2026-1-17 20:01 |

Ecoinometrics shared a post on X highlighting the reasons behind Bitcoin’s sluggish price growth over the past few months BTC $95 443 24h volatility: 0.1% Market cap: $1.91 T Vol. 24h: $37.93 B .

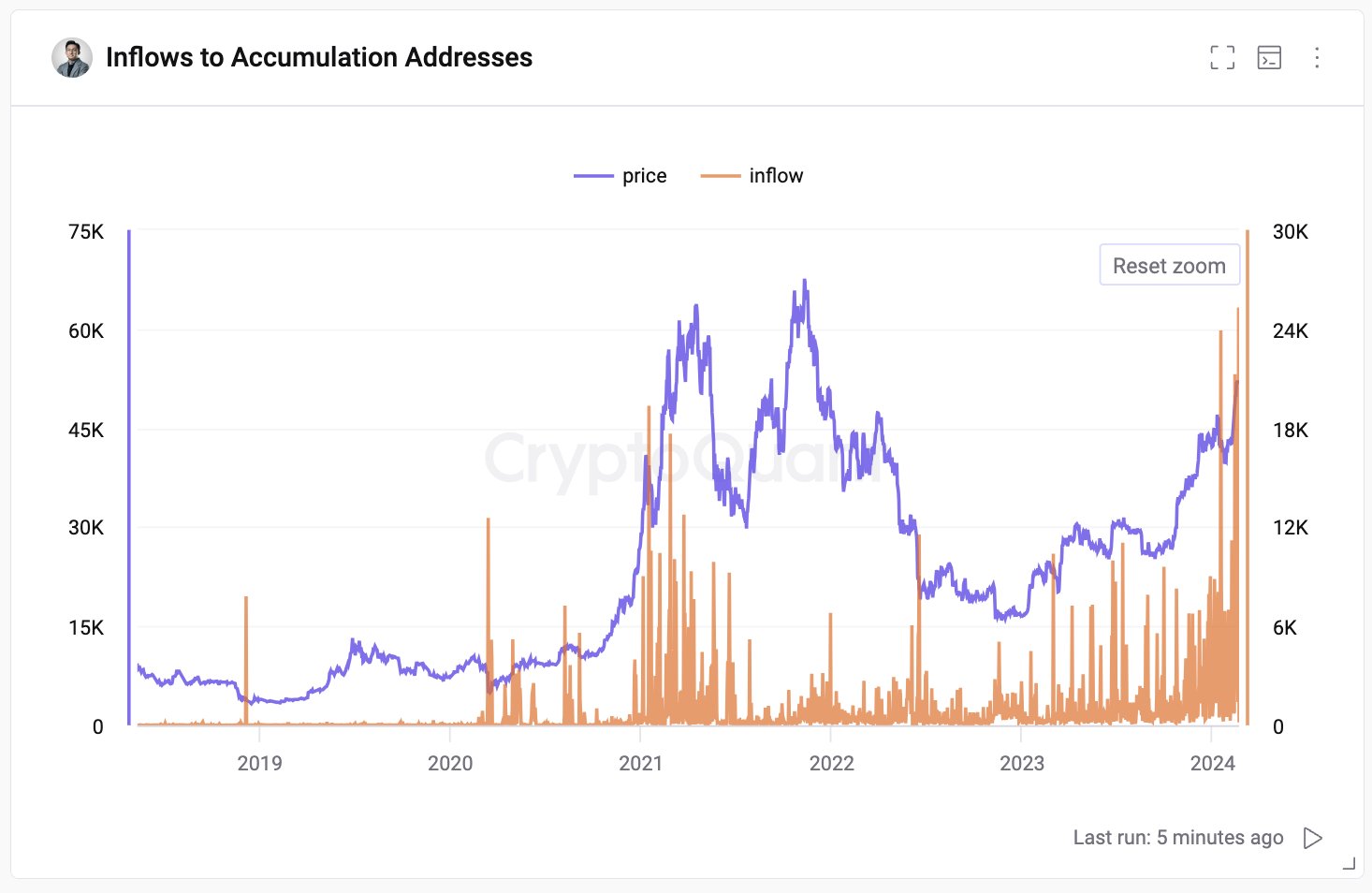

The financial analytics platform acknowledged that the broader crypto market saw a slight bounce these last few days. It also pointed out that short-term demand supports price, although it has failed to repair the broader demand trend.

Bitcoin ETF Flows Experience Drawdown

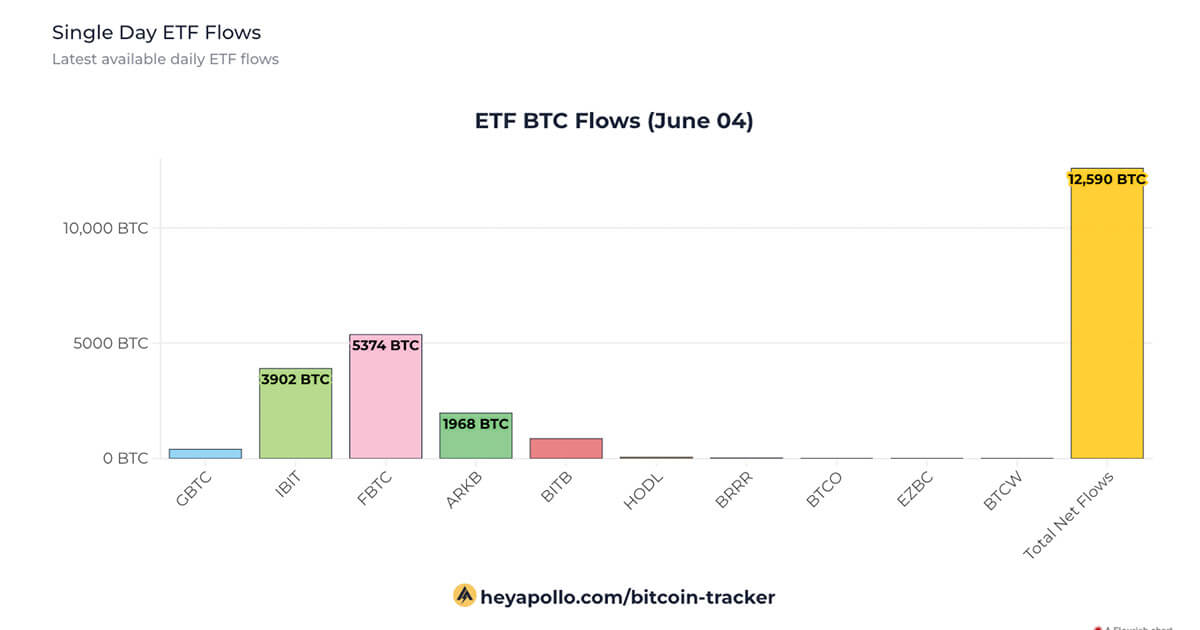

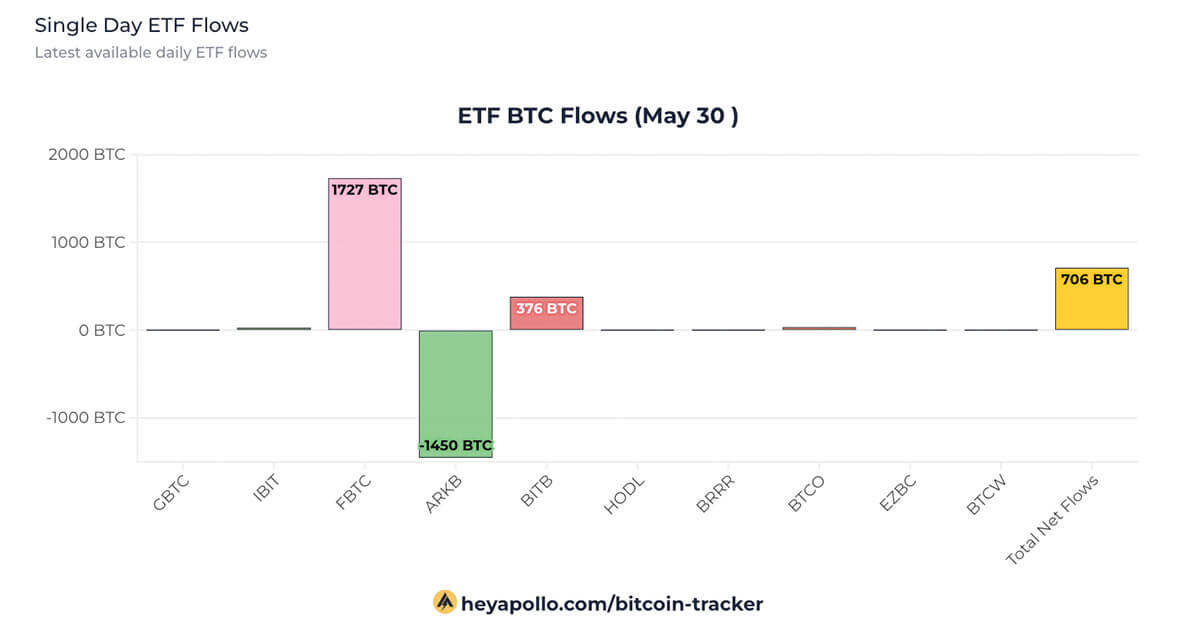

In the Ecoinometrics post, the core analysis centers on Bitcoin Exchange Traded Fund (ETF) flows, noting recent $1.7 billion inflows.

This was recorded over three days in mid-January 2026 and barely dented the deep cumulative drawdown from the 2025 peaks.

A shared chart showed that the net flows dropped from $18 billion to under $10 billion.

This is why Bitcoin keeps stalling near the same levels.

Short-term demand supports price, but it hasn’t repaired the broader demand trend yet.

Follow @ecoinometrics for more data-driven insights on Bitcoin and macro.

— ecoinometrics (@ecoinometrics) January 16, 2026

Amid this movement, Bitcoin’s price has improved, moving from under $90,000 to trade at around $96,000 and $97,000. At the time of writing, BTC’s price is currently trading at $95,404.88, with a 1.4% dip over the last 24 hours.

This indicates that Bitcoin hasn’t yet achieved a meaningful rebound. Ecoinometrics noted that a few good days of inflows aren’t enough to offset outflows. It will take several strong weeks to make a significant impact.

“We’ve seen this pattern repeatedly: a short burst of ETF inflows, a quick price bounce, and then momentum fades,” Ecoinometrics explained.

Current demand isn’t strong enough to shift the ongoing trend. This outlook is linked to cumulative ETF flows, which remain in a deep drawdown.

Inflows will need to cluster over several weeks before rallies can meaningfully stabilize prices.

Crypto treasury firms, including Strategy and Twenty One Capital, have increased their demand for Bitcoin in recent times.

However, broader support from both retail and institutional investors is needed before Bitcoin can begin a sustained uptrend.

Bitcoin Hyper Presale Tops $30 Million in Funding

Amid BTC’s struggle to gain momentum, all eyes are turning to Bitcoin Hyper (HYPER).

HYPER is one of the fastest-growing projects in the crypto space, having raised over $30 million so far. Its strong reputation, innovative design, and attractive staking APY of 38% continue to draw attention from a wide range of investors

Built as a Layer-2 solution for Bitcoin, HYPER offers massive potential for early adopters. It is tailor-made for those willing to embrace high risks for high rewards. Its strong presence and promise have earned it a spot among the most exciting crypto presales of 2026.

Current Presale Stats of Bitcoin Hyper

Current Price: $0.013585

Amount Raised So Far: $30.7 million

Ticker: HYPER

Investors can join the Bitcoin Hyper presale directly on the official website using ETH, BNB, USDT, or a credit card. Not sure how to get in on the action? Check out our guide on how to buy Bitcoin Hyper and join the presale excitement!

nextThe post Bitcoin Stalls Near $96K as ETF Inflows Fail to Boost Momentum appeared first on Coinspeaker.

origin »EthereumFog (ETF) на Currencies.ru

|

|