2025-12-25 09:57 |

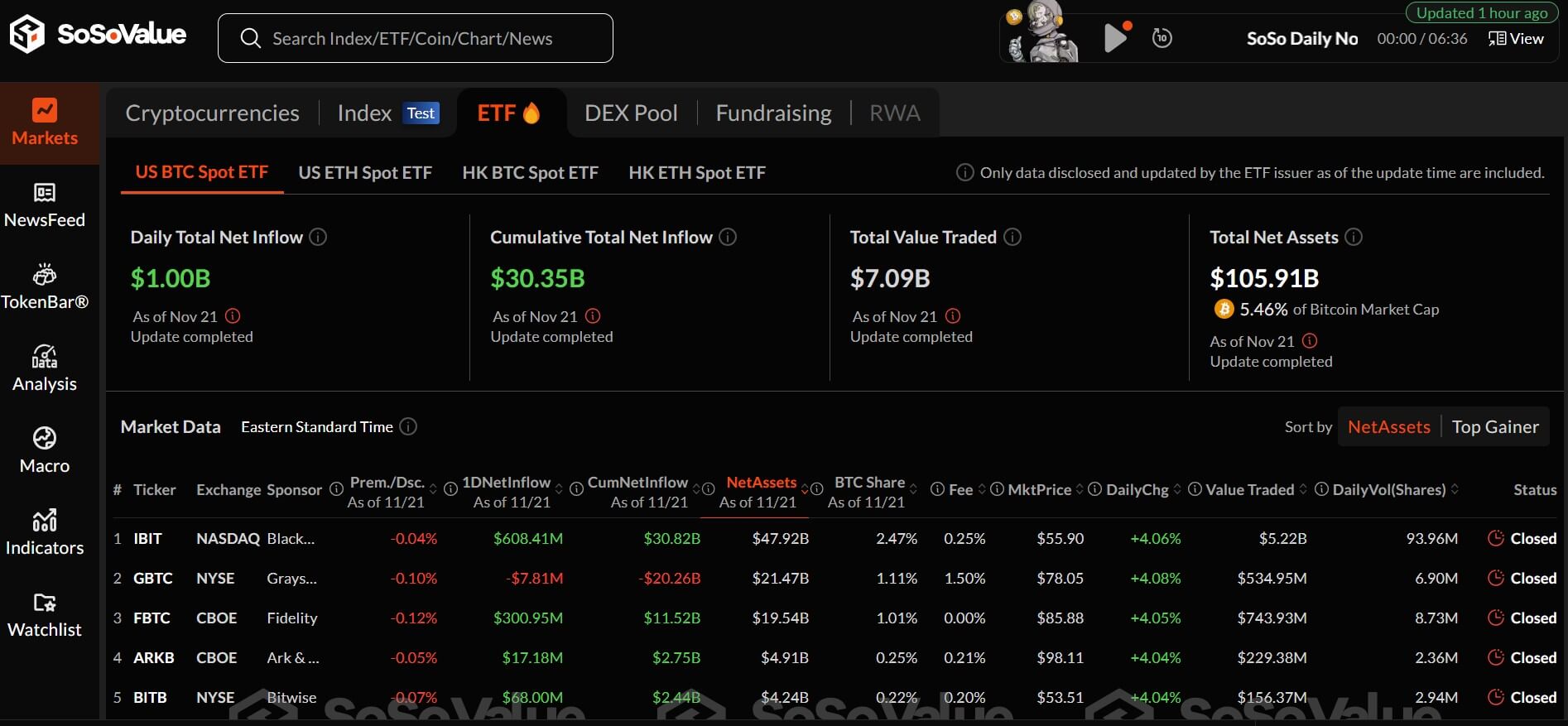

The biggest single-day exit came from BlackRock’s IBIT, which saw $91.37 million leave the fund. Grayscale’s GBTC followed with a $24.62 million outflow. origin »

Bitcoin price in Telegram @btc_price_every_hour

ExitCoin (EXIT) íà Currencies.ru

|

|