2019-9-25 11:50 |

On Sept. 25, the crypto market experienced one of its steepest falls in recent years as the bitcoin price abruptly dropped by more than $1,500 in merely hours, sending many cryptocurrency investors to Tether.

Tether, a stablecoin said to be run by iFinex, the parent company of a major cryptocurrency exchange in Bitfinex, has often been used as a hedge option for cryptocurrency investors, especially amidst sharp pullbacks and corrections.

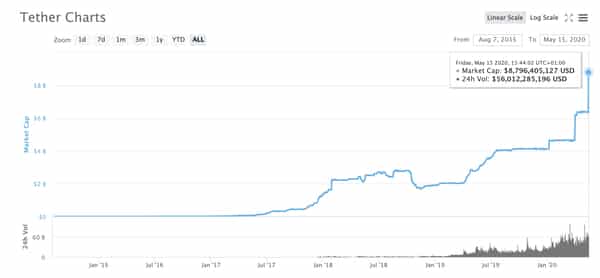

As investors flocked to Tether to safeguard their holdings in crypto assets, the daily volume of the stablecoin spiked to levels unseen before.

Tether surpasses bitcoin in daily volume (source: coinmarketcap.com)According to data published by CoinMarketCap, the daily volume of Tether hit $34 billion, surpassing the daily volume of bitcoin and Ethereum.

Will the crypto market continue to correct?Technical analysts predict that if the bitcoin price cannot recover from its current range at $8,300 to $8,600 in the near term, a drop to the $6,000 to $7,000 becomes a possibility.

DonAlt, a cryptocurrency trader, said that a key technical indicator suggests bitcoin hovering at $8,000 is similar to when the dominant cryptocurrency was at $5,000 following a drop from $6,000. BTC ended up dropping all the way to $3,150 from $6,000 in December 2018.

Like bitcoin corrected to $3,150 in late 2018 following a convincing recovery to $5,000, DonAlt said that BTC could fall even further from $8,000, potentially to mid-$7,000.

“A range of 100 days just broke to the downside. If this is a bullish shakeout it’ll be obvious once BTC reclaims $10k. If this is bearish I don’t want to be long. Buying this feels like buying $5500 after the $6000 break. Something I’m not willing to do,” he said.

Continuous sell-off of bitcoin and a bigger pullback in the crypto market will inevitably lead the volume of Tether to surge, forcing more investors to hedge to last an extended correction.

As the bitcoin price fell by $1,500, other crypto-assets like Ethereum, EOS, and Litecoin demonstrated losses in the range of 20 to 40 percent against the U.S. dollar.

A good month for TetherThis week, Tether secured a motion from a court in New York in an ongoing case in which the New York Attorney General’s office alleges iFinex of mismanagement, that would prevent the company from having to hand in additional documents to the court.

“We are gratified by the panel’s decision and we look forward to addressing the significant substantive issues before the appellate court,” a representative of iFinex said, Forbes reported.

Although Tether may be requested to send more paperwork in the future, for now, the company has found itself a small win in a challenging case.

With daily volume noticeably on the rise and the company seeing some progress in the New York case, it has been a good quarter for the stablecoin so far.

“The injunction that prohibits the movement of money between Tether and Bitfinex is still in place. We look forward to making our case in court as we seek to have Judge Cohen’s decision upheld and continue our investigation,” the New York Attorney General’s office said.

The post Tether becomes 4th largest crypto, demonstrating intensity of market blood bath appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Tether (USDT) на Currencies.ru

|

|