2024-11-21 19:29 |

Ethereum Classic (ETC) has captured significant attention in the cryptocurrency market, climbing to a six-month high of $28.16.

This surge has been driven by a mix of technical factors and broader market developments, positioning the Proof-of-Work blockchain as a key player in the current crypto rally.

Golden Cross forms signalling bullish momentumThe recent Ethereum Classic price movements reflect ETC’s growing momentum.

Over the past week, ETC has gained 24.5%, and its performance over the last month and year—both exceeding 41%—underscores its strong upward momentum in the wake of Bitcoin’s bull run.

A golden cross was observed on the exponential moving averages (EMAs), with the 20-day EMA crossing above the 50-day and 200-day EMAs.

This pattern, often signalling a sustained bullish trend, coincides with ETC trading within an ascending channel pattern.

Source: TradingViewThe channel, characterized by higher lows and highs, suggests the potential for further gains, provided the current trajectory holds.

Despite these bullish indicators, Ethereum Classic faces stiff resistance at the $27-$30 range, a critical zone that has been tested multiple times without a decisive breakthrough.

Meanwhile, the Relative Strength Index (RSI) stands at 64, hinting at slightly overbought conditions.

This raises the possibility of a short-term correction, with support likely around $23, near key EMA levels.

What is fueling the current ETC price rise?The surge in Ethereum Classic’s value has been fueled by several external factors.

To start with, renewed regulatory clarity surrounding Proof-of-Work blockchains has bolstered investor confidence, positioning ETC as a viable long-term asset.

Secondly, speculation about potential partnerships with institutional mining firms has further amplified optimism, signalling possible improvements in Ethereum Classic network security and adoption.

Adding to this bullish sentiment are reports of favourable tax policies under consideration by the Trump administration, a development that has resonated strongly with US-based investors.

Increased listings on platforms like Robinhood have also enhanced ETC’s accessibility, attracting a broader retail audience.

In the derivatives market, sentiment around Ethereum Classic is mixed.

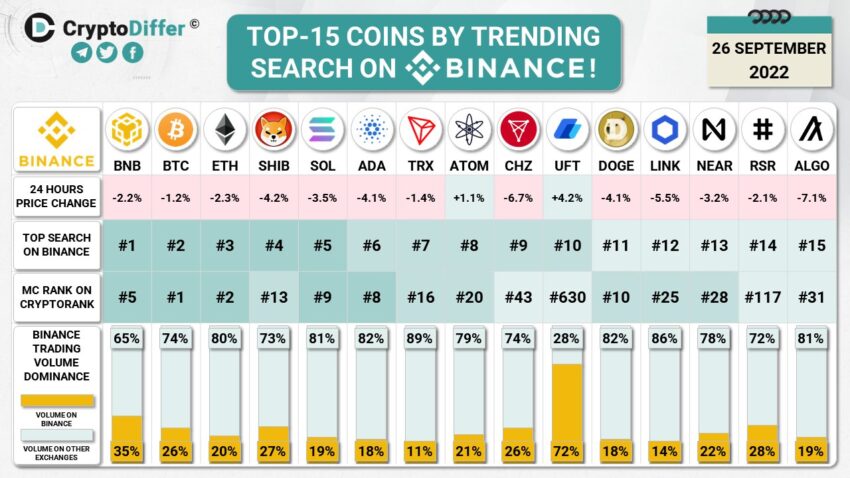

Open Interest has declined by 4.56% to $148.63 million, and trading volume has dropped by 14.03%, suggesting a temporary slowdown in activity.

However, the Long/Short ratios on platforms like Binance and OKX reveal a more optimistic outlook, with traders on these exchanges preparing for continued price gains.

As Ethereum Classic builds on its recent success, its short-term prospects remain closely tied to Bitcoin’s performance.

Should Bitcoin maintain its bullish trajectory, ETC could break past its current resistance levels and target the $29-$30 range.

Conversely, any slowdown in Bitcoin’s momentum could lead to a pullback toward the $21-$22 support zone.

The post Will Ethereum Classic (ETC) hit $30 as price reaches six-month high? appeared first on Invezz

origin »Bitcoin price in Telegram @btc_price_every_hour

High Voltage (HVCO) на Currencies.ru

|

|