2025-6-2 15:58 |

BlackRock’s iShares Bitcoin Trust (IBIT) recorded its largest single-day outflow on May 30, with investors pulling $430.8 million from the fund.

This marked the end of a 31-day inflow streak and the first net withdrawal in over seven weeks.

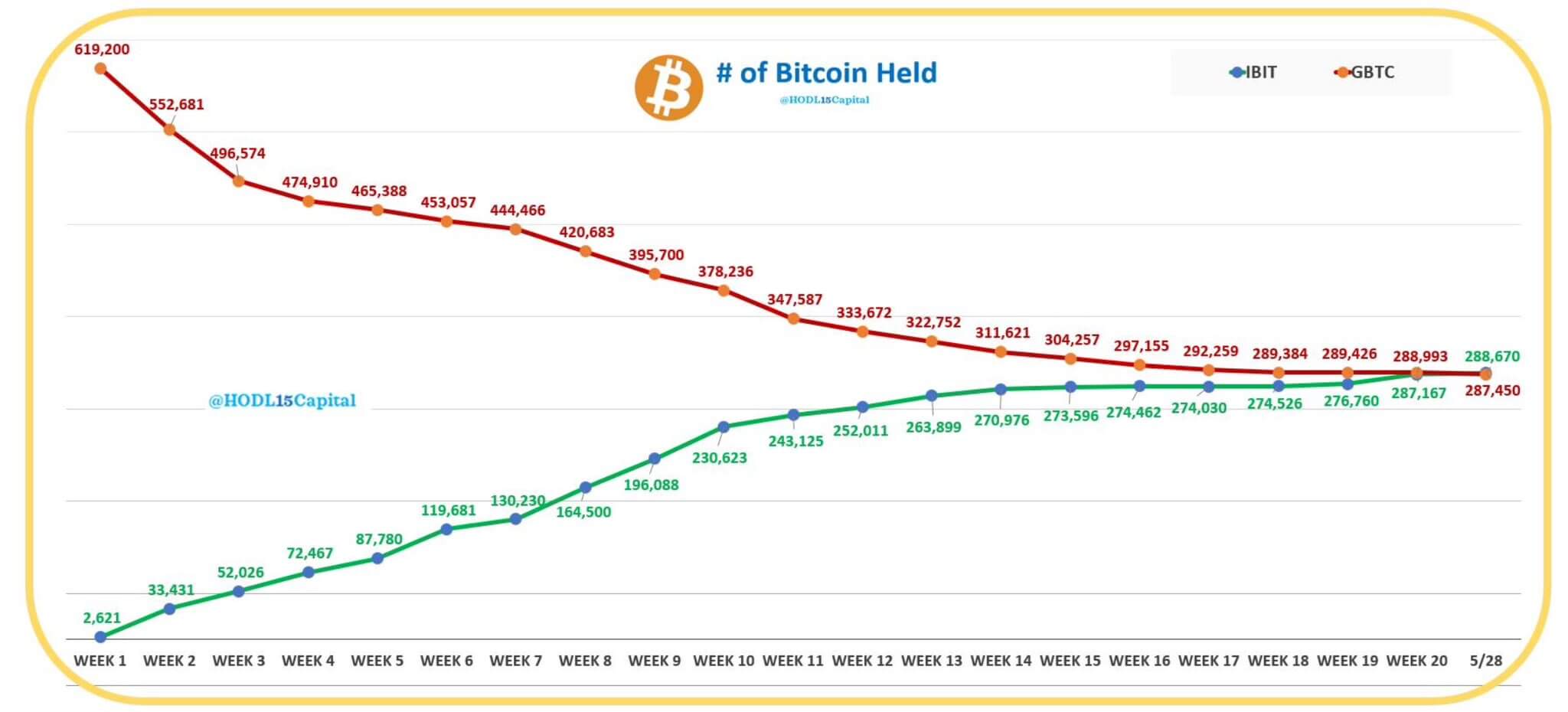

BlackRock’s IBIT Still Dominates Bitcoin ETF InflowsBefore this reversal, IBIT attracted $6.5 billion in May alone, making it one of the strongest months since its debut in January 2024.

IBIT’s rapid ascent is not limited to the crypto space. Within 18 months, it climbed into the top 25 US-listed ETFs by assets under management, which many have described as unprecedented.

At the same time, the fund ranks among the top five ETFs for year-to-date inflows across over 4,200 US-listed funds.

IBIT hits new monthly record for inflows…

Nearly $6.5bil in May.

Has now taken in money 31 of past 32 trading days overall.

via @sidcoins pic.twitter.com/mWWkoImjFD

According to ETF Store president Nate Geraci, IBIT’s performance has been exceptional. He pointed to the fund’s consistent appeal during both bullish and uncertain market conditions as evidence of its dominance in the sector.

“What a run over the past 30+ days though. IBIT now pushing $ 70 billion in assets < less than 17 months since launch. Not sure I have words to describe how ridiculous this is,” Geraci stated.

Industry analysts attribute IBIT’s momentum largely to growing institutional demand for Bitcoin.

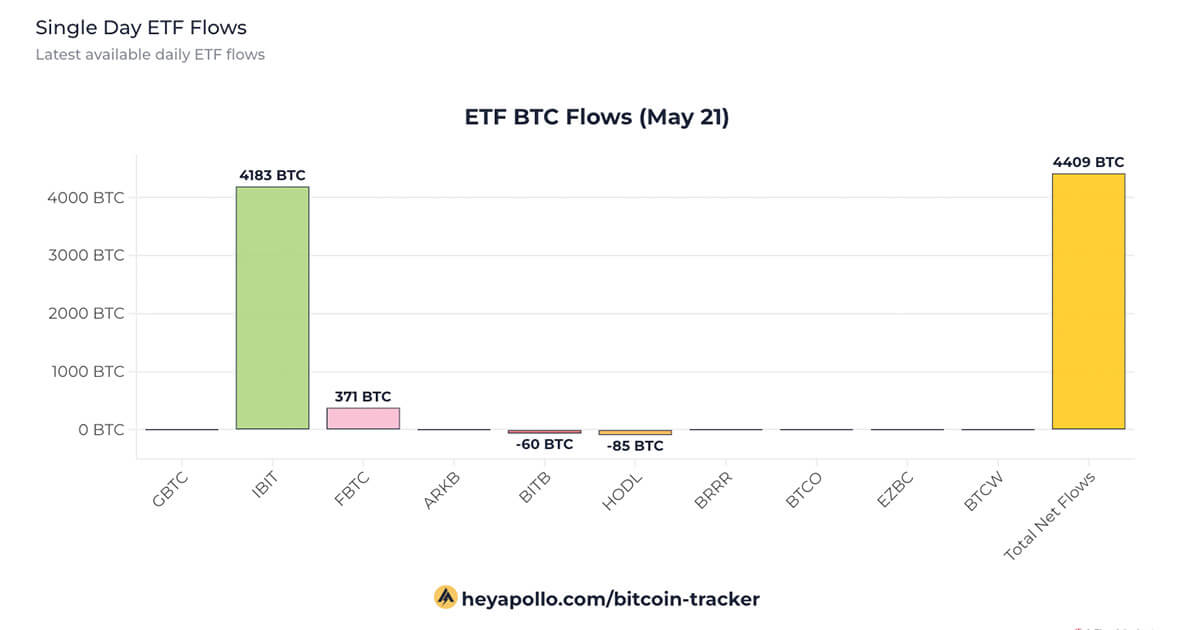

Bloomberg ETF analyst Eric Balchunas highlighted that IBIT has recently absorbed more than 100% of net Bitcoin ETF inflows. This marks an unusual shift from its typical 70% share.

The IBIT vs Everyone Else flow disparity is interesting. Normally IBIT takes in 70% of the net inflows but lately it’s over 100%. My theory: the latest rally was more an institutional buying spree than retail (perhaps sparked by the decoupling and lessened vol). https://t.co/9mNLCUaOEz

— Eric Balchunas (@EricBalchunas) May 31, 2025This institutional pivot comes as inflation concerns, economic uncertainty, and improved US regulatory clarity drive traditional investors toward digital assets.

Bitcoin has increasingly been seen as a hedge against fiat devaluation and systemic risk, prompting corporations and nation states to adopt it as part of their treasury strategy.

BlackRock’s iShares Bitcoin Trust (IBIT) Flows in May. Source: SoSoValueAs a result, Bitcoin’s price surged to a record high above $111,000 in May. The rally highlighted the growing influence of institutional capital in driving the crypto market.

According to BeInCrypto data, the top cryptocurrency has since pulled back to around $105,000 over the past week.

The post BlackRock’s IBIT Inflow Streak Snaps as $430 Million Exits in One Day appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Miner One token (MIO) íà Currencies.ru

|

|