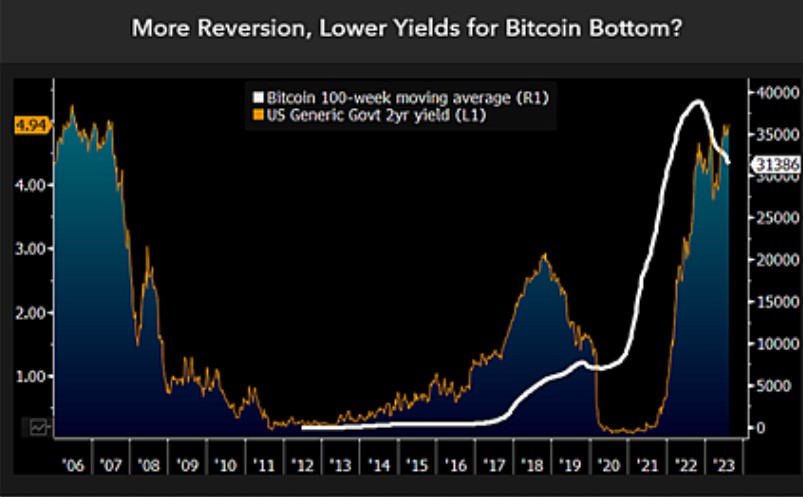

On the subject of moving averages, the 100 SMA is above the longer-term 200 SMA to indicate that the path of least resistance is to the upside. In other words, the uptrend is more likely to resume than to reverse.

However, RSI is already indicating overbought conditions and might be due to turn lower to signal a return in selling pressure. Stochastic hasn’t quite reached overbought territory yet but also looks ready to head south, so bitcoin might follow suit.

The pop higher earlier today is being pinned on anticipation for the SEC ruling on the ProShares bitcoin ETF application on August 23. Unlike the other applications shelved until the end of September, the regulator can no longer extend the ruling deadline on this one as it has been filed in December last year.

Approval could bring even more gains for bitcoin and its peers as this would build anticipation for a similar decision in the other applications. This could also mean more liquidity and increased activity for bitcoin trades. Denial, on the other hand, could force bitcoin to return its recent wins.

Risk sentiment is also a general factor to keep close tabs on as there has been a lot going on in terms of trade talks and geopolitical risks. Turkey appears to have taken the back seat for now and the central bank’s pledge to take action seems to have spurred a bit of calm.

The post Bitcoin (BTC) Price Analysis: Can More Bulls Join In? appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|