2018-11-9 06:59 |

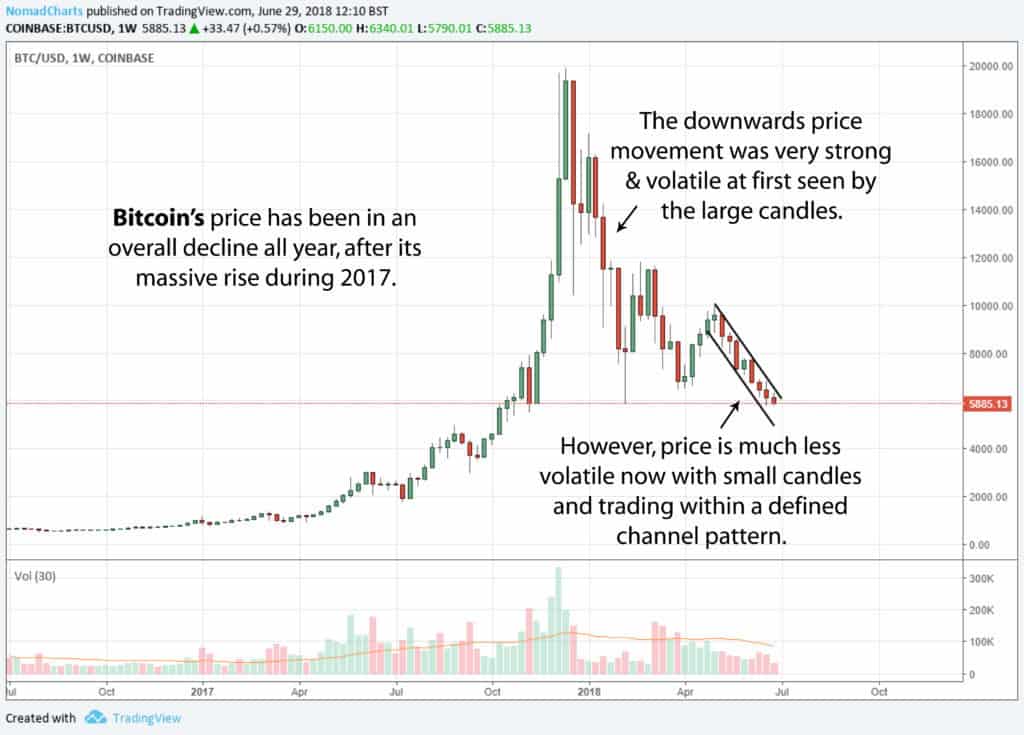

Bitcoin was previously trading higher inside an ascending channel on its 1-hour chart, but support gave way to signal that bears have the upper hand. Price has also broken below the 100 SMA dynamic inflection point and is on its way to test the 200 SMA.

A quick pullback to the broken channel bottom around $6,550 may be in order as this lines up with an even shorter-term descending trend line. The 100 SMA is still above the longer-term 200 SMA, though, so the path of least resistance might be to the upside. In other words, there’s still a chance for support to hold and the uptrend to resume.

Stochastic is heading lower to indicate that sellers are in control but appears to be bottoming out as it approaches the oversold area. Turning back up could bring a pickup in bullish momentum and a move above the channel bottom could signal a continuation of the uptrend. RSI is also starting to turn higher without hitting oversold levels, suggesting that bulls are eager to charge again.

The mood in the cryptocurrency industry has been mostly positive for the week, although some of the gains were returned likely on regulatory jitters. The SEC has charged EtherDelta’s founder for operating an unlicensed exchange for tokens while it has also ended the public comment period for bitcoin ETF applications, signaling that a decision might be ready soon.

With that, it’s understandable that profit-taking came back in play towards the latter part of the week as investors might be keen to reduce their exposure to these risks. Dollar strength also came in play as the FOMC decision kept hopes for a December hike in play. Still, it’s worth noting that Morgan Stanley’s report on bitcoin has been overall bullish on account of expectations of strong institutional flows next year.

The post Bitcoin (BTC) Price Analysis: Short-Term Channel Breakout, Pullback Next? appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|