2025-1-4 02:30 |

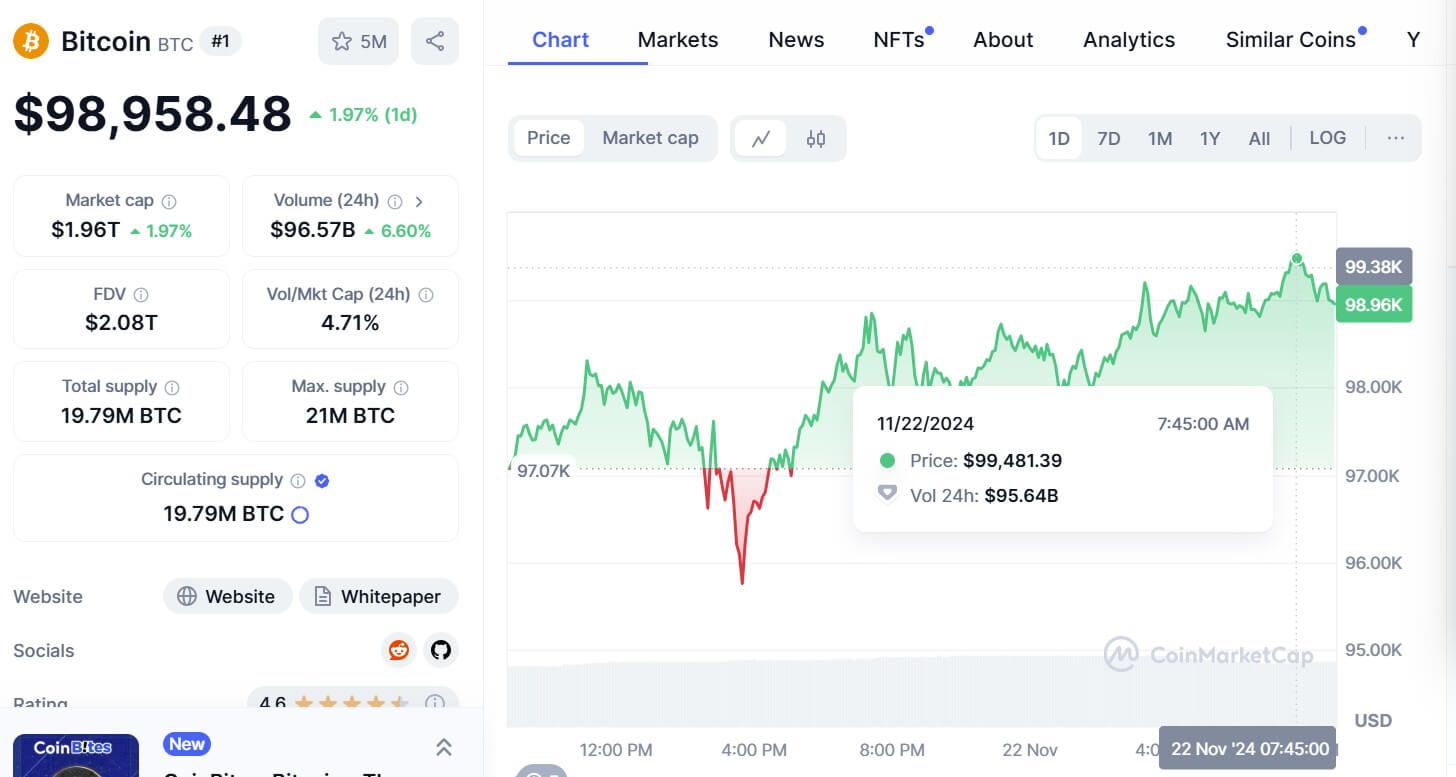

Using technical indicators like Fibonacci extensions and the Elliott Wave Theory, a crypto analyst pinpoints an ideal “sweet spot” for selling Bitcoin (BTC). According to the analysis, specific price zones have been identified as target BTC sell areas that investors and traders could use to exit positions strategically ahead of possible downtrend.

Analyst Sets $169,000 And $194,000 As BTC Sell ZonesIn an X (formerly Twitter) post, crypto analyst Tony Severino revealed that Bitcoin is currently in Wave 5, experiencing the final push of its bullish Elliott Wave cycle. In previous cycles, the BTC price has consistently terminated near the 1.618 Fibonacci extension of subwaves i through iii.

Severino’s Bitcoin chart shows that its price action is segmented into five distinctive waves. Wave 1 represents the initial bullish movement, followed by Wave 2, a corrective pullback. Wave 3 stands out as the most powerful and extended wave, while Wave 4 introduces another corrective phase. Finally, Wave 5, where BTC currently trades within, signals a possible final bullish push upwards.

Each wave in the BTC chart has triggered a price increase to different levels, whether to new highs or lows. For Wave 5, however, Severino has proposed an ambitious price target that would act as an important sell zone for investors and traders.

The analyst questioned whether BTC could repeat historical trends and terminate again at the 1.618 Fibonacci extension of Waves 1 through 3 combined. This points to a price range between $169,366 and $194,000. According to Severino, these price levels, marked in the red zone on the chart, are called a “sweet spot.” He identified these price areas as a significant sell zone for Bitcoin.

Currently, BTC is trading at $96,341, meaning Severino expects the leading cryptocurrency to surge 75.31% and 101.24% to reach the projected target range between $169,000 and $194,000, respectively. The analyst asserts that his bullish projections are reasonable price targets for Bitcoin, underscoring his confidence that the cryptocurrency could hit these new ATHs.

For traders and investors, a sell zone is an ideal exit point to potentially lock in profits and prevent financial loss before a trend reversal. Whether or not Severino’s projected “sweet spot” holds, his analysis provides valuable insights into Bitcoin’s potential price movements and potential sell targets for investors.

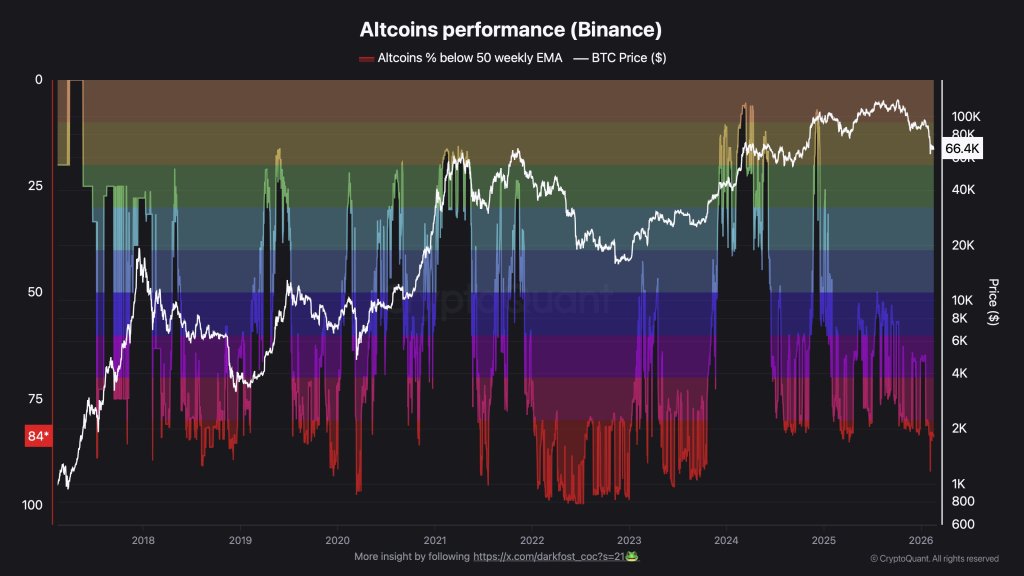

Bitcoin Market Top Expected In 2025Trader Tardigrade, a prominent crypto analyst, declared on X that the Bitcoin 4-year cycle is still in play. The analyst warns that 2025 could still be a pivotal year for Bitcoin. He predicts that BTC will hit a market peak in 2025, creating a prime opportunity for investors who missed its ATH in 2024.

However, investors who overlook this window of opportunity in 2025 may have to wait until 2029, after the next halving event, for BTC’s next market peak. Sharing a price chart, Trader Tardigrade highlighted Bitcoin’s price performance during each four-year cycle.

The analyst noted that during each halving cycle from 2011 to 2023, Bitcoin rose to a peak the following year after the halving event. If this historical trend holds, Bitcoin could experience another final surge to new heights in 2025.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|