2018-6-24 00:51 |

Coincidentally, in the days following the hack, there was a large marketwide dip — Bitcoin and Ethereum dropped 11 and 15 percent, respectively.

On a small positive note, Bithumb promised to fully reimburse all those who had cryptocurrency stolen from them.

Many critics argue that EOS is guilty of violating ‘decentralization’ and ‘immutability’, the most basic essences of blockchain technology.

This week, The U.S. Securities And Exchange Commission (SEC) announced it would not be classifying Bitcoin and Ethereum as securities.

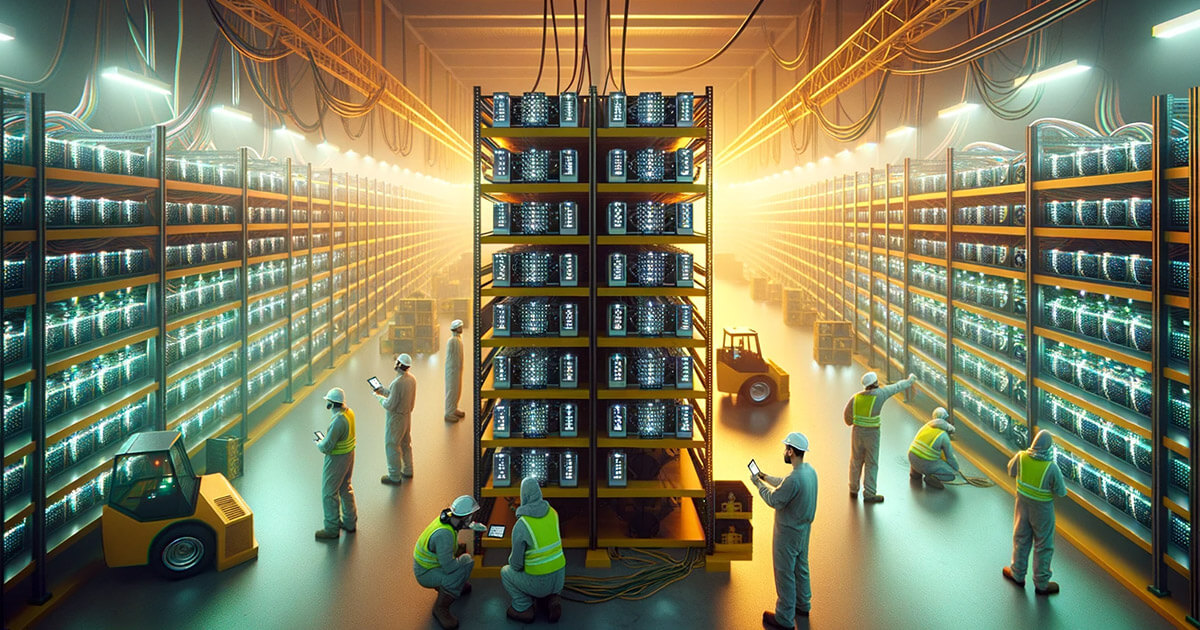

Image courtesy of Twitter, Shutterstock

The post 6 Reasons Why Bitcoin Price is Down — (And Some Positive News Too) appeared first on Bitcoinist.com.

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|