2023-4-12 13:21 |

Crypto market traders and analysts fear Ethereum’s Shapella hard fork could cause volatility in altcoin markets as validators start exiting, albeit in a controlled fashion. Adding to the mix are the unpredictable effects is the release of U.S. Consumer Price Index (CPI) data for March.

Bitcoin and cryptocurrencies are likely to rally if the price of a basket of goods and services shows signs of cooling.

ETH Traders Brace for Potential Crypto Market VolatilityThe Ethereum (ETH) Shapella hard fork, a combination of an execution layer upgrade Shanghai and a consensus layer upgrade called Capella, will go live at block 6209536 on Apr 12.

The upgrade will enable validators who staked ETH on the network’s consensus layer to help secure the network to withdraw their funds.

Anyone could lock up 32 ETH in a smart contract to confirm and broadcast transaction blocks after Ethereum changed from a proof-of-work blockchain to a proof-of-stake chain in September 2022. They could earn up to 5% interest as a reward for doing this work.

The intraday ETH price has been mostly flat, around the $1,870 mark, indicating that traders may be preparing for potential selling pressure that could impact ETH and altcoin markets.

A report by K33 Research suggests that stakers could withdraw 1.1 million ETH in staking rewards. The rewards can be drawn immediately after the upgrade and liquidated using a centralized exchange. The user will remain a validator after this partial withdrawal.

A full withdrawal, which can take up to 60 days in some cases, will remove the validator’s original 32 ETH plus any accrued rewards. The node operator will then cease to become a validator.

Bankrupt crypto lender Celsius is also set to withdraw about 158,000 staked ETH to recover funds for creditors.

Both these withdrawals will amount to $2.4 billion in selling pressure, roughly a quarter of ETH’s 24-hour trading volume.

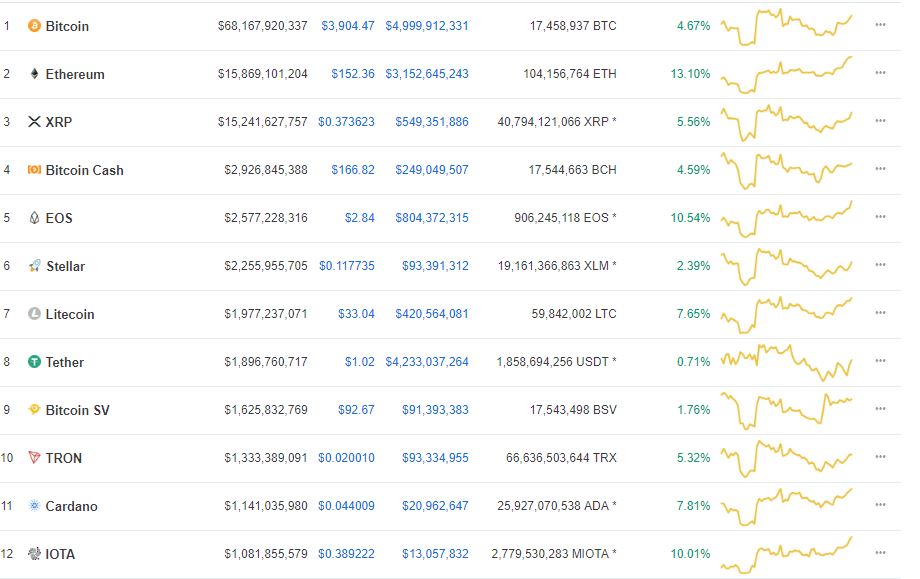

Of the top 10 altcoins by market capitalization, 90% have been underwater in the last 24 hours. Dogecoin (DOGE), Cardano (ADA), Binance Coin (BNB), and Polygon (MATIC) are all down over 3%.

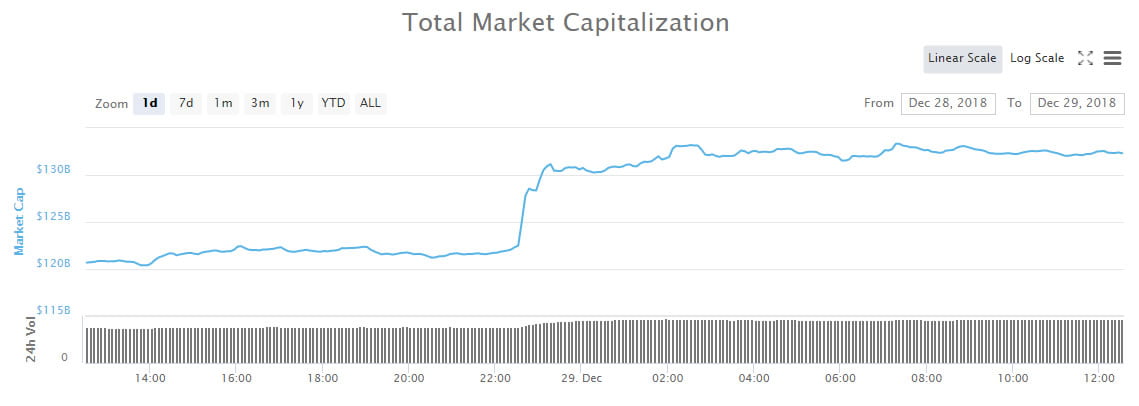

Lower U.S. CPI Likely to Push Altcoins upThe release of U.S. CPI numbers later today will likely cause volatility in the Bitcoin (BTC) market. Investors tend to mine the economic data for clues about easing Federal Reserve (Fed) monetary policy.

Analysts predict an annual U.S. CPI of 5.2% for March, down 0.8% from February’s 6%. Month-on-month inflation is expected to be half that of last month, at 0.2%.

Should this result prove true, Bitcoin’s gains could continue outperforming the Nasdaq and gold. On April 10, Bitcoin rose 4.5%, while the Nasdaq and gold recorded 0.1% and 0.9% declines. According to K33 Research, the Bitcoin pump was likely due to traders on the Chicago Mercantile Exchange shuffling their exposure to BTC.

Bitcoin’s Daily seven-day spot trading volume reached $2.8 billion on April 10, 2023, the lowest trading volume in almost a year. BTCUSDT perps saw bursts in trading volumes during a short-squeeze as Bitcoin rose above $30,000.

Real BTCUSD seven-day Average Volume | Source: K33 ResearchSigns that the Federal Reserve will pause or reduce rate hikes will likely mean that derivatives volume will drive Bitcoin beyond $30,000.

While Bitcoin’s correlation with traditional finance is declining, positive CPI news could also see it outperforming other crypto market indices.

Performance of Weighted Market Cap Indexes | Source: K33 ResearchThe correlation between Bitcoin and altcoins also suggests that a positive BTC response will surge altcoin prices.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

The post Why Crypto Markets Brace for Volatility appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|