2020-1-14 15:00 |

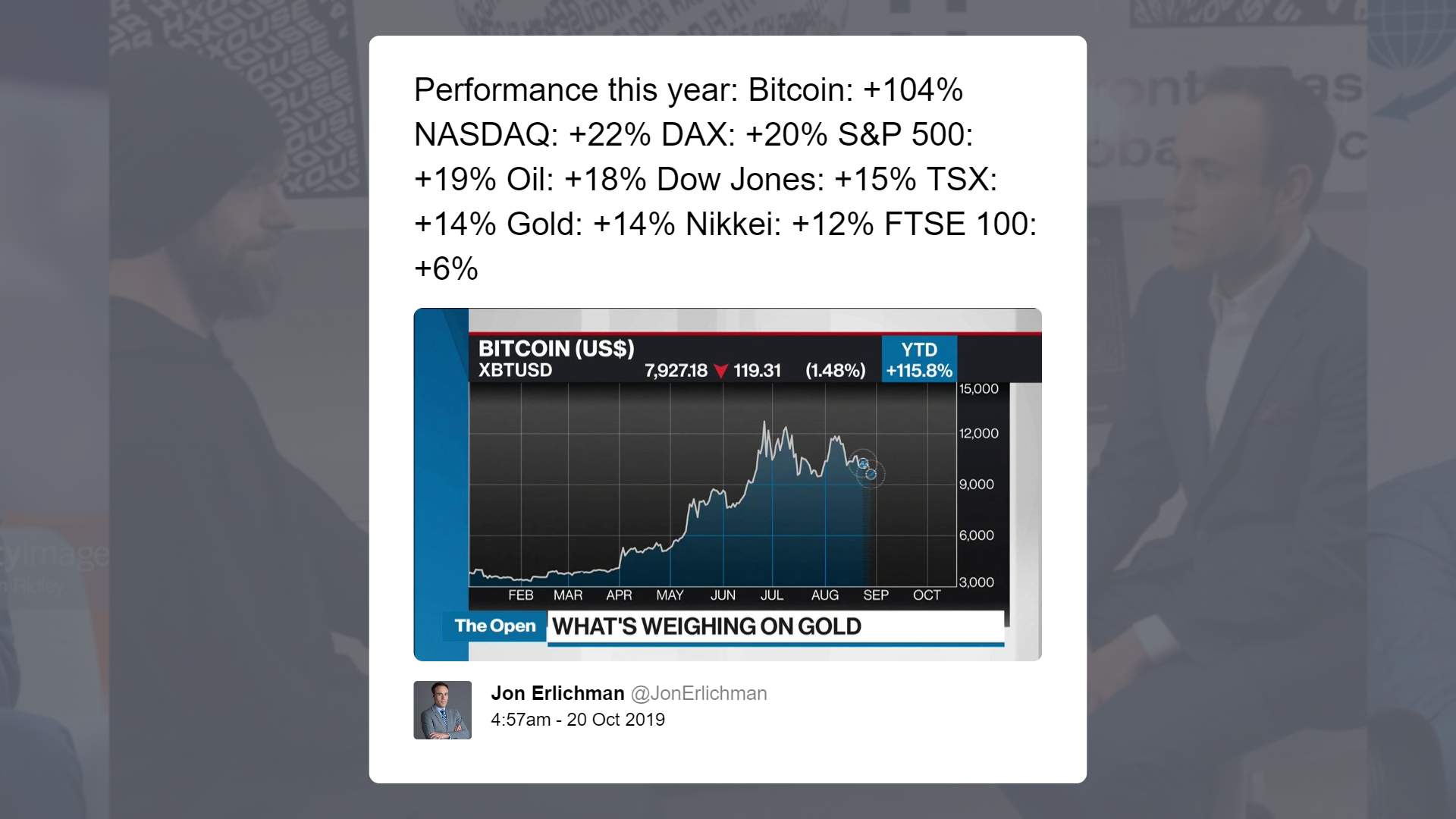

For months and months, Ethereum (ETH) has been in the trenches of a bear trend. Even in 2019, when global markets saw near-record gains and Bitcoin gained 90% in 12 months, the second-largest cryptocurrency by market capitalization posted a loss, managing to underperform effectively everything. Related Reading: This Late Night Host Just Exposed Millions to Bitcoin, Again And since peaking near $1,400 at the start of the bear market in 2018, the cryptocurrency has fallen by literally 90%, crumbling under the pressure of a market recentralizing in BTC. But, according to a prominent cryptocurrency trader, the macro downtrend may soon end, if Ethereum can break this one key level that is. Ethereum Needs to Break $200 Prominent cryptocurrency trader Dave the Wave recently noted that while Bitcoin’s strong pump has pushed Ethereum and its ilk higher today, ETH remains a far way from a macro downtrend line that has constricted upward price action for over a year now. He noted that for ETH to break this downtrend, it will need to push around 35% higher from current levels and surmount $202, which would allow it to break past a number of key resistances, leaving it in the open air. One the maximalists won't want to see. Will ETH beat BTC in breaking out it's macro downward trendline? pic.twitter.com/O8Xwvp1UjH — dave the wave (@davthewave) January 14, 2020 Related Reading: Crypto Tidbits: Elon Musk Pokes Bitcoin Bear, Japanese Giants Delve Into Cryptocurrency Mining, Baidu’s Blockchain Beta Technicals Suggest It’s Possible While $200 may seem far away, it’s purportedly possible. Cryptocurrency trader CryptoWolf recently noted that Ethereum’s price, with the latest price action, has allowed the cryptocurrency to break above a seven-months falling wedge chart structure. Due to the magnitude of the importance of this chart pattern, the turning of the wedge into support could lead to ETH pressing much higher than it is now. ETH breaking 7-months FW structure. pic.twitter.com/Qhkm92yXGe — CryptoWolf (@IamCryptoWolf) January 11, 2020 Not to mention, fundamental metrics suggest that growth is imminent. A Twitter user recently shared the below chart, writing that “Ethereum’s network growth is on an upward trend.” Indeed, per their chart, network growth, defined by the number of new addresses created each day, has recently surged to levels not seen since the top of 2019’s bull run. Ethereum's network growth is on an upward trend. pic.twitter.com/rsjGAA0Ura — Adam Ship (@AdamSophrosyne) January 8, 2020 Although the number of new Ethereum addresses may not seem to related to ETH’s price on the surface, the user’s chart shows that there is a clear correlation between the two metrics, with address count growth seemingly preceding price action. Due to this historical correlation, the rapid growth seen in this metric could imply that the second-largest cryptocurrency has extreme upside potential ahead of itself, upside that may take it back towards $200 and $300. Featured Image from Shutterstock The post appeared first on NewsBTC. origin »

Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|