2025-12-18 13:23 |

Spot Bitcoin exchange-traded funds recorded a sharp rebound in investor interest on Wednesday, pulling in $457 million in net inflows, the strongest single-day intake in more than a month.

The surge suggests institutional demand may be stabilising after a volatile stretch marked by alternating inflows and outflows through November and early December.

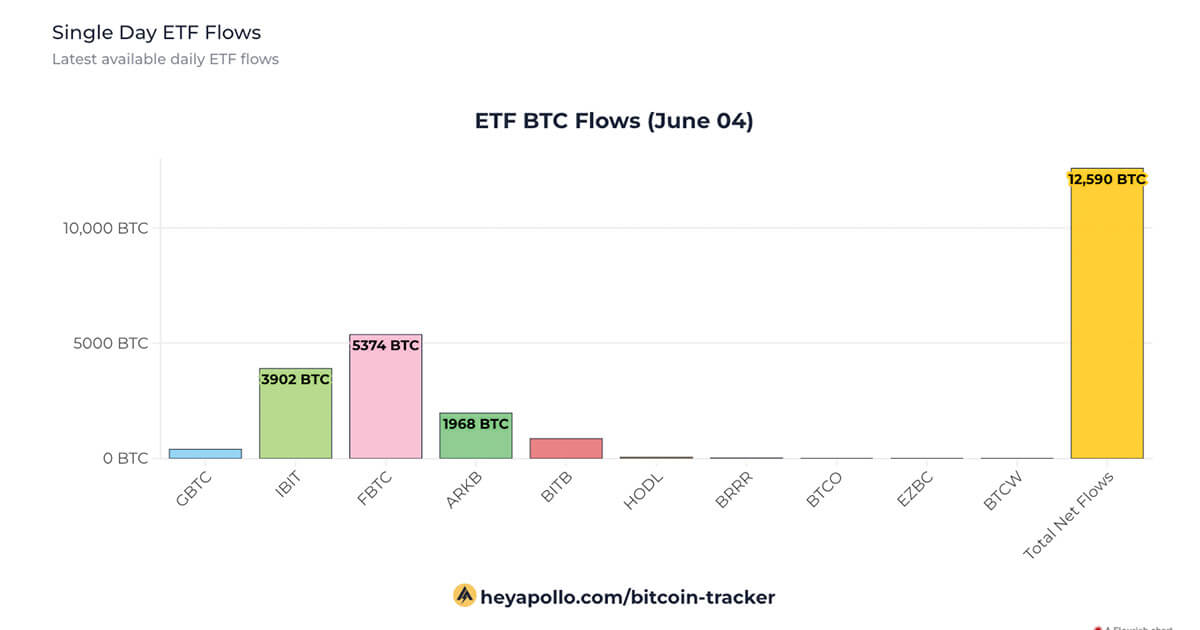

DateIBIT (BlackRock)FBTC (Fidelity)BITB (Bitwise)ARKB (ARK)BTCO (Invesco)EZBC (Franklin)BRRR (Valkyrie)HODL (VanEck)BTCW (WisdomTree)GBTC (Grayscale)BTC (Grayscale)Total17 Dec 2025111.2391.5(8.4)(37.0)0.00.00.00.00.00.00.0457.316 Dec 2025(210.7)26.7(50.9)(16.9)0.00.00.0(18.0)0.00.0(7.4)(277.2)15 Dec 20250.0(230.1)(44.3)(34.5)0.00.00.0(21.2)0.0(27.5)0.0(357.6)12 Dec 202551.1(2.0)0.00.00.00.00.00.00.00.00.049.111 Dec 202576.7(103.6)8.4(16.4)0.00.00.0(19.4)0.0(12.2)(11.0)(77.5)Data from Farside Investors.Fidelity’s Wise Origin Bitcoin Fund led the day’s activity, attracting approximately $391 million in net inflows, accounting for the bulk of Wednesday’s total.

BlackRock’s iShares Bitcoin Trust followed with around $111 million in net inflows, according to data from Farside Investors.

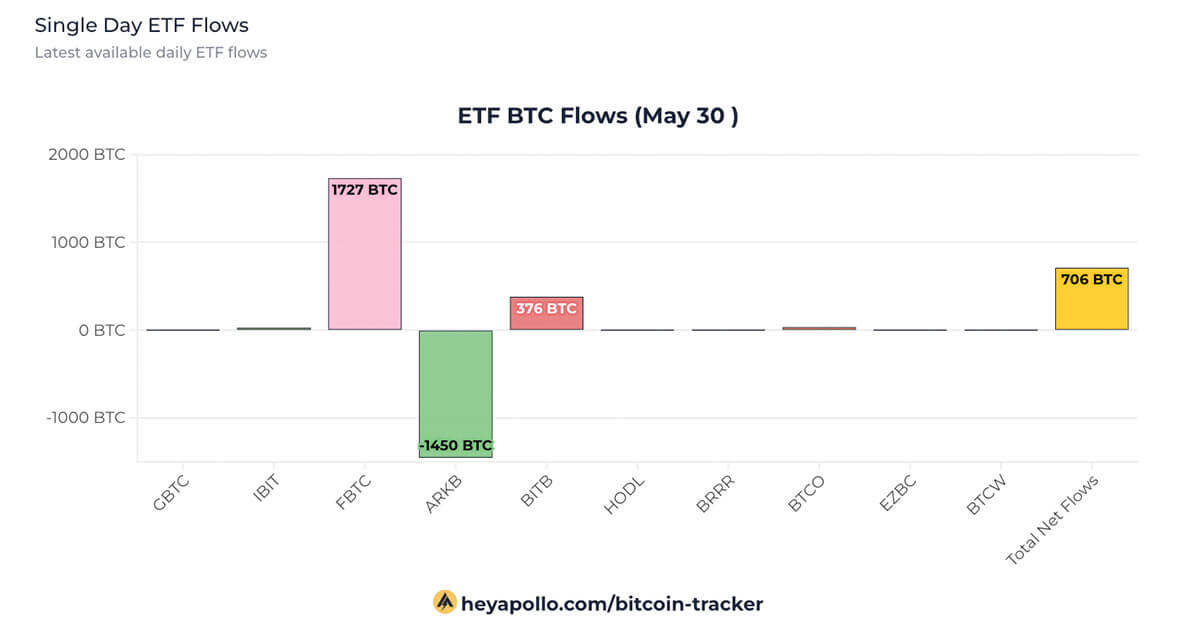

Recovery after a choppy periodWednesday’s intake marked a notable reversal after weeks of uneven flows.

Throughout November and early December, spot Bitcoin ETFs experienced a stop-start pattern, swinging between modest inflows and sharp daily outflows.

The last time inflows exceeded $450 million was on Nov. 11, when the funds collectively drew about $524 million in a single session.

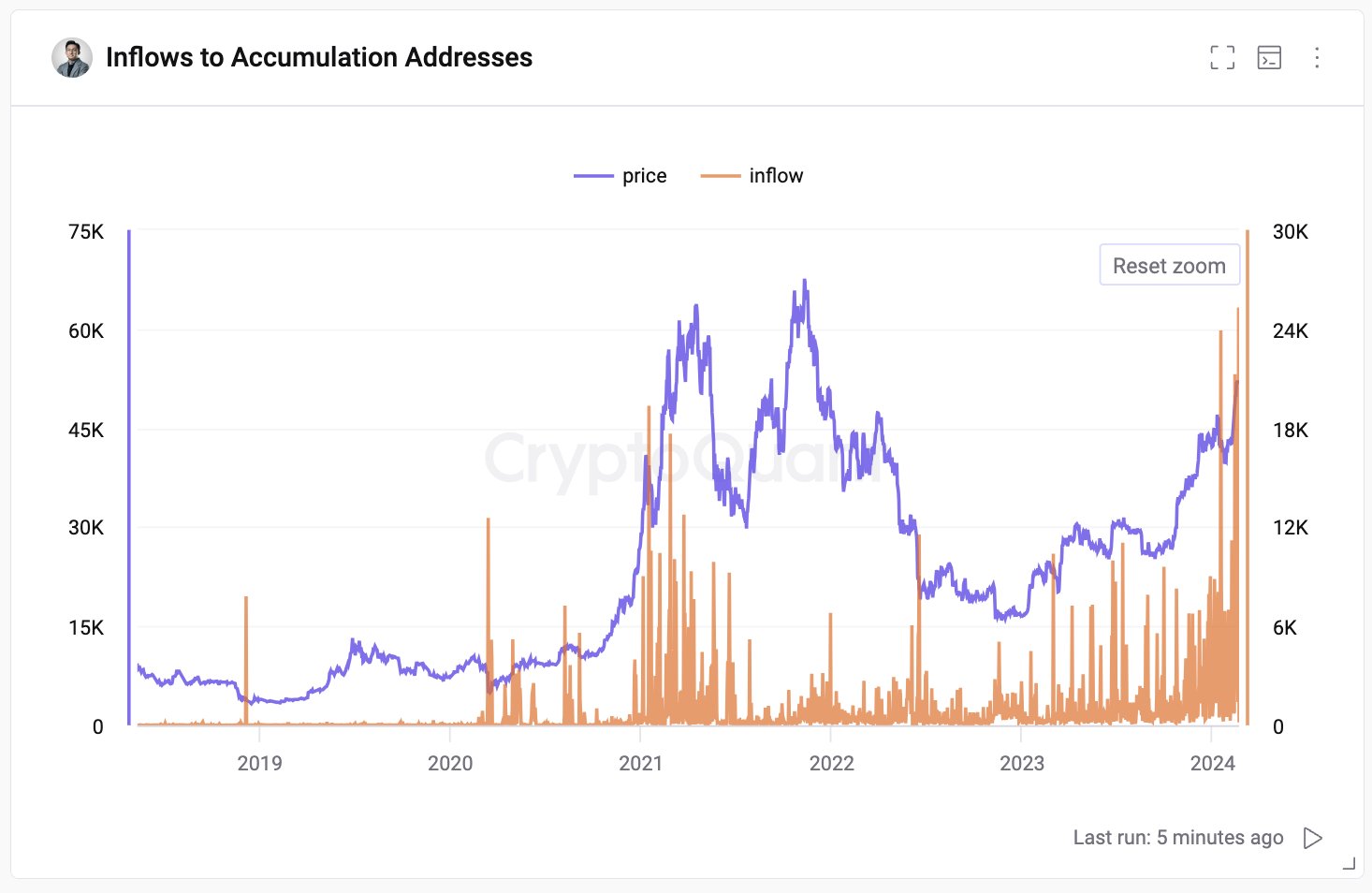

The renewed buying comes as Bitcoin prices have stabilised following a sharp pullback from earlier highs.

While the cryptocurrency surged earlier in the year, recent price action has reflected consolidation rather than a renewed expansion phase.

Ethereum ETFs remain under pressureIn contrast to Bitcoin funds, spot Ethereum ETFs have continued to struggle with sustained capital outflows.

Over the past five trading sessions, the sector has experienced a marked reversal in sentiment, including two consecutive days of heavy selling on Dec. 15 and 16, when combined net outflows exceeded $449 million.

DateETHA (BlackRock)FETH (Fidelity)ETHW (Bitwise)TETH (21Shares)ETHV (VanEck)QETH (Invesco)EZET (Franklin)ETHE (Grayscale)ETH (Grayscale)Total17 Dec 2025(19.6)(2.8)0.00.00.00.00.00.00.0(22.4)16 Dec 2025(221.3)(2.9)0.00.00.00.00.00.00.0(224.2)15 Dec 2025(139.1)(11.0)(13.0)0.0(6.4)0.00.0(35.1)(20.2)(224.8)12 Dec 202523.2(6.1)0.00.00.00.00.0(14.4)(22.1)(19.4)11 Dec 20250.0(3.2)0.02.10.00.00.0(31.2)(10.0)(42.3)Data from Farside Investors.Even the largest products were not spared. BlackRock’s iShares Ethereum Trust recorded a single-day outflow of $221.3 million on Dec. 16.

Although the pace of selling slowed by Dec. 17, with net outflows narrowing to $22.4 million, flows across major issuers such as Fidelity and Grayscale remain negative, indicating waning institutional appetite as the year draws to a close.

Bitcoin holds steady ahead of inflation dataBitcoin traded in a narrow range on Thursday as investors adopted a cautious stance ahead of key US inflation data that could influence the Federal Reserve’s interest-rate outlook.

The world’s largest cryptocurrency was last trading about 1% higher at $87,554.6.

Despite earlier gains this year, Bitcoin has struggled to decisively reclaim the $90,000 level, reinforcing the view that the market is consolidating rather than embarking on another leg higher.

Investor focus is now firmly on the release of the US consumer price index data for November.

Economists expect the report to show an uptick in annual headline inflation, a development that could complicate the Fed’s assessment of how much room remains for further monetary easing.

Fed uncertainty weighs on risk appetiteEarlier in the week, delayed US labour market data painted a mixed picture.

Nonfarm payrolls rebounded modestly in November after a sharp contraction in October, but the unemployment rate rose to its highest level in years.

The conflicting signals have clouded expectations around the Fed’s next policy steps and dampened conviction in the outlook for further rate cuts.

Adding another layer of uncertainty, President Donald Trump has indicated that his preferred candidate for the next Federal Reserve chair would favour significantly lower interest rates.

The remarks have fuelled debate about the future direction of US monetary policy, a key variable for risk assets such as cryptocurrencies.

The post Bitcoin ETFs see over $450M in inflows as BTC hovers near $87K ahead of inflation data appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|