2024-6-21 20:00 |

Data shows XRP is currently exhibiting an interesting on-chain behavior amidst a broader market uncertainty. This unusual behavior was highlighted by CryptoQuant, a crypto on-chain analytics company. The peculiar behavior is noteworthy because it is associated with a growing open interest in XRP in comparison to other cryptocurrencies, suggesting XRP is primed for a major price move.

XRP Open Interest SurgesAccording to CryptoQuant data initially noted by an analyst associated with the analytics platform, recent news involving the SEC and Ripple, XRP’s parent company, has seen the open interest for XRP resuming an uptrend.

As per the CryptoQuant chart below, the open interest, which has generally been in an uptrend since April 15, recently took a hit in the first week of June and started to decline concurrently with a fall in the price of XRP. However, the open interest has now rebounded and has resumed its uptrend.

Interestingly, this increase is more significant than that of other cryptocurrencies, considering many crypto prices have struggled in the past week. The rising open interest also relays the current sentiment among XRP investors, as it indicates that investors are opening more positions in anticipation of an increase in the price of XRP.

How Will This Affect Price?Open interest refers to the total number of outstanding derivative contracts that haven’t been settled. Climbing open interest often signals more money flowing into the market. This is evident in the chart above, as increases in open interest have mostly been registered with a corresponding increase in the price of XRP.

Furthermore, open interest is considered a leading indicator for many savvy investors. When it soars, it signals that new money is flowing into the market as traders open new positions. This increased activity and liquidity can foreshadow where an asset’s price might be headed next. Regardless of the direction in which the price heads, one outcome is nearly guaranteed: more volatility.

At the time of writing, XRP is trading at $0.486 and has increased by 1.44% in the past seven days. Despite this meager increase, it’s interesting to note that XRP is currently the only asset among the top 20 largest cryptocurrencies still in the green zone in the past week. Adding to the bullish outlook is the strong trading volume over the past few days.

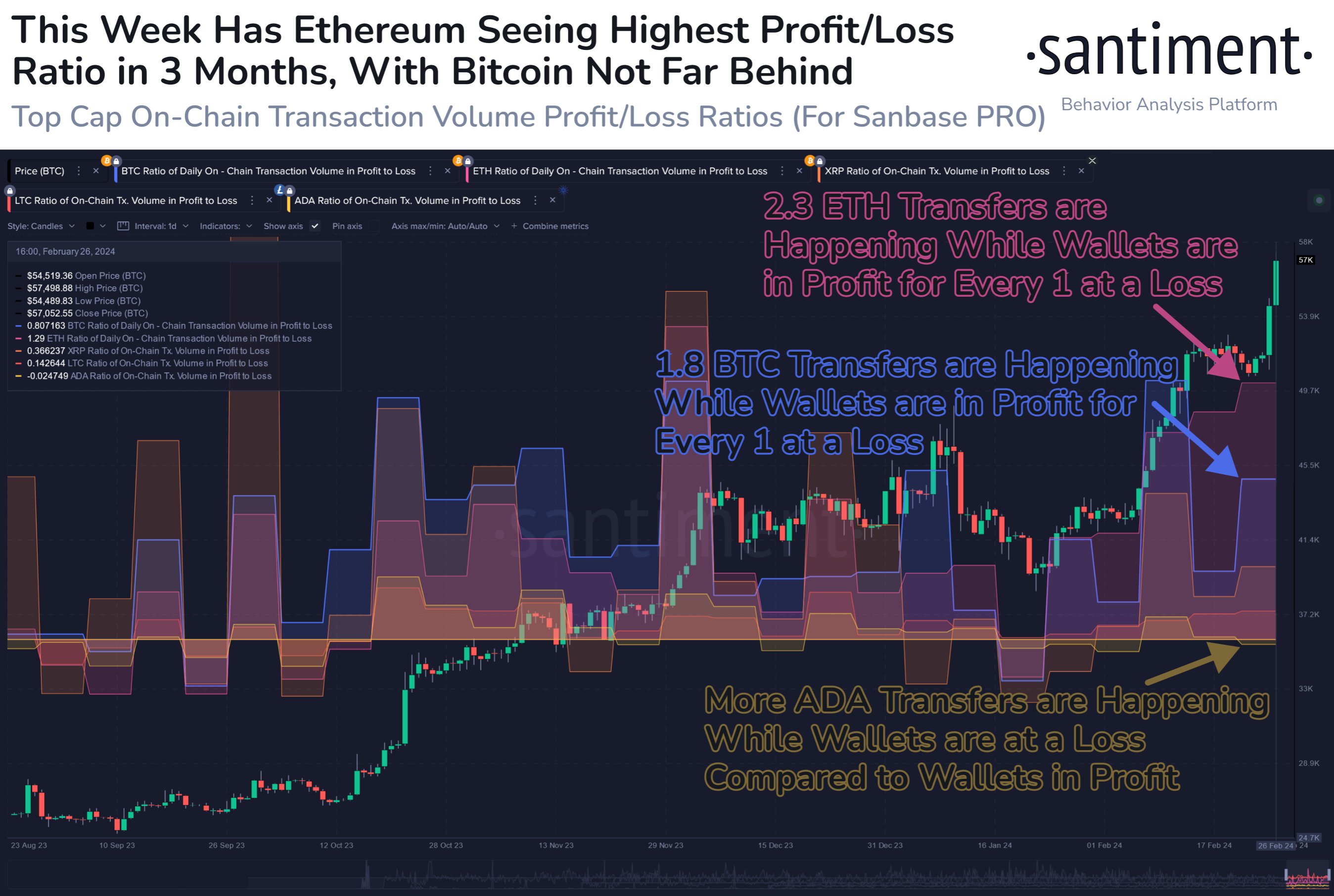

According to data from Santiment, some traders are still bearish on XRP despite the fact that it is currently outperforming many other assets. XRP is also traders shorting to counter the bulls. However, as Santiment noted, this is a good sign for patient bulls, as the shorting activity can act as ‘rocket fuel’ for continued price rises when they eventually become liquidated.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ripple (XRP) на Currencies.ru

|

|