2024-3-19 15:00 |

The flagship cryptocurrency, Bitcoin, dropped below the $63,000 mark in the last 24 hours and is currently on a price correction, having recently hit a new all-time high (ATH) of $73,750. This price dip is believed to be due to several factors, including the Bitcoin Halving, which is fast approaching.

Bitcoin Price Is In The Second Phase Of The Halving TrendCrypto trader and analyst Rekt Capital recently provided insights into the four phases of Bitcoin Halving, which provides a plausible explanation for Bitcoin’s recent decline. He suggested that Bitcoin was entering into the ‘Final Pre-Halving Retrace,’ having just concluded with the ‘Pre-Halving Rally.’

This ‘Final Pre-Halving Retrace’ is said to occur 28 to 14 days before the Halving event. However, it looks to have come earlier this time around (just like the Pre-Halving Rally), with the Halving still about 30 days away. Rekt Capital alluded to the Pre-Halving retrace in 2016 and 2020 when Bitcoin pulled back by 38% and 20%, respectively.

Bitcoin has already pulled back over 11% in the past week. Interestingly, the analyst noted that this phase of the Halving can last “multiple weeks and up to 77 days.” Rekt Capital, however, expects it to be much shorter than historical ones. He added that this year’s Pre-Halving Retrace “would more likely be on the shallower side than on the deeper side.”

Long-Term Bitcoin Holders Are Taking ProfitAlex Thorn, Head of Research at Galaxy Digital, highlighted in an X (formerly Twitter) post that long-term Bitcoin holders are starting to sell. This is evidenced by different metrics, such as the movement in coins that had stagnated for over a year.

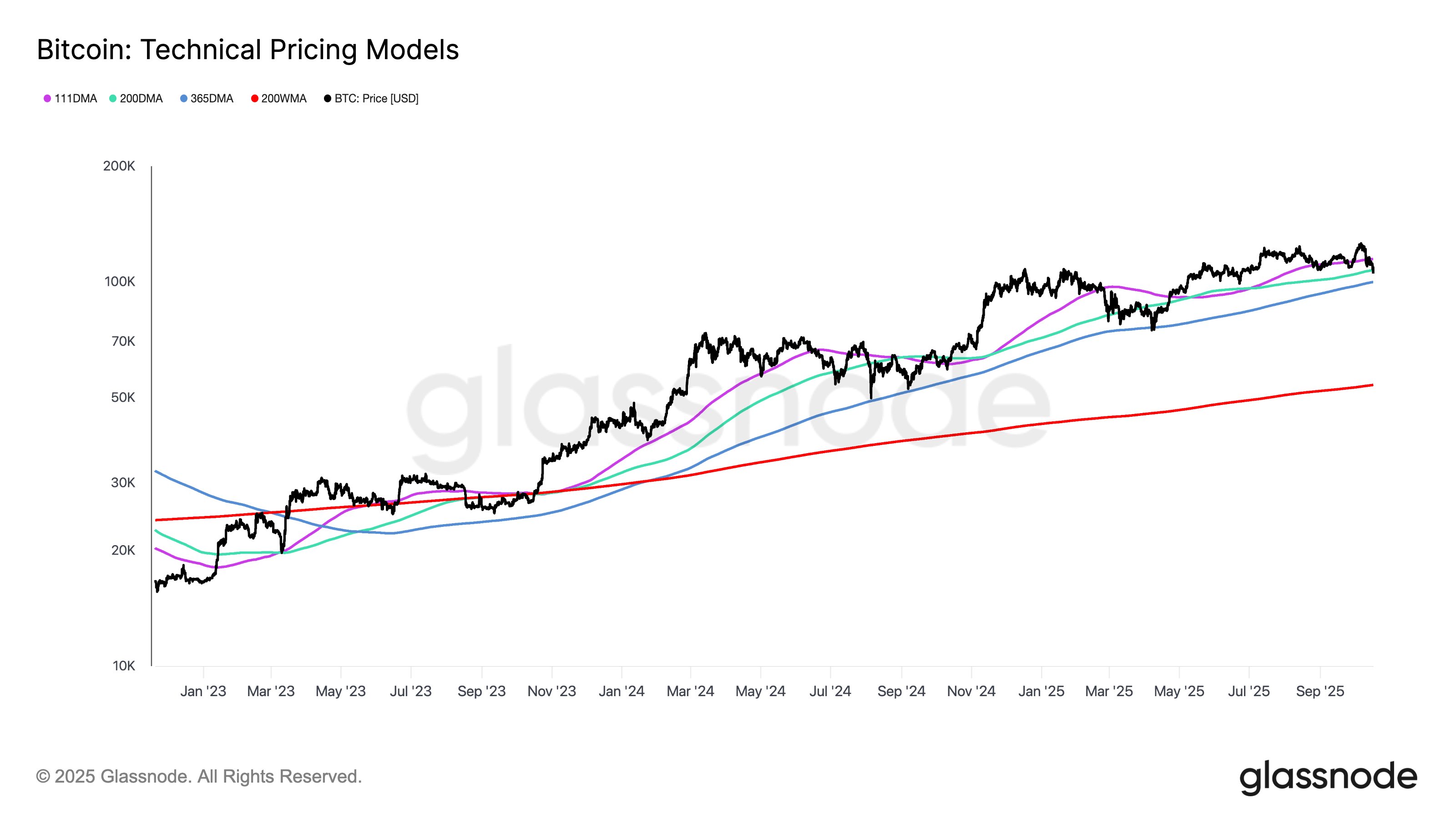

Crypto analyst Ali Martinez previously alluded to this wave of profit-taking, noting data from market intelligence platform Glassnode, which showed that those holding over 1,000 BTC were increasingly cashing out. This has also led to a 4.83% drop in this category of BTC addresses this past few weeks.

Thorn, however, sounded optimistic about Bitcoin’s future trajectory in his post, noting that new whales are entering (through the Spot Bitcoin ETF market) as some others are exiting. He also suggested that some of these whales aren’t exactly leaving the market but selling their spot BTC and investing in Bitcoin ETFs instead.

Bitcoin Sentiment Is Currently BearishData from Coinglass shows that the bears currently have the upper hand, with almost $82 million in long positions liquidated in the last 24 hours compared to just about $23 million of shorts liquidated during the same period.

There has also been a decrease in open interest on these exchanges, which suggests that traders are choosing to stay out of the market at the moment. Therefore, activity in the derivatives market shows that the current outlook for Bitcoin is bearish, with many still expecting further declines.

At the time of writing, Bitcoin is trading at around $63,000, down over 4% in the last 24 hours according to data from CoinMarketCap.

origin »ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|