2023-4-18 12:01 |

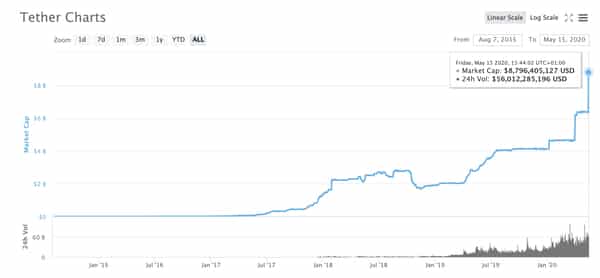

Key Takeaways Tether opened the year at a market cap of $66.2 billion, but has grown 22% to $81 billion CircleUSD has moved the opposite way, losing 21% of its market cap Tether’s share of the stablecoin space is up to 61.5%, its highest mark in two years Collapse of TerraUSD in May 2022 and shutdown of BinanceUSD in February have increased concentration in the stablecoin market CircleUSD is struggling amid regulatory concerns in US and fallout from banking chaos, when it had 8.25% of its reserves in Silicon Valley Bank Growth in market share for Tether should only increase, but concerns persist over reserves underlying the stablecoin Centralisation of wealth is a massive stress point for entire crypto industry, whose grasp on the concept of decentralisation continues to slip

Last October, I published a deep dive into the stablecoin wars. Things have changed a lot since then.

A few weeks after, in November, FTX collapsed, sending the entire crypto market bananas, capital flowing out of the space en masse. Then in February, the world’s third biggest stablecoin, BinanceUSD, was shut down by regulators (deep dive on that here).

Finally, in March, the world’s second-biggest stablecoin, Circle USD, depegged to 88 cents amid the banking chaos, before its peg was restored after the US administration guaranteed bank deposits at the fallen Silicon Valley Bank.

Against all odds, the stablecoin with perhaps the most controversial status, Tether, has been the one with the least drama.

Hit “play timeline” on the below chart to see the movements of the entire stablecoin market over the last two years – and the growth of Tether.

TerraUSD and BinanceUSD fall

The below is the previous chart plotted out in static form. We can immediately see a few massive developments. The first is in May 2022, the well-covered collapse of TerraUSD, the LUNA ecosystem going down in flames as its uncollateralised stablecoin model was found to be flawed.

The second is the BUSD’s shutdown in February 2023, less pernicious to the market and a more gradual decline than UST (thankfully, say crypto investors). Its market cap is currently at $6.2 billion, down from $17.5 billion two months ago, an evaporation of two-thirds of the supply, the final third likely to follow before long.

The below chart presents the situation clearer, as it displays the market caps of each stablecoin post-UST collapse.

Circle drops off and Tether grows

The cases of BinanceUSD and DAI are obvious. The former will trickle to zero as a result of regulators outlawing the minting of new supply, the Binance-branded stablecoin gradually coming out of circulation.

As for DAI, it has issues scaling because of its overcollaterisation model (requiring users to lock up extra capital due to the volatility of the underlying crypto) meaning that it is unlikely ever to make much noise under its current makeup. It is not surprising that it has lost a bit of capital, but not really done anything of note.

The intrigue comes in analysing CircleUSD (USDC) and Tether. More specifically, how they have acted in the last four months. The duo have moved in completely opposite directions in 2023. USDC opened the year with a market cap of $44.1 billion. Today, the number is $31.6 billion, a fall of 21%.

Tether, on the other hand, opened 2023 with a market cap of $66.2 billion and is now sitting at $81 billion, an uptick of 22%.

But why?

Well, USDC is struggling for two glaring reasons. The first is that it had 8.25% of its reserves in Silicon Valley Bank. As the bank was collapsing, USDC depegged to 88 cents as the market panicked. While deposits were since guaranteed, the stablecoin has not recovered its market cap.

The second is regulation. USDC is based in the US, where regulators have been moving in hard thus far this year. The shutdown of BinanceUSD showed this for all to see. Immediately, people feared that USDC could go the same way.

Adding to this uncertainty are the ongoing developments around Coinbase, which is a partner of Circle. The exchange was recently issued with a Wells notice, which normally precedes legal action, around the potential violation of securities laws.

Tether, on the other hand, is based in Europe, where regulations are far kinder – and less uncertain. The next chart shows how much it has benefitted from this – its market share growing perceptibly since the start of the year, up to 61.5%, the highest mark in two years. It opened the year with only a 48.1% share.

USDC, meanwhile, has seen its market share fall from 32.1% to 24.1% year-to-date. BinanceUSD is down to 5.1% from 12.0% in the same timeframe.

Of course, it would be remiss not to mention the glut across the space in general. The stablecoin market, like crypto as a whole, is very illiquid right now. I published a deep dive looking at this two weeks ago, as the stablecoin balance on exchanges has seen a 45% outflow in the last four months. There are now the least amount of stablecoins sitting on exchanges since October 2021.

Looking at the total market cap of stablecoins, meanwhile, it has been decreasing consistently for a year now.

Is Tether dominance a good thing?

Tether really is the outlier across the board, therefore. While the other coins have either gone to zero or lost substantial capital, Tether’s market cap is not far off what it was before the collapse of TerraUSD, the seminal moment that truly triggered the crypto bear market.

In essence, Tether has scooped up many of the outflows from other stablecoins, especially in the last few months. And the bulk of what it has not picked up has left the stablecoin market entirely.

But is it a good thing that one coin, Tether, holds a 61% market share that only appears to be growing?

Well, not really. And there are two reasons why.

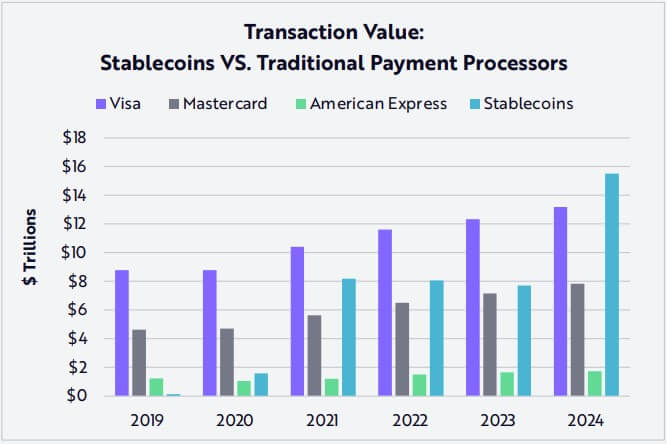

The first is that, ironically, this shows how centralised a lot of crypto is. Were anything to happen to Tether, the entire ecosystem would be thrown into absolute mayhem, with it quite possibly existential for the industry as a whole, such is the importance of Tether to the underlying pipelines of the space.

This was always meant to be what crypto fought against, striving to build a more decentralised financial system. That has proved to be largely idealistic at this point. Even within the “decentralised” area of DeFi, the bulk of activity is through USDT, a stablecoin which can be directly shut down by regulators (as well as USDC).

“Crypto was sold as a decentralised alternative to the legacy financial system. Looking at the stablecoin market, however, shows that the reality is very, very different. DeFi, and the crypto ecosystem as a whole, is only becoming more and more centralised – Tether has nothing but open space in front of it to continue to suck up market share. At the current pace of growth, we could see its market share at 75% this year” said Max Coupland, director of CoinJournal.

The second issue with Tether’s growth is transparency, possibly the most overcovered – but so vitally important – story in crypto. Tether is no stranger to controversy around its reserves, with longtime doubt over whether it is 100% backed.

Recently, it has improved somewhat with the publication of reports, but has still paid fines in the past related to false disclosures, and its standards are far, far away from what you would expect, say, from a publicly listed company. But that is not the way crypto operates at the moment. Instead, opaque financials and verbal promises rule the roost.

But that is the situation the crypto world currently faces. In truth, Tether probably is fine. But the mere fact that it has such a dominant market share is concerning, regardless of any doubt around the reserve situation. However, with BinancUSD slowly disappearing, TerraUSD long gone, and CircleUSD falling off, its market share is only going one way: up.

CircleUSD is certainly regulated closer and presents its financials more transparently. But with the banking issues scaring people, and the continued hostile crypto environment in the US, Tether is sprinting clear.

I’m not sure that is a good thing. And even if it is, was cryptocurrency not promised as a more decentralised financial system? As time goes by, it appears increasingly apparent that such thinking was nothing more than a head-in-the-clouds dream.

If you use our data, then we would appreciate a link back to https://coinjournal.net. Crediting our work with a link helps us to keep providing you with data analysis research.

The post Tether’s market share expands to 61%, a two-year high as crypto centralisation grows: a Report appeared first on CoinJournal.

origin »Tether (USDT) на Currencies.ru

|

|