2023-9-16 14:13 |

Throughout the pandemic, crypto’s vicious volatility was a mainstay in mainstream media headlines. Today, that is far from the case – not only has volatility dropped severely, but overall volumes, interest and capital in the space has been decimated.

Let’s start with volatility. The below chart plots the 90-day annualised volatility of both Bitcoin and Ethereum since the summer of 2021, when crypto trading was at all-time highs. Since then, the trajectory has been steeply downward.

Most stark has been the fall since the start of this year. Zooming in on the 2023 section of the previous chart now, we can see that volatility has fallen from 53% and 80% for Bitcoin and Ethereum respectively in January, to around the mid-30%’s today for both.

Intriguingly, the crypto markets have been so placid that the volatility gap between Bitcoin and Ethereum has all but disappeared. Historically, the latter operated at a level of volatility above that of the world’s biggest cryptocurrency. This year, however, the gap has been closed significantly. While this could be viewed as a positive for Ethereum, it also sums up quite how muted the overall market has been.

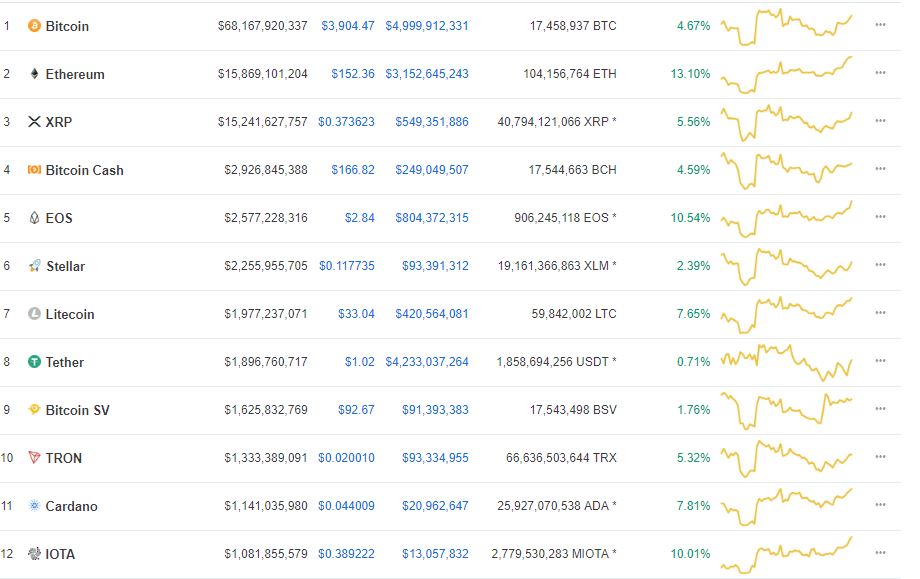

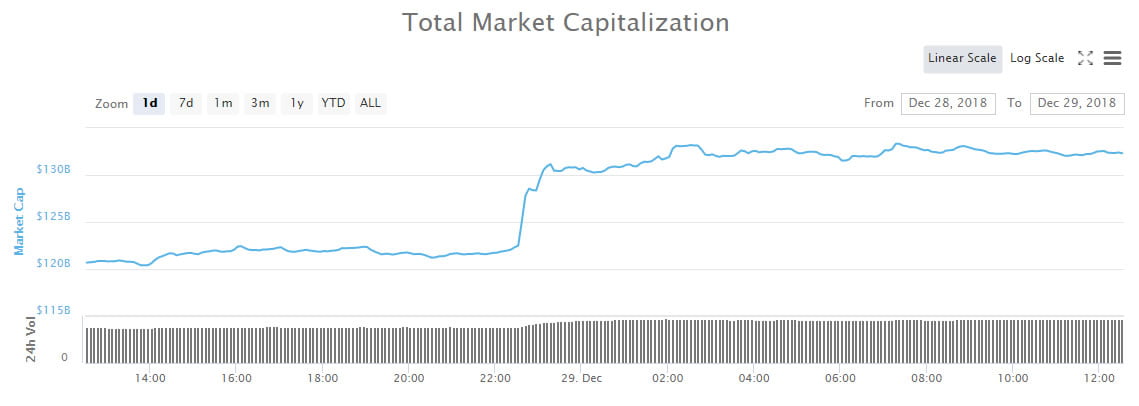

Volatility suppressed off cratering trade volumesWhile traders bemoan the disappearance of this volatility, it really comes down to volume. Activity in the crypto market is now down to its lowest level in four-and-a-half years, a remarkable fact when you consider where the industry was back then. Those days – Q1 of 2019 – saw Bitcoin trading at $3,500, in the midst of a bear market two years removed from the bonanza of 2017, viewed by many as the first time the sector really announced itself to the wider world.

Last month, despite the brief kickup in volatility out of the Grayscale court victory over the SEC, spot trading dropped another 8% to $475 billion, the lowest since March 2019, according to CCData.

Volume in derivatives, which has been more resilient than the spot markets, also dropped 12% to $1.62 trillion. Despite the stouter figure than spot markets, however, it still represents the second-lowest month since 2021. When looking at open interest, a $4.1 billion decline was seen – that is a 20% fall and the sharpest decline in open interest this year.

It really is staggering to what extent the space has been decimated. Looking backwards, the shocking collapse of FTX stands out, unsurprisingly, as a seminal event with regard to liqudity. The below chart from Kaiko demonstrates this well, analysing aggregated market depth for Bitcoin, Ethereum and the top 30 altcoins. Clearly, the demise of prominent market maker Alameda is evident, and this Alameda-sized gap has yet to be replaced, nearly a year on.

It has been an immensely challenging time for both market makers and exchanges. In addition to the obviously suboptimal market conditions, they have also had to fight an increasingly abrasive regulatory battle, with authorities in the US clamping down harshly on the sector.

Bloomberg recently reported that the profit margin of market makers has declined by 30% since the collapse of FTX. At a high level, that figure would appear to make sense when viewed against the backdrop of the liquidity conditions we have talked about here.

It all comes back to macroLike almost anything in crypto, macro conditions are at the heart of the storm.

Various collapses, such as the aforementioned FTX but also a litany of other companies and protocols such as Terra, Three Arrows Capital, Celsius and so on, have obviously been integral to the collapse in liquidity. But the capital drain has also been immensely affected by liquidity conditions across the wider economy.

Bitcoin was only launched in 2009, timed perfectly in retrospect – propelled into one of the longest bull markets in history. With interest rates near-zero and risk assets accelerating all across the financial system, the rising tide carried all boats – and Bitcoin caught at least some of those rising water levels.

But that party is now over. Central banks transitioned to a tight monetary regime as inflation spiralled coming out of the COVID pandemic. Suddenly, T-bills are paying north of 5%.

For a system built upon the assumption that those cheap interest rates would remain indefinitely, while money printers continued to operate effusively, the capital drain has been immense.

Within crypto, combined with its own issues, this has been particularly punitive, with the industry featuring so much speculation and residing so far out on the risk curve. When US-government guaranteed T-bills are paying more than 5%, while crypto prices have been chopped to the extent they have, it is not hard to see why capital continues to remain reluctant to return.

Times will improve, and there are signs that the end of the tunnel may be approaching with regard to monetary policy at least. But for market makers and traders, it has been an extraordinarily exercise to be in crypto markets in recent times. A glance at any of trading volume, volatility or market depth will show you why.

The post Where has the crypto volatility and liquidity gone? appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Inverse Bitcoin Volatility Token (IBVOL) на Currencies.ru

|

|