2026-1-15 13:24 |

US spot Bitcoin exchange-traded funds recorded their largest daily net inflows in more than three months on Tuesday, signalling a renewed wave of institutional demand as investors move past year-end portfolio rebalancing and re-engage with digital assets.

According to data from Farside Investors, spot Bitcoin ETFs attracted $753.7 million in net inflows on Tuesday, the strongest daily intake since Oct. 7, 2025.

The surge marked a sharp turnaround after weeks of choppy and often negative flows that dominated late November and December.

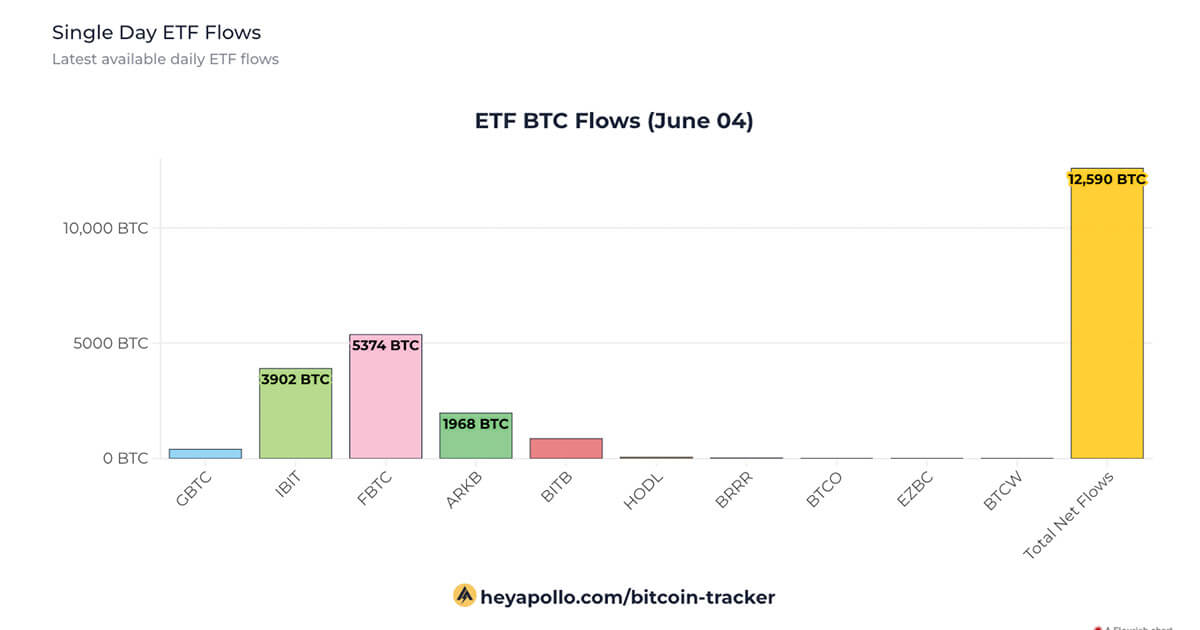

DateIBITFBTCBITBARKBBTCOEZBCBRRRHODLBTCWGBTCBTCTotal13 Jan 2026126.3351.4159.484.90.00.00.010.03.00.018.8753.812 Jan 2026-70.7111.70.00.00.00.00.06.50.064.34.9116.709 Jan 2026-252.07.9-5.90.00.00.00.00.00.00.00.0-250.008 Jan 2026-193.3-120.53.0-9.60.00.00.00.01.9-73.1-7.2-398.807 Jan 2026-130.0-247.6-39.0-42.30.00.00.0-11.60.0-15.60.0-486.1Data from Farside Investors.Fidelity’s Wise Origin Bitcoin Fund led the inflows, pulling in $351 million on the day.

Bitwise’s BITB followed with $159 million, while BlackRock’s iShares Bitcoin Trust added $126 million.

Other bitcoin-linked funds also reported positive flows, reflecting broad-based participation rather than a single-fund anomaly.

Ethereum ETFs also turn positiveThe renewed appetite for crypto exposure was not limited to Bitcoin.

US spot Ethereum ETFs also recorded strong inflows, posting a combined $130 million in net positive flows across five funds on Tuesday. T

he parallel move suggests that investors are increasing allocations across major digital assets rather than rotating into Bitcoin alone.

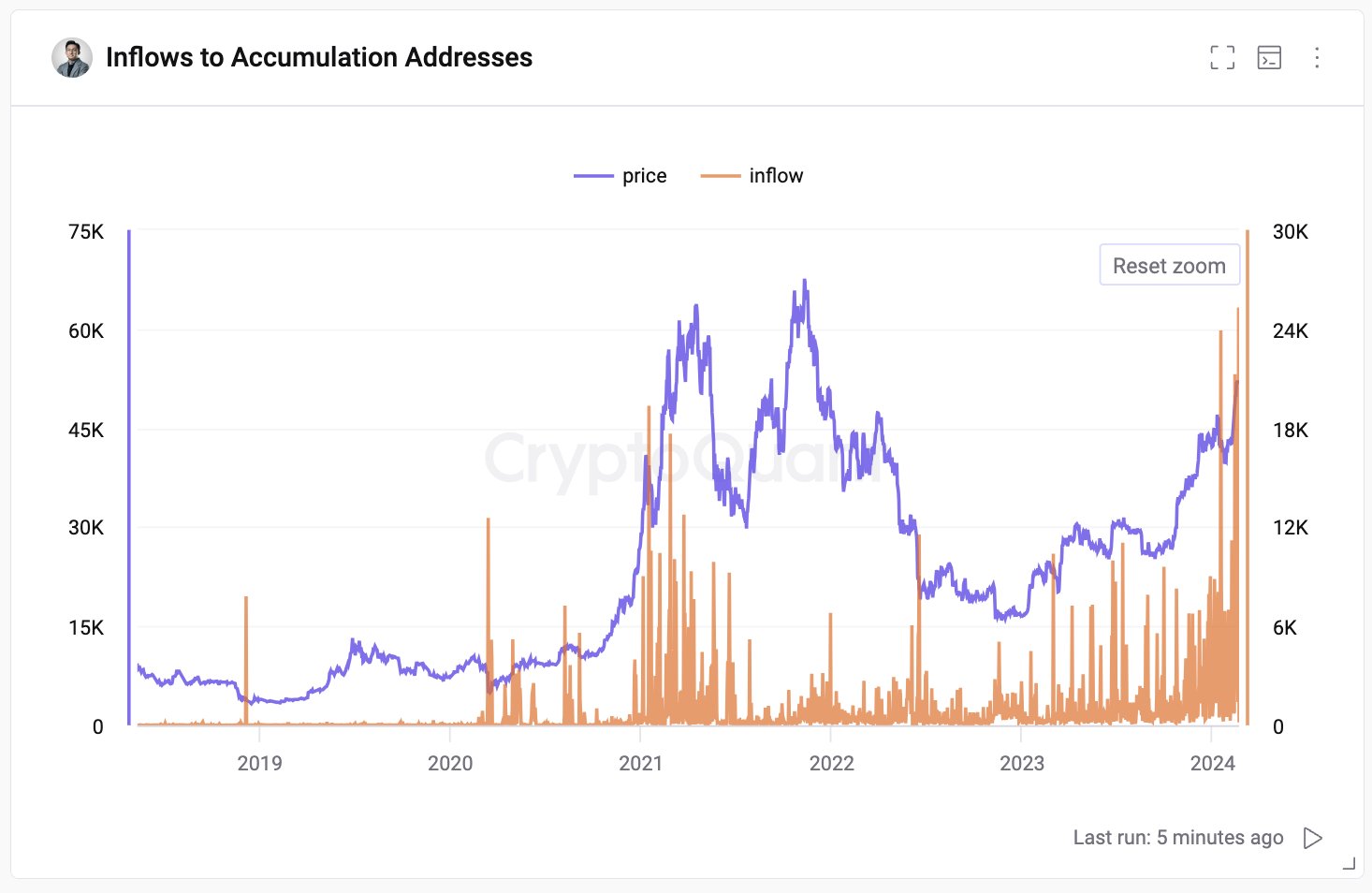

The synchronised inflows into both Bitcoin and Ethereum products indicate improving confidence among institutional investors after a period marked by caution, regulatory uncertainty, and profit-taking toward the end of 2025.

Broader crypto market confirms bullish momentumThe resurgence in ETF demand coincided with a broad rally across the crypto market.

Total cryptocurrency market capitalization climbed nearly 4% over the past 24 hours to about $3.25 trillion, pushing above recent local highs.

The move has reinforced a developing bullish structure, characterised by a sequence of higher local highs and higher lows.

Market participants note that, from a technical perspective, the crypto market faces limited resistance until around $3.32 trillion, a level that corresponds to the 61.8% Fibonacci retracement of the decline from the early October peak.

Investor sentiment has also improved notably. The widely followed crypto sentiment index rose to 48, still in the lower half of its historical range but representing the highest reading since the end of October.

The uptick suggests a meaningful shift in mood after weeks of subdued confidence.

Bitcoin breaks above key technical levelsBitcoin traded above $95,000 on Tuesday, its highest level since Nov. 17, confirming the improving technical backdrop.

The flagship cryptocurrency successfully rebounded from its 50-day moving average, broke above previous resistance levels, and reinforced the pattern of higher lows that technicians often associate with trend reversals.

Over the past 24 hours, Bitcoin rose about 3% to trade near $94,610, while ether outperformed with a gain of 6.21%, changing hands around $3,324.

The stronger move in ether reflects growing investor confidence in riskier segments of the crypto market as sentiment improves.

The rally followed the release of US consumer price index data on Tuesday, which showed that inflation remains elevated but has continued to cool from its peak.

The data strengthened expectations that the Federal Reserve may be able to cut interest rates later this year, a backdrop that typically boosts demand for risk assets, including cryptocurrencies.

At the same time, regulatory developments in Washington are drawing increased attention.

The US Senate Banking Committee is preparing for a markup session on Thursday for a market structure bill aimed at amending and voting on legislation that would provide greater clarity for digital assets.

Investors view the prospect of clearer regulatory rules as a potential catalyst for longer-term institutional adoption.

The post Bitcoin ETFs see over $750M in inflows as BTC breaches $95K appeared first on Invezz

origin »Bitcoin (BTC) на Currencies.ru

|

|