2020-1-28 14:00 |

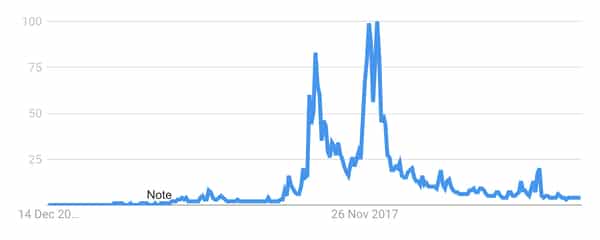

Crypto markets have been bullish for the past couple of days but Ethereum is still not getting the momentum it needs. This begs the question as to why ETH is still flat when DeFi is booming. Since the weekend over $20 billion has flooded back into crypto markets raising total capitalization to $250 billion once again. The majority of that momentum has been driven by bitcoin as usual with a push past $9,000 today. Ethereum has made some gains but is still largely on the back foot, and bearish below $200. ETH has made a couple more percent today as it inches towards $175 but it is still in the depths of a two-year bear market that even rapidly expanding DeFi markets cannot break it free from. DeFi Not Helping Yet Decentralized finance keeps making new highs, this week the total value locked in USD hit an all-time high of $845 million according to defipulse.com. The amount of ETH locked up is also at a peak with 3.2 million or almost 3% of the total supply. MakerDAO is leading the way with a market share of 57% and it is not surprising to see why. Maker’s DAI Savings Rate (DSR) is currently 7.75% which can be had by simply holding dollar-pegged DAI which can be exchanged with ETH. This trounces on any high street bank offerings, most of which are less than half a percent, or even negative interest. With such attractive investment opportunities, it begs the question as to why ETH prices are still so bearish. There are some possible reasons why the Ethereum bears still have such a strong grip over the markets. Ethereum Bears Still Resilient Ethereum is currently priced at mid-2017 levels, a whopping 87.5% down from its all-time high this time two years ago. It is still in the depths of a two-year bear market and until it can crack $400 again will remain there. Longhash has reached out to crypto-asset research firm Delphi Digital’s Anil Lulla and Yan Liberman for more insight. The main reason for Ethereum’s weakness at the moment, according to the pair, is that DeFi markets are generating a fraction of the interest that the ICO boom did in late 2017. Some 16 million ETH was raised via ICOs from mid-2016 to mid-2018 at a time when the Ethereum supply was lower than today’s level of 109 million. The amount locked in DeFi is just a fraction of this and mostly from people already involved in crypto – not new money. “Put simply, none of these DeFi projects are attracting new capital to flow into ETH as buying pressure,” Delphi Digital revealed at the time that 60% of the ETH raised via the ICOs they tracked had been sent to exchanges which caused the price to collapse during 2018. It never really recovered in 2019 when the majority of altcoins suffered at the expense of bitcoin. So, in conclusion, only when new capital from those not already holding ETH starts flowing into DeFi will Ethereum prices begin to recover. This could happen in 2020 when DeFi markets top $1 billion and start attracting bigger investors. Further earning opportunities with new ETH staking options may also drive new money into the asset this year. Will ETH prices recover this year as DeFi grows? Add your comments below. Images via Bitcoinist Media Library The post appeared first on Bitcoinist.com. origin »

Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|