2018-7-5 22:12 |

The only major Wall Street strategist to issue price targets on Bitcoin, Tom Lee, has recently told the media that he sees the price of the token at the end of the year at about $20,000 USD per unit, which is about 20% less than his last estimative.

According to the specialist, Bitcoin historically is traded at 2.5 times its mining costs, which would make up for the value. While he does not deny that it could be over $20,000, his last prediction was $25,000, which means that even the people who believe in the potential of Bitcoin are toning down a bit on their predictions for the future.

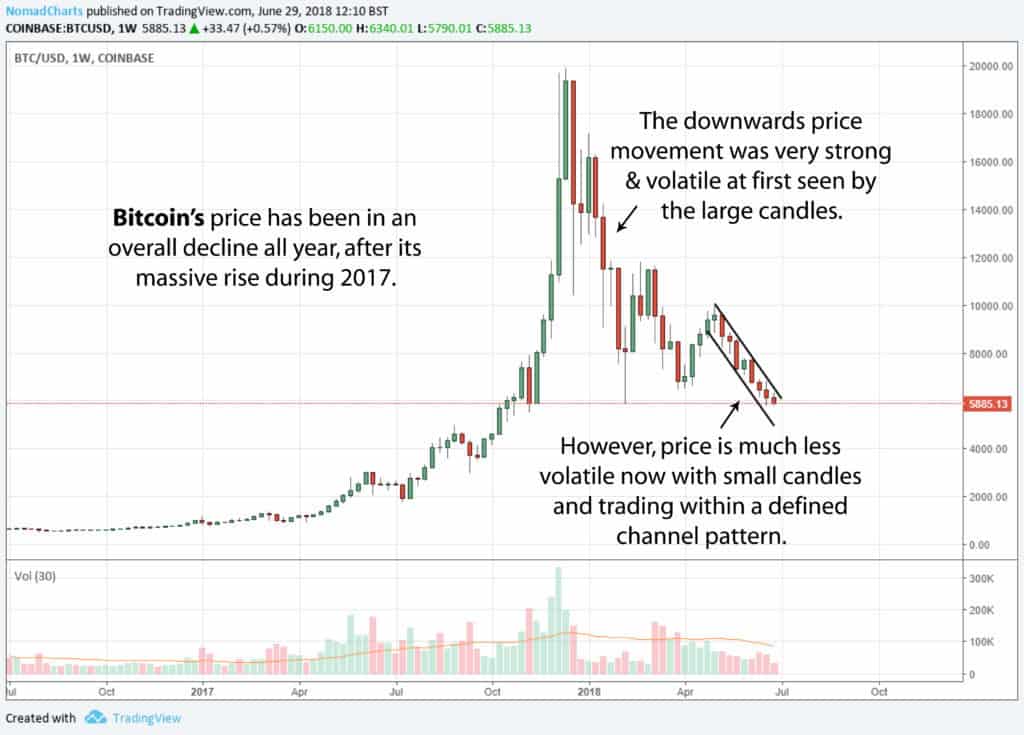

$20,000 Is Still Good Price For InvestingAccording to the trader, $20,000 USD is not a bad price for investors. While less than it used to be, it would still be about 200% higher than the current price of the token, about $6,600. This means that if you buy right now, you still have some window to get a lot of profit until the end of the year. Bitcoin has recently reached almost $10,000 in May, but have recently lost a lot of value.

Lee believes that the difficulty of mining tokens will only increase with time going up from about $7,000 USD per token to $9,000 USD. This means that the price of Bitcoin will be even higher in 2019. As Bitcoin has a cap of 21 million tokens and about 80% of them have been mined, mining costs will increase exponentially.

The trader stated that blockchain and Bitcoin are a multi decade story that is only beginning. According to him, the industry will change over time.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|