2024-10-18 19:30 |

Spot Bitcoin exchange-traded funds (ETFs) have reached a significant milestone, surpassing $20 billion in total net inflows for the first time, according to data shared by Bloomberg senior ETF analyst Eric Balchunas.

The achievement follows a week of extraordinary inflows totaling $1.5 billion, indicating growing investor demand for crypto exposure via ETFs.

Balchunas highlighted that net inflows are the “most important” and “most difficult” metric to grow in the ETF industry, making this milestone particularly noteworthy. By comparison, it took gold ETFs nearly five years to hit the same net inflow figure.

Some in the community highlighted that excluding the massive outflows from Grayscale’s Bitcoin Trust (GBTC) makes the net inflows for the Newborn Nine over $40 billion, an even more staggering number compared to other ETF launches in the market’s history.

Balchunas acknowledged the impact of the outflows but argued that including GBTC showcases the growth and eliminates all avenues of criticism. He said:

“I like net [because] it’s net GBTC so there’s simply no way for haters to poke holes in it. You have to respect it.”

US Bitcoin ETFs now manage $65 billion in total assets and collectively hold roughly 951,000 Bitcoin, a new record high. Balchunas noted that the ETFs will soon rival the estimated 1.1 million Bitcoin held by the flagship crypto’s mysterious pseudonymous creator, Satoshi Nakamoto. He said:

“Bitcoin ETFs are 86% of the way to Satoshi.”

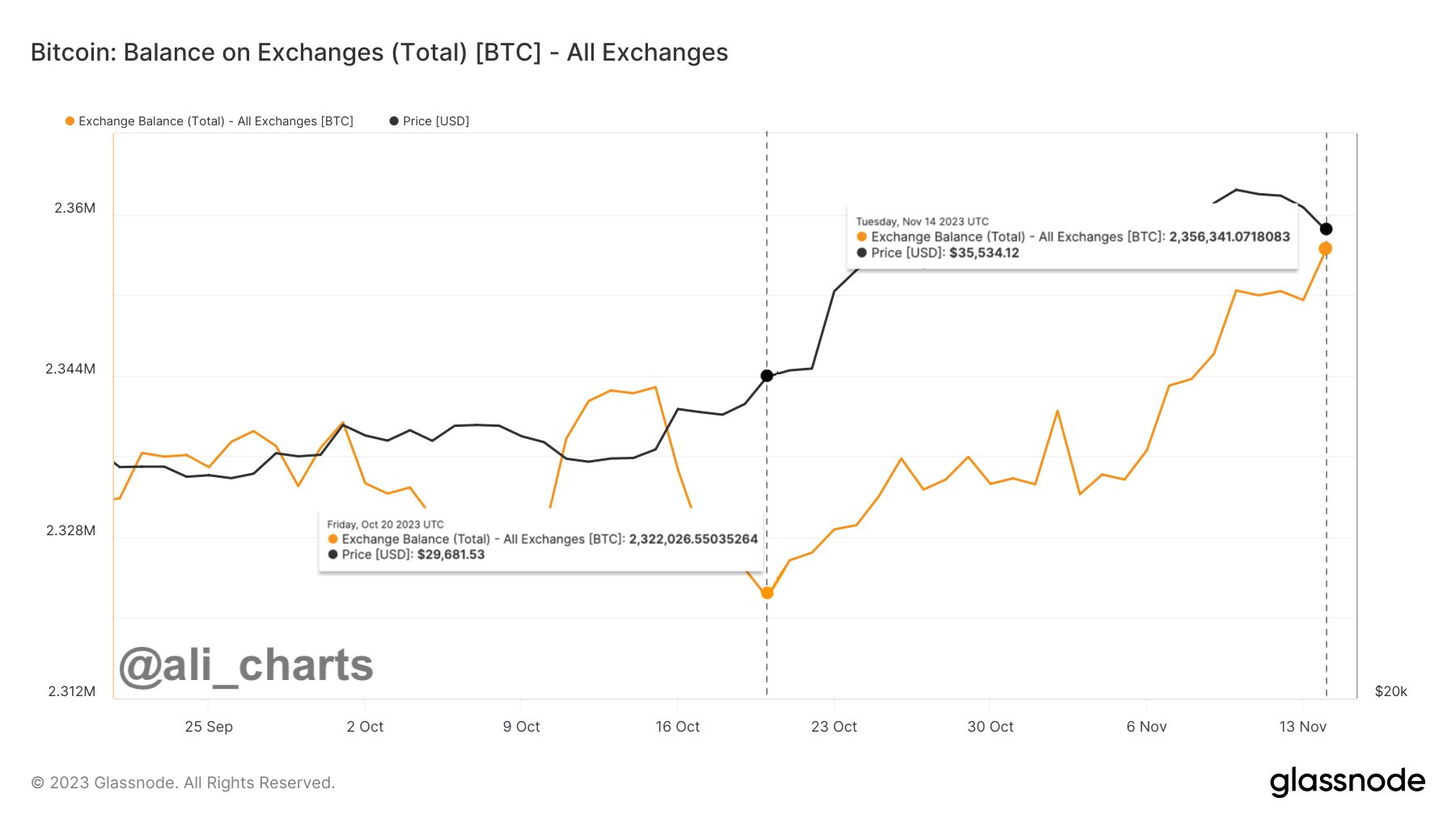

The surge in inflows has not only bolstered the total assets under management but also impacted the available supply of Bitcoin. With major institutional holders like BlackRock continuing to accumulate, Bitcoin ETFs are playing an increasingly significant role in concentrating ownership of the digital asset.

As demand for Bitcoin ETFs grows, their influence on the broader market is likely to intensify, offering regulated investment vehicles that continue to attract both retail and institutional investors.

The growing dominance of Bitcoin ETFs highlights their critical role in shaping the future of crypto investments as more investors seek secure and regulated ways to gain exposure to digital assets.

The post US Bitcoin ETFs surpass $20 billion in net inflows, nearing Satoshi’s holdings appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|