2020-12-18 18:35 |

The decentralized finance (DeFi) space has arguably been the most impressive component of the entire crypto industry in 2020.

With Bitcoin rallying to record highs, total assets locked in DeFi protocols have reached record levels too. However, it now appears to be bringing in an influx of users to decentralized apps (dApps), again.

DeFi is Pulling DApps UseThis week, top DApp tracking platform DAppRadar published its 2020 DApp Industry Report, revealing that there has been over $270 billion in transaction volumes in 2020. The platform noted that a staggering 95 percent of these volumes came from the Ethereum-based DeFi ecosystem, marking a jump from $21 billion last year.

The report pointed out that the DeFi space had also contributed to Ether's growth, with money flowing from Bitcoin to the asset all through the year. DAppRadar explained that this cash influx's primary driver was the theoretical yields in DeFi, with renBTC and Wrapped Bitcoin (wBTC) allowing dApps to tap some of Bitcoin's liquidity.

Moving on, DAppRadar explained that only ten DeFi dApps accounted for 87 percent of the total transaction volumes on Ethereum. The report echoed findings from November when DAppRadar's rankings showed that dApps had attracted over a million users in 30 days.

At the time, the top three DApps – DeFi Swap, Uniswap, and Compound, respectively – accounted for over 930,000 users between them. None of the remaining dApps in the top ten rankings had over 30,000 users that month.

Data from Dune Analytics also found that a single DeFi user could have used multiple addresses to interact with several dApps on several occasions during a month. It would be challenging to accurately estimate the actual number of users from DAppRadar's numbers. As Dune estimated, the total cumulative DeFi wallet addresses were about 901,000.

Even at that, the numbers seem pretty impressive, especially considering that the DeFi space was almost nowhere this time in 2019.

Problems RemainWhile the report was positive, it also highlighted some of the challenges plaguing the DeFi space. As expected, it touched issues such as the apparent dependence on the Ethereum blockchain, which has led to challenges like network congestion and higher gas fees.

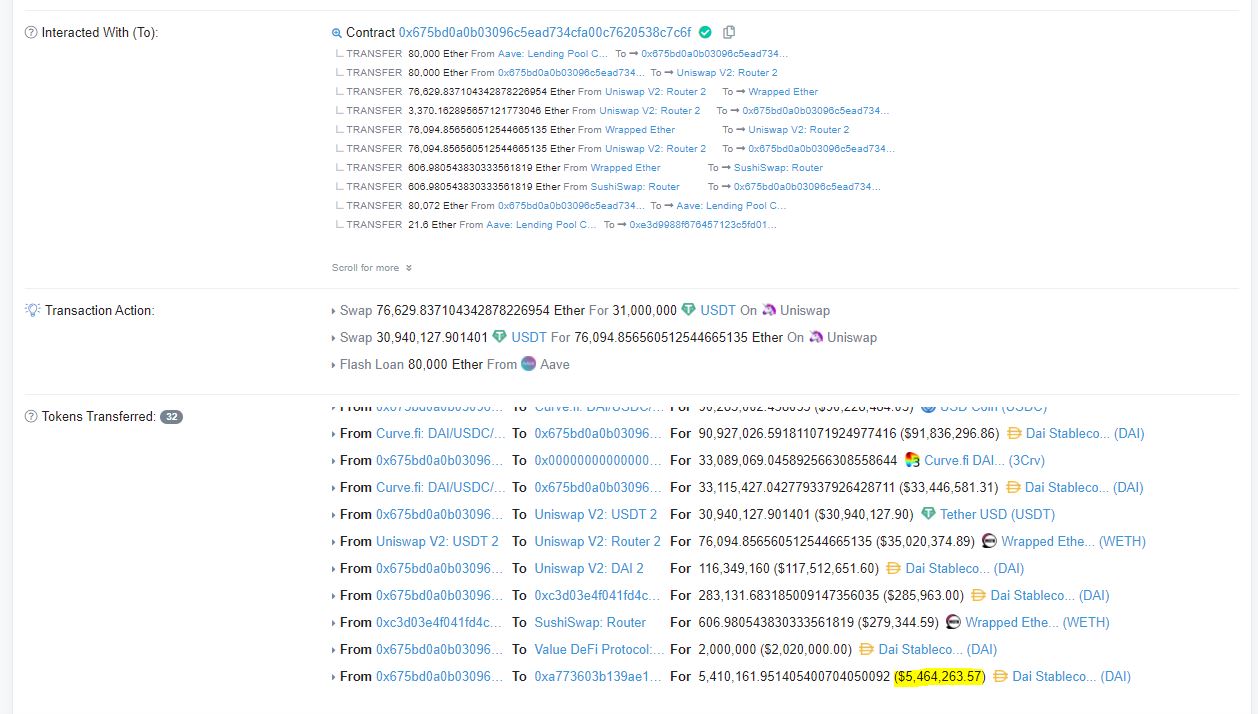

Hacks and security breaches have also become common, with crafty hackers capitalizing on security flaws in DeFi smart contracts to steal users' funds. As DAppRadar estimates, hackers have stolen over $120 million across 12 hacks this year. The tracking platform adds that the industry should improve insurance in 2021, which will enhance user confidence.

In general, DAppRadar notes that the future is bright for DeFi. Issues like the coronavirus pandemic and more have brought decentralized platforms into the forefront, and dApps have benefited from that rise in prominence.

With DeFi set to play a more prominent role in the global economy, it should spread its benefits to components like gaming, non-fungible tokens (NFTs), and dApps.

The post Yield Farming & NFT’s Led 2020’s DeFi Boom; Boosting DApp Volume by 1178%: DappRadar first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|