2021-9-14 18:22 |

At the time of this report, the cryptocurrency market is suffering major losses in the last 24 hours. The standard cryptocurrency Bitcoin is not exempt from the bearish storm that struck itself and the majority of the leading altcoins.

Bitcoin currently trades at a price of $44,121, as losses continue to increase. The market lost momentum mid-last week when billions were liquidated from the Bitcoin market. The result has left investors panicking, but institutional firms like MicroStrategy show themselves to be unfazed by the bloodbath.

MicroStrategy ignores bear storm, acquires over $200 million worth of BitcoinReiterating its bullish stance on the market, the enterprise business intelligence (BI) application software vendor led by popular Bitcoin proponent Michael Saylor has bought $242.9 million worth of Bitcoin this month. The purchase was made at an average price of $48,099 per Bitcoin, making it an extra 5,050 Bitcoins added to the company’s total holdings of 114,042 bitcoins, acquired for $3.16 billion, at an average price of $27,713 per bitcoin.

If it wasn’t previously clear where MicroStrategy stood with Bitcoin, the company’s constant purchase of the asset during major market dips is changing that. As Saylor had stated repeatedly, the company is in for the long term.

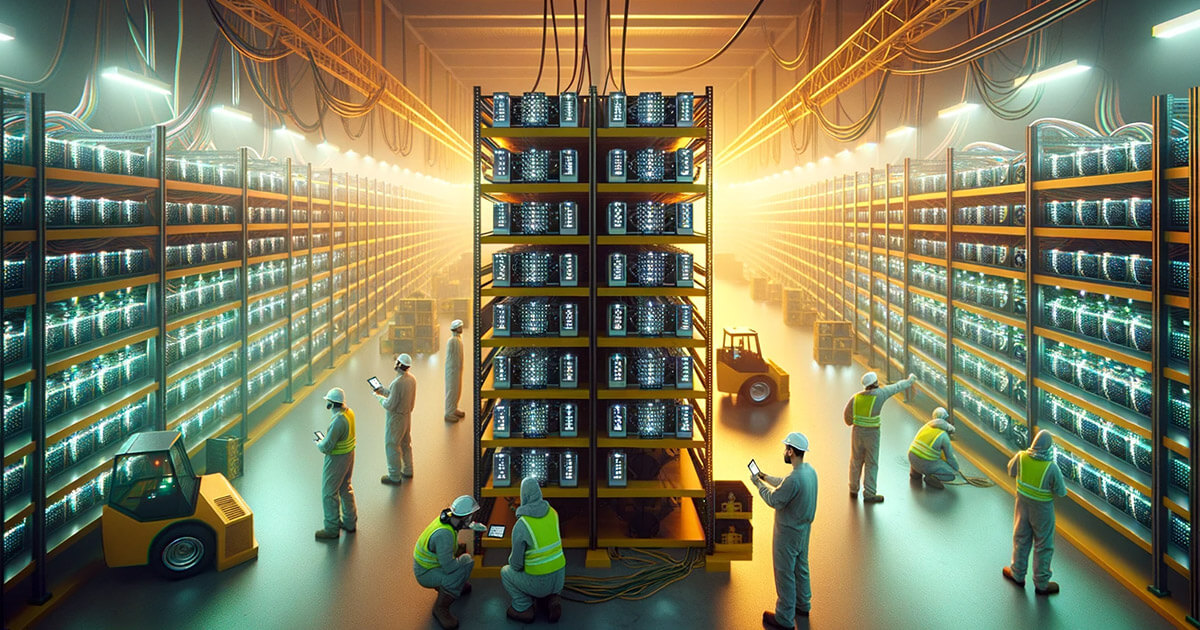

Aside from heading the company with the highest Bitcoin holding, Saylor is also a staunch Bitcoin evangelist who continues to preach the relevance of Bitcoin in today’s market. With recent reports about Bitcoin’s energy consumption spike sparking a debate between proponents and critics, Saylor has taken to Twitter to back up his favorite cryptocurrency, explaining that Bitcoin’s energy usage is nowhere near excessive.

“Bitcoin does not consume electricity to process transactions. Bitcoin transactions on Layer 2 platforms like Lightning or Layer 3 applications like CashApp are instantaneous & effectively free. The electricity is used to secure the network and ensure its integrity over time.”

Another interesting take was shared in a response tweet to the report that the Canadian government is going to ban foreign ownership in Canada for the next two years and tax the existing vacant, foreign-owned properties. He proposes digital property ownership as the solution, adding that Bitcoin is the pathway through.

“This policy deprives foreigners of their property rights and impairs the value of all residential property in Canada, thereby destroying wealth. This is why investors need to replace real property with digital property. Bitcoin is hope for Canada.”

origin »Bitcoin price in Telegram @btc_price_every_hour

Global Cryptocurrency (GCC) на Currencies.ru

|

|