2026-1-15 11:00 |

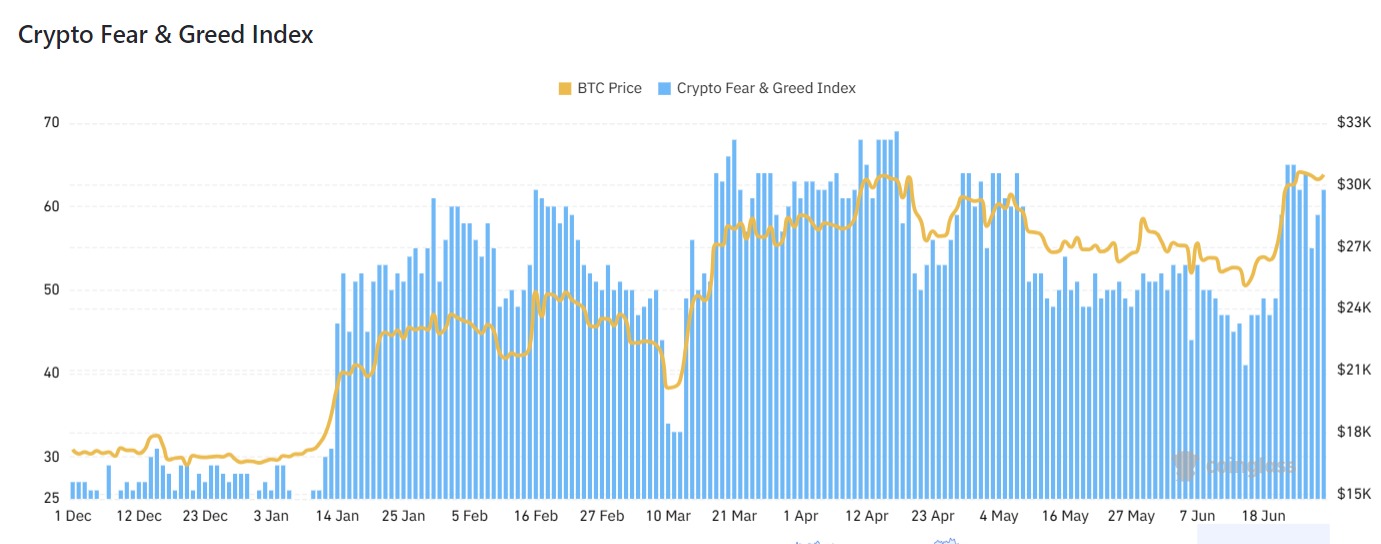

Sentiment in the Bitcoin market has marked an improvement recently as the Fear & Greed Index has surged into the neutral zone for the first time in months.

Bitcoin Fear & Greed Index Is Now Pointing At ‘Neutral’The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the average sentiment present among traders in the Bitcoin and wider cryptocurrency markets. It determines the investor mentality using the data of five factors: market cap dominance, trading volume, volatility, social media sentiment, and Google Trends.

To represent the sentiment, the index makes use of a numerical scale running from 0 to 100. All values below 47 correspond to fear among the investors, while those above 53 reflect the dominance of greed. The metric being between the two cutoffs suggests a net neutral sentiment.

Now, here is how the current market sentiment is like, according to the Fear & Greed Index:

As is visible above, the index has a value of 48 right now, indicating that sentiment around Bitcoin is neutral. This is a sharp change from how the market mood looked just yesterday.

The Bitcoin Fear & Greed Index had a value of 26 on Tuesday, which means that the investor sentiment was deep inside the fear zone. The reason behind the turnaround in trader mood has been the coin’s recovery rally, which has now taken its price beyond the $97,000 level.

Since the Fear & Greed Index hasn’t made it into the greed zone yet, investors still look to be hesitant about embracing the bullish price action. In the past, the cryptocurrency market has often tended to move against the expectations of the majority, so the fact that traders aren’t outright greedy yet could actually be a positive sign for the rally’s sustainability.

That said, the latest jump in sentiment has been a rapid one, so the indicator could be to keep an eye on in the coming days, as a venture into the greed zone could very well be next.

The current break into the neutral zone reflects the first time since late October that the Fear & Greed Index has surged into the region. A greedy sentiment hasn’t been witnessed since the first half of October, more than three months ago.

In some other news, the new Bitcoin recovery run has triggered a large amount of liquidations, as revealed by on-chain analytics firm Glassnode.

“Across the top 500 cryptocurrencies, the latest move triggered the largest short-liquidation event since 10/10,” explained Glassnode.

BTC PriceAt the time of writing, Bitcoin is floating around $97,500, up more than 7% in the last seven days.

origin »Bitcoin price in Telegram @btc_price_every_hour

Blockchain Index (BLX) на Currencies.ru

|

|