2019-4-27 09:00 |

On Thursday, the cryptocurrency market took a major hit, dropping more than $10 billion in market cap following allegations surrounding Tether (USDT). According to a press release officially published on the New York Attorney General website, iFinex Inc which is the company behind Bitfinex crypto exchange and Tether Limited, covered up a loss of $850 million.

Details On the Cover-UpAccording to the press release, Bitfinex, without any contract or approval at all, handed over the funds to a “Crypto Capital Corp” based in Panama and hid this information from stakeholders and investors. The publication has it that the companies involved are now “barred from destroying, deleting, or permitting others to delete potentially relevant documents and communications, including documents and communications stored on any self-deleting or ‘ephemeral’ computer applications.”

It’s important to note that Bitfinex has since come out to explain that the amount was not lost but “seized and safeguarded” and that both the exchange and Tether have been cooperating fully with the New York Attorney General’s office.

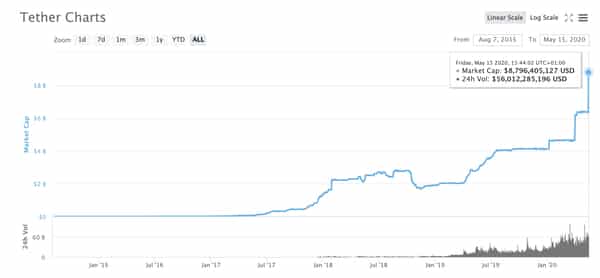

Effect on the MarketOn the same day, Bitcoin dropped over 6% that morning to about $5,145 with Tether also dropping to $0.955. This drop, coupled with the news and uncertainty felt in many corners of the industry, reducing the general market cap by more than $10 billion and by the end of the day, Bitcoin had already dropped below $5,000 to about $4,953. Thankfully, both USDT and BTC have picked up a bit with Bitcoin now currently over $5,200.

ReactionsReactions have continued to trail the recent events with most people expressing disappointment at not just the misdeed but also the effect it now has on the crypto market in general. However, some people believe that the news is not that pressing and will have little or no impact on the market in the long run.

One of the notable responses came from Anthony “Pomp” Pompliano who is a co-founder and partner at Morgan Creek Digital and also a vocal crypto stakeholder and analyst. Pomp, on Thursday, expressed on Twitter that the news about Tether is largely inconsequential and not a lot of people are bothered about the coin in the first place.

The tweet said:

“UNPOPULAR OPINION: The Tether news doesn’t matter. Nobody outside a very small group of cryptocurrency enthusiasts even understands it or cares.”

Seeing that the market loss could be directly tied to the “Tether news”, Pompliano’s opinion may not have been entirely correct, at least in the short term.

Another somewhat similar opinion came from Josh Rager, another crypto trader, and investor. Rager opined that even if the situation causes the market to drop so much that BTC falls quite low, it would still work as a good time to buy in when that happens.

His tweet said:

“To calm nerves, really don’t see the Bitfinex situation wrecking the market in the short term. If $BTC does fall to $4,200 or below, I’ll still be a confident buyer for investing. Would love to long/buy Bitcoin in mid to high $4ks and profit at $6200-$6400 before another drop.”

A crypto blog called Galgitron, however, expressed on Twitter that a Tether failure might help in the long run.

According to the tweet:

“I’m kinda hoping Tether fails. It might hurt the market for a bit, but it will set a nice precedent for all time that counterparty risk is a real threat to stablecoins, unlike decentralized crypto which holds its own value.”

Hopefully, all the losses in the market pick up again very quickly, Tether or not.

The post Crypto Market Loses a Whopping $10 Billion in Wake of Tether/Bitfinex Scandal appeared first on ZyCrypto.

origin »Tether (USDT) на Currencies.ru

|

|