2024-12-18 02:00 |

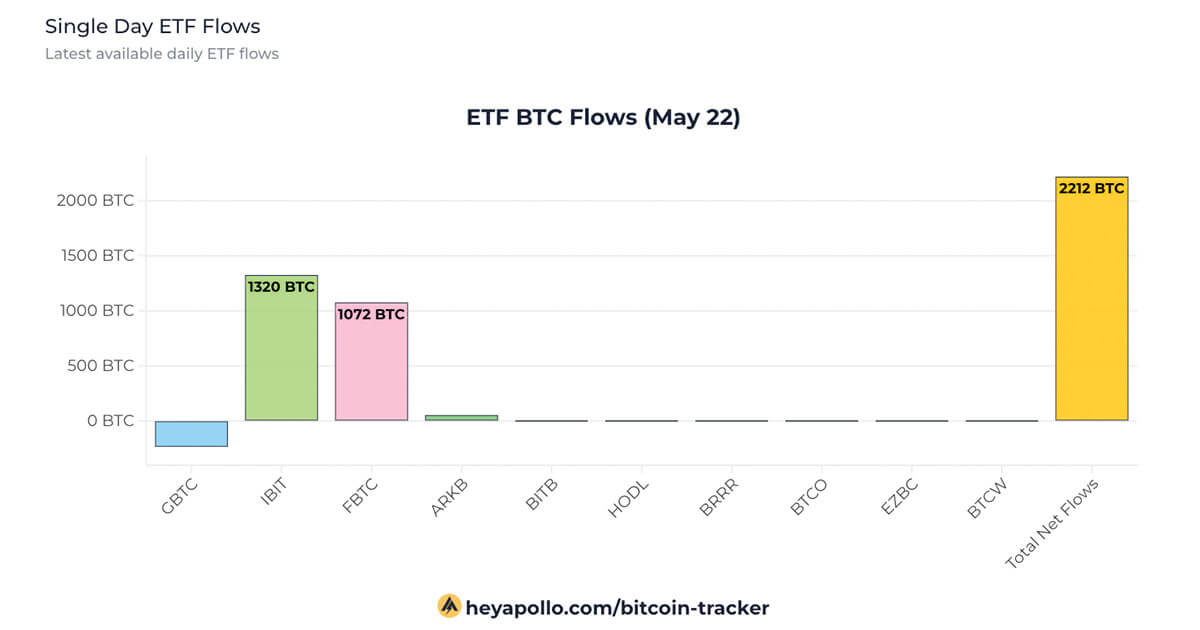

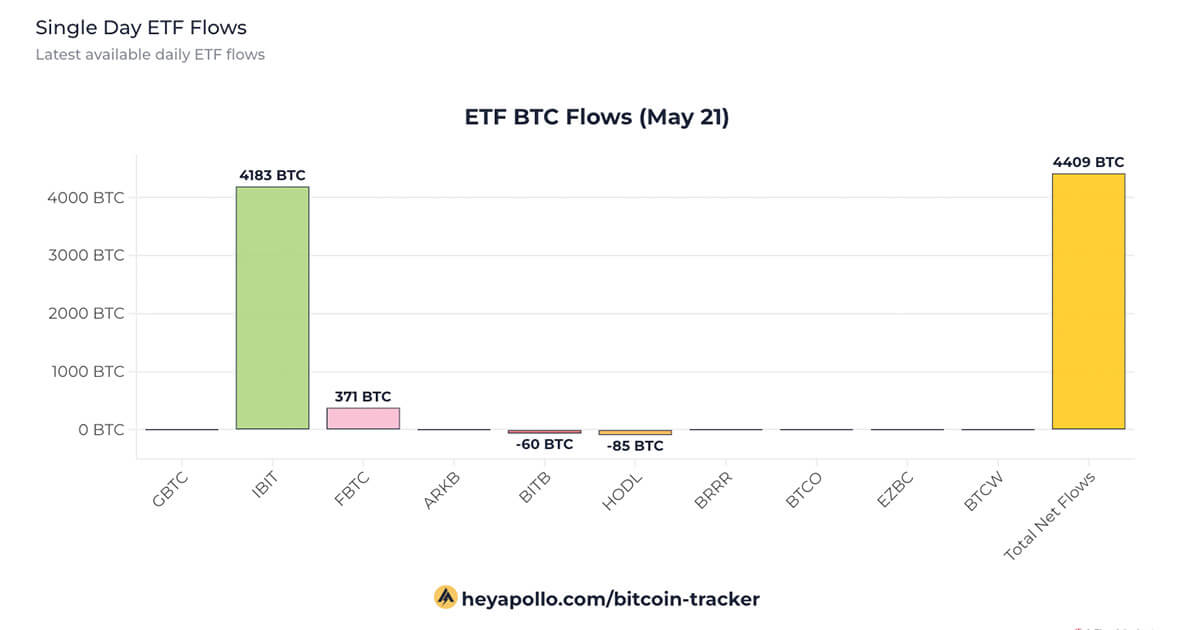

BlackRock’s spot Bitcoin (BTC) exchange-traded fund (ETF) IBIT became the most successful ETF launch in over 10 years, following the $418.8 million in net flows registered on Dec. 16.

Nate Geraci, CEO of The ETF Store, highlighted that IBIT had beaten approximately 2,850 ETFs. He added:

“In other words, IBIT has more lifetime inflows than any ETF launched since 2014. Did this in just over [11 months].”

Since its launch, IBIT has amassed $36.3 billion in positive net flows, surpassing the $36.2 billion in inflows received by US-traded spot Bitcoin ETFs, according to Farside Investors’ data.

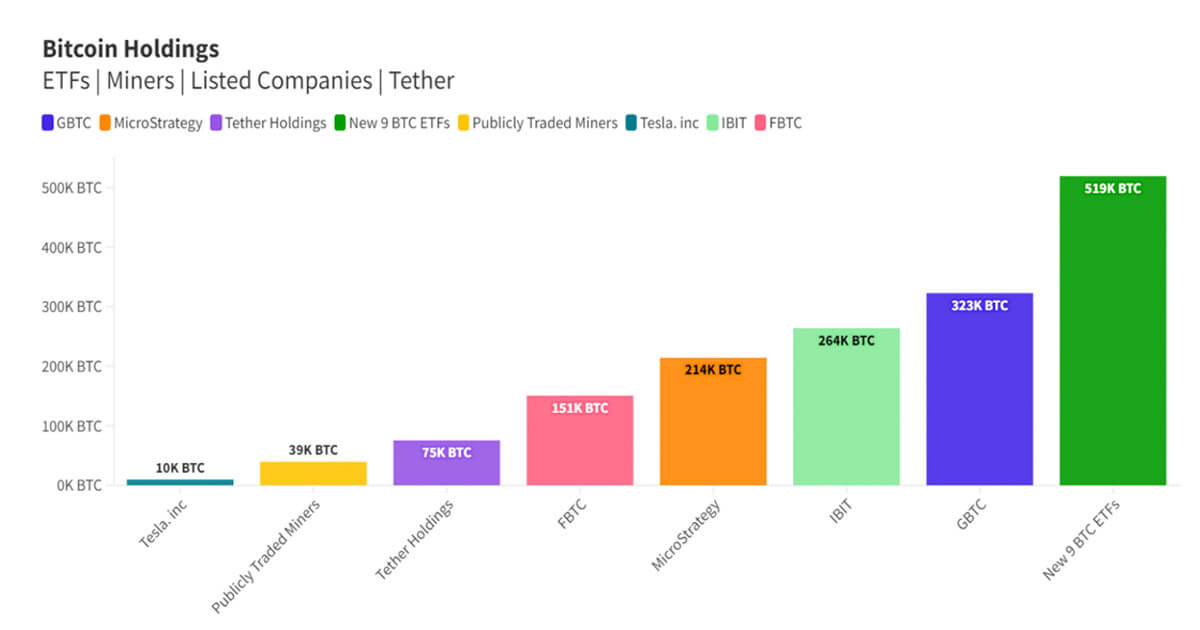

The amount is nearly 3x higher than the $12.4 billion in inflows received by the second-largest spot Bitcoin ETF, FBTC, managed by Fidelity.

Additionally, IBIT holds the record for the most significant daily inflow among the Bitcoin ETFs, with over $1.1 billion captured in a single day. This is over 2x higher than FBTC’s single-day inflow record of $473.4 million, the second-largest daily inflow by a spot Bitcoin ETF.

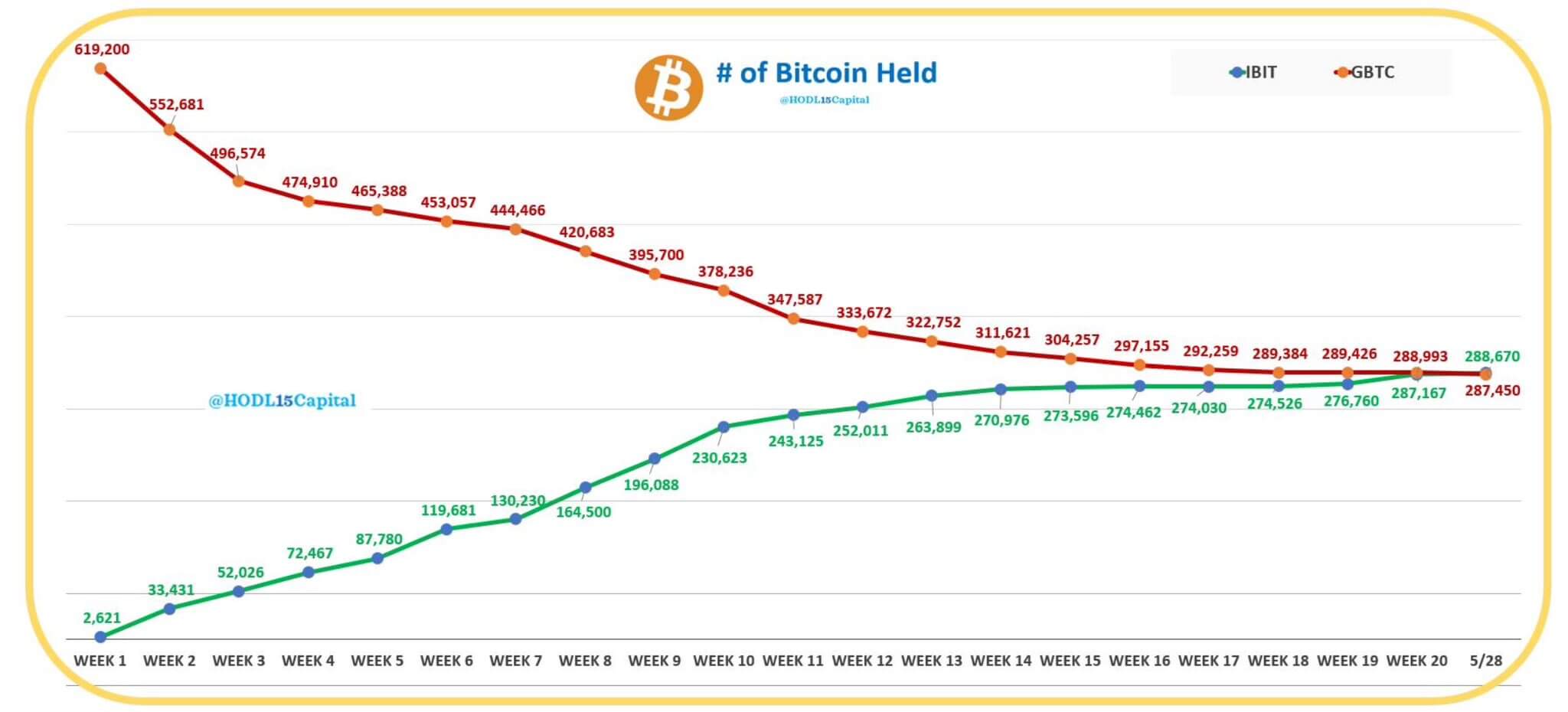

Notably, spot Bitcoin ETFs secured over $36 billion in year-to-date flows despite Grayscale’s GBTC’s $21 billion in outflows since its conversion.

ETFs in the spotlightCrypto-related ETFs were one of the key topics for the market this year. They provided US-based institutional investors with a regulated way to gain exposure to Bitcoin and Ethereum (ETH).

Analysts see crypto ETFs as one of the main drivers of Bitcoin’s stellar growth this year. In a recent report, Bitfinex analysts pointed out ETF adoption is one of the main catalysts capable of changing Bitcoin’s patterns from previous cycles.

Additionally, Bloomberg senior ETF analyst Eric Balchunas highlighted how fast Bitcoin ETFs are growing. The total assets under management by these products traded in the US, including futures and leveraged ETFs, reached $130 billion, surpassing gold ETFs’ $128 billion.

Even taking just the nearly $117 billion in AUM from spot Bitcoin ETFs, Balchunas stated that it is “unreal” how close they are to gold ETFs within just 11 months after launch. Bitwise also considers ETFs one of the two main catalysts for significant growth in Ethereum over the next year.

The post BlackRock’s IBIT becomes decade’s top ETF for inflows, surpassing all rivals appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

EthereumFog (ETF) на Currencies.ru

|

|