2026-1-17 09:00 |

On-chain data shows Bitcoin short-term holders have transferred a large amount of tokens to exchanges alongside the asset’s recovery rally.

Bitcoin Short-Term Holders Have Made Profit Transactions To ExchangesIn a new post on X, CryptoQuant community analyst Maartunn has talked about the latest trend in the exchange deposit transactions of Bitcoin short-term holders (STHs).

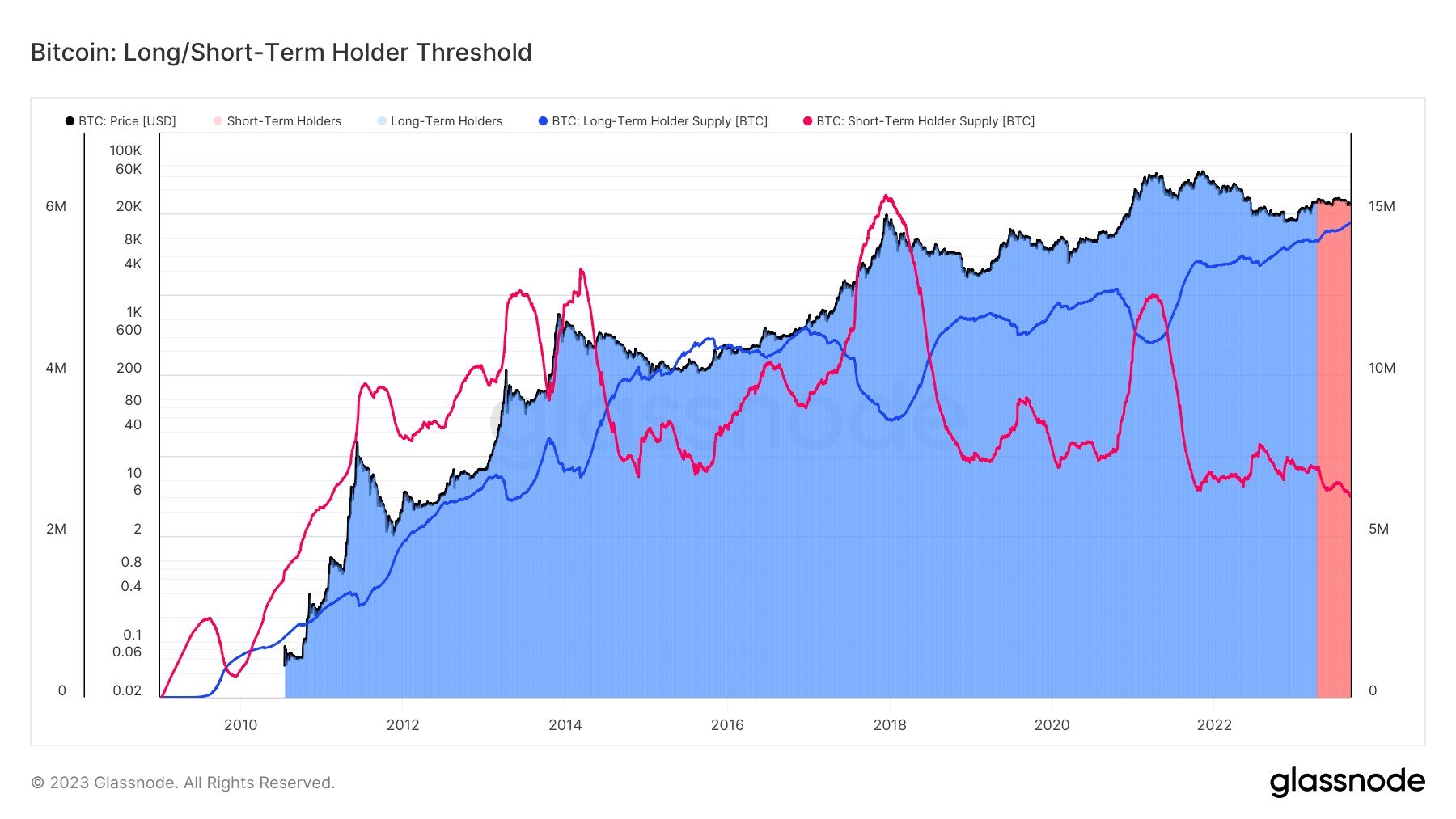

STHs include the BTC investors who purchased their coins within the past 155 days. They make up for one of the two main sides of the network divided on the basis of holding time, with the other side being known as long-term holders (LTHs).

Historically, the STH cohort has proven to represent the weak hands of the market, who easily react to market volatility. In contrast, LTHs include the diamond hands of the sector.

Bitcoin has witnessed a recovery rally recently, so, considering the track record of STHs, some selling from them is likely to have occurred. One way to track distribution from the group is through its exchange inflow data.

Below is the chart shared by Maartunn that shows the exchange deposit transactions that Bitcoin STHs have made over the last couple of months.

In the graph, the STH exchange inflows are shown separately for profit and loss transactions, based on whether holders held an unrealized gain or loss before sending the tokens to exchanges.

From the chart, it’s apparent that the 24-hour sum of the STH exchange deposit transactions in profit has shot up as the cryptocurrency has gone through its rally, reaching a high of 41,800 BTC. Meanwhile, loss exchange inflows have shrunken, falling to a low of 1,800 BTC. Thus, it would appear that selling focus from STHs has largely shifted to profit-taking.

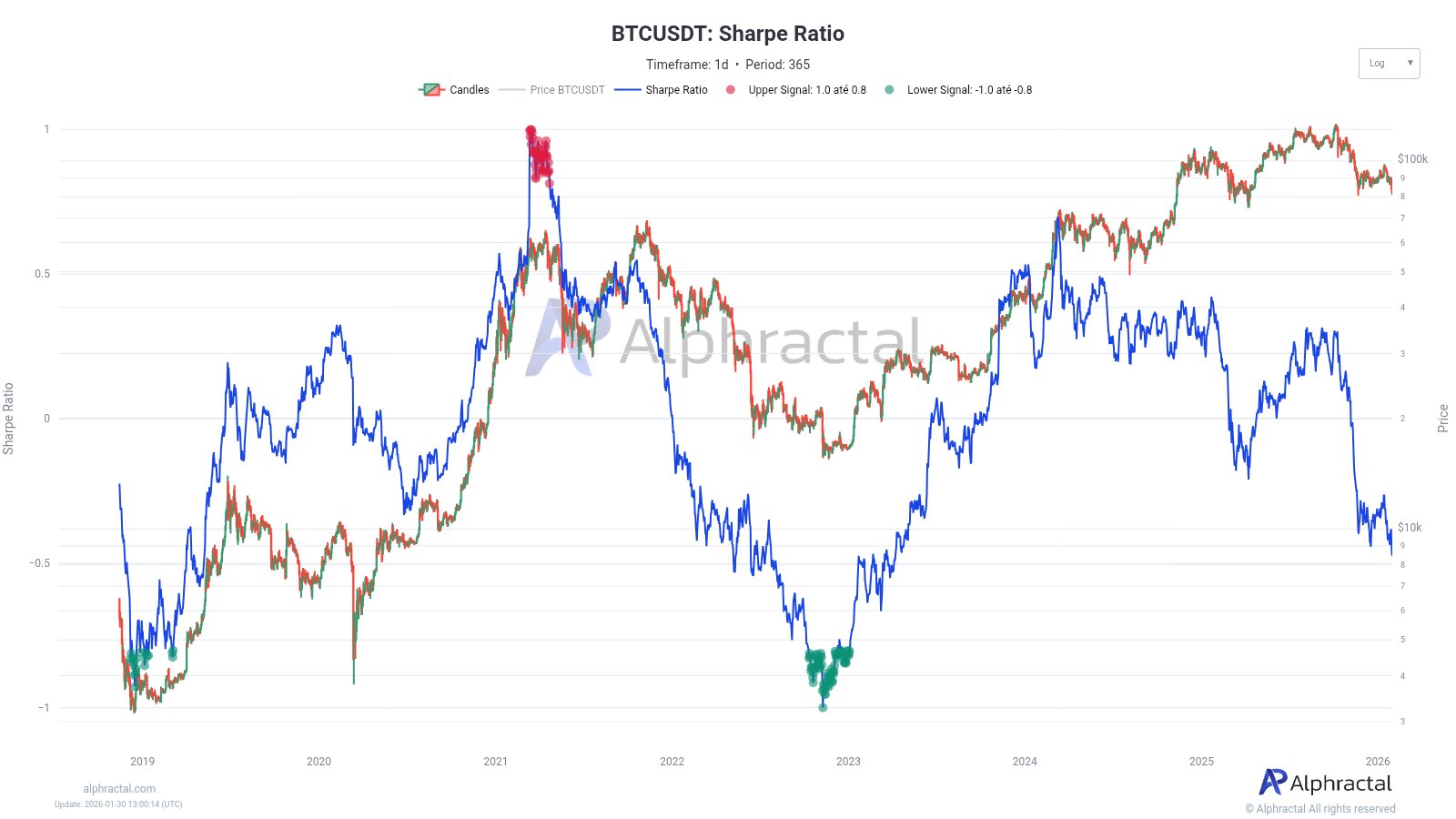

Though, while some STHs may be harvesting profits, the cohort has a whole is still in a state of net unrealized loss as Bitcoin is trading below the STH Realized Profit, as highlighted by the analyst in another X post.

The “Realized Price” is an on-chain metric that measures the average cost basis of Bitcoin investors or addresses as a whole. The STH version specifically tracks the break-even level of the supply purchased within the past 155 days.

As displayed in the above chart, the Bitcoin spot price plummeted under the STH Realized Price during the drawdown of Q4 2025. Since then, it has remained under the line, although the latest rally has brought it close. Currently, the indicator’s value is situated at $99,412.

BTC PriceBitcoin has gone down since its high above $97,000 earlier in the week as its price is now trading around $94,600.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|