2018-6-30 15:15 |

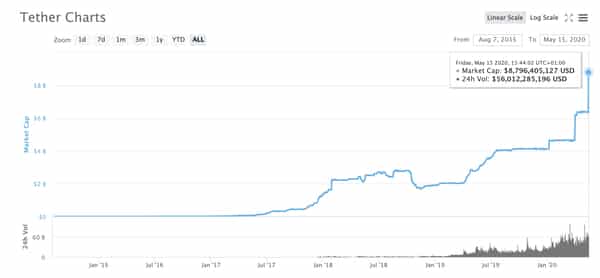

After accusations that Tether was used to manipulate Bitcoin’s price during the cryptocurrency market’s 2017 peak, experts are now looking closely at Tether’s logic-defying activity on the exchange Kraken.

Two critical red flags have been identified in reports by Bloomberg. The first is that large trades of the Tether coin are only moving market prices in the same way as very small trades, contrary to the normal rules of supply and demand.

Secondly, when Kraken’s public order book was analyzed, there appear to be many oddly specific order amounts, with some of them repeating.

Kraken is important in Tether markets as it is one of only a few exchanges which allows the exchange of Tether for U.S dollars.

Wash Trading SuspectedTether’s strange behaviour on Kraken was first identified by an ex-professional poker player by the name of Andrew Rennhack. Rennhack downloaded data from Kraken’s order book and speculated over what he had found. Bloomberg then completed its own study of over 56,000 trades in May and June. Bloomberg shared its findings with Rosa Abrantes-Metz, a New York Professor, and ex-Federal Reserve bank examiner Mark Williams.

Abrantes-Metz and Williams looked at a commonality that Bloomberg had discovered, a frequent trade of 13,076.389 Tether where other common trade amounts were numbers like 75 or 1000. The pair suspect the commonality could indicate cheating using automated trading programs or wash trading in which a trader takes both sides of a transaction (the buy and the sell).

Wash trading is banned in regulated markets like stock markets as it gives an inaccurate impression of supply and demand and can impact the price of an asset. As cryptocurrency exchanges are not regulated in the same way, wash trading is a far more likely occurrence in the trading of tokens and coins.

Tether Price Not Responding as ExpectedBloomberg’s research discovered that Tether’s price on Kraken wasn’t responding as expected to buy orders when they looked at the May and June data. Small buy orders were increasing Tether’s price by 0.0002 but the large buy orders of 13,076.389 were only moving the price by 0.0001, for example.

These price movements don’t make sense, as larger buy orders should increase the price substantially more than the smaller ones. Sometimes the price of Tether didn’t move at all.

“Large trades are not impacting prices,” said Abrantes-Metz. “I’ve looked through lots and lots of data, and I don’t think this is real.”

“Many of the trade amounts are frequently occurring to the fifth decimal point, a unique identifier which increases the probability it is being generated by the same person or entity,” said Williams.

The experts who reviewed the data downloaded from Kraken suggest that “wash trading” could be involved.

Bloomberg has said there is “no evidence that Kraken itself is involved in any manipulation,” but it has reached out to Kraken executives who declined an interview and provided few comments.

“Nothing looks out of place to us in our publicly available trade data feed,” said Allen Stevo, Kraken Chief of Staff, in initial contact with Bloomberg.

As mentioned above, Tether was suspected of being used to manipulate Bitcoin in 2017, according to another recent study. Tether was also subpoenaed in December by the U.S. Commodity Futures Trading Commission (CFTC) seeking proof of Tether’s backing in U.S dollars. Tether subsequently provided evidence via a law firm of $2.55 billion dollars USD in its bank accounts.

There is no evidence that Kraken is involved, nor supported evidence that Tether is manipulated on Kraken by an individual or an organisation. However, if the same activity occurred in traditional stock markets regulators would certainly be investigating.

The post Further Controversy for Tether as Data Suggests Market Manipulation on Kraken appeared first on UNHASHED.

origin »Tether (USDT) íà Currencies.ru

|

|