2024-4-3 14:29 |

Quick Take

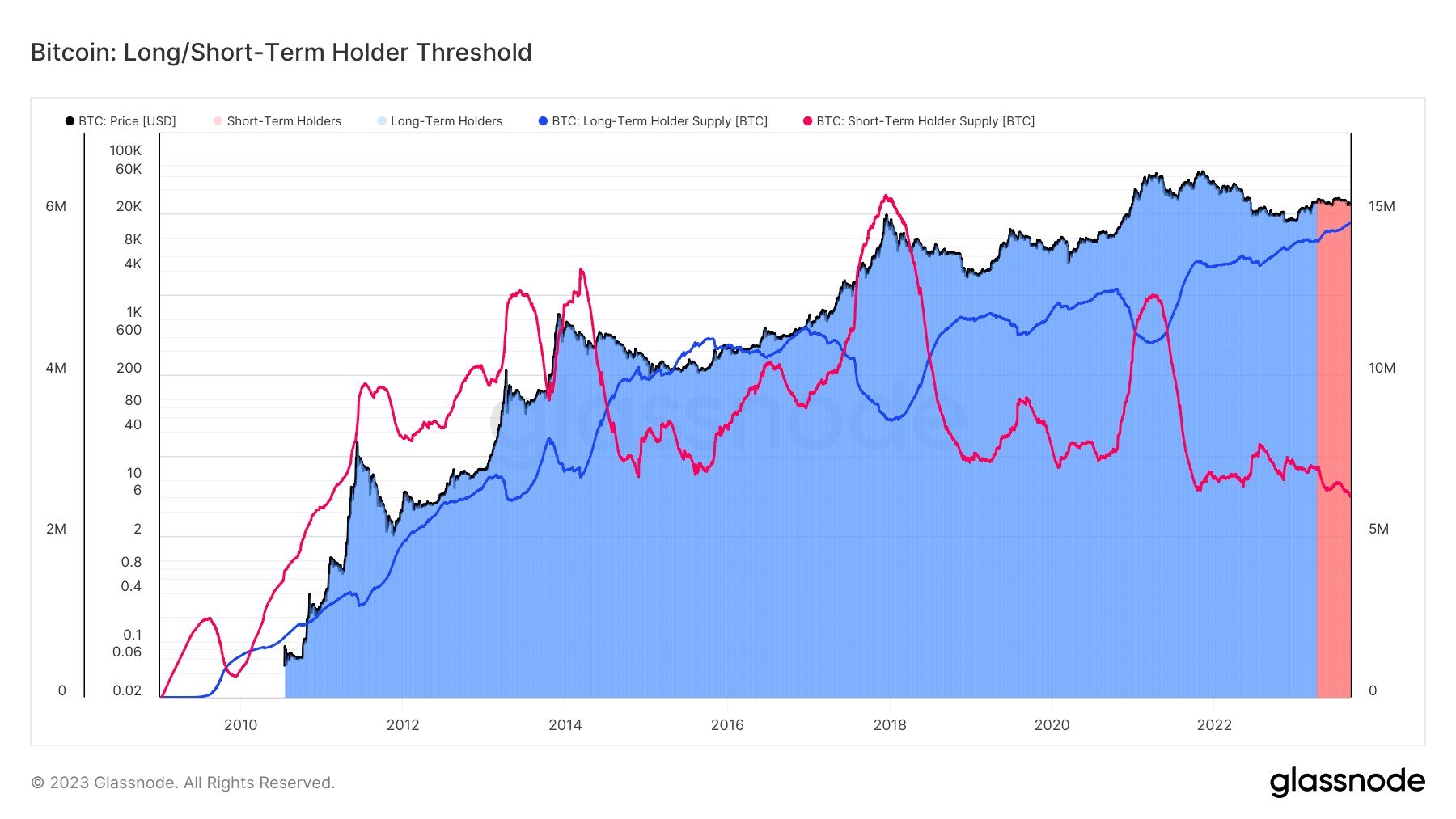

As Bitcoin’s price has surged roughly 50% since the beginning of 2024, data from Glassnode reveals a noteworthy pattern in behavior among short-term holders (STHs), defined as investors holding Bitcoin for less than 155 days, who tend to exhibit a pattern of fear and greed—buying high and selling low.

Glassnode data shows that during the past two days of April, as Bitcoin experienced a 2.4% dip on Apr. 1, followed by a 6% decline on Apr. 2, a substantial $5.2 billion, equivalent to roughly 76k Bitcoin was sent to exchanges at a loss by STHs.

Short-Term Holders in Loss to Exchanges: (Source: Glassnode)In contrast, only around $570 million in profits was sent to exchanges by this group on Apr. 2—a figure that represents one of the lowest levels observed this year.

This pattern reflects the emotional behavior commonly observed among STHs. While significant profit-taking was evident when Bitcoin reached new all-time highs last month, the recent sell-offs at losses indicate the fear and capitulation that frequently affect short-term speculators during market downturns.

Short-Term Holders in Profit to Exchanges: (Source: Glassnode)The post Emotional trading patterns hit short-term Bitcoin holders’ wallets appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|