2020-11-24 20:44 |

The recent bitcoin price rally has put around 97% of all BTC held in wallets into profit. However, not all crypto-asset holders are as close to being ‘in the money.’

Leading DeFi tokens remain much further below their current all-time highs than bitcoin. For example, almost half of YFI holders bought at higher prices.

Bitcoin at $18,600, Only 0.11% of Addresses Aren’t Yet ‘In the Money’Bitcoin has rallied hard over recent weeks. The leading digital asset opened Nov. trading around $13,800. Just over three weeks later, a single bitcoin now trades at more than $18,600.

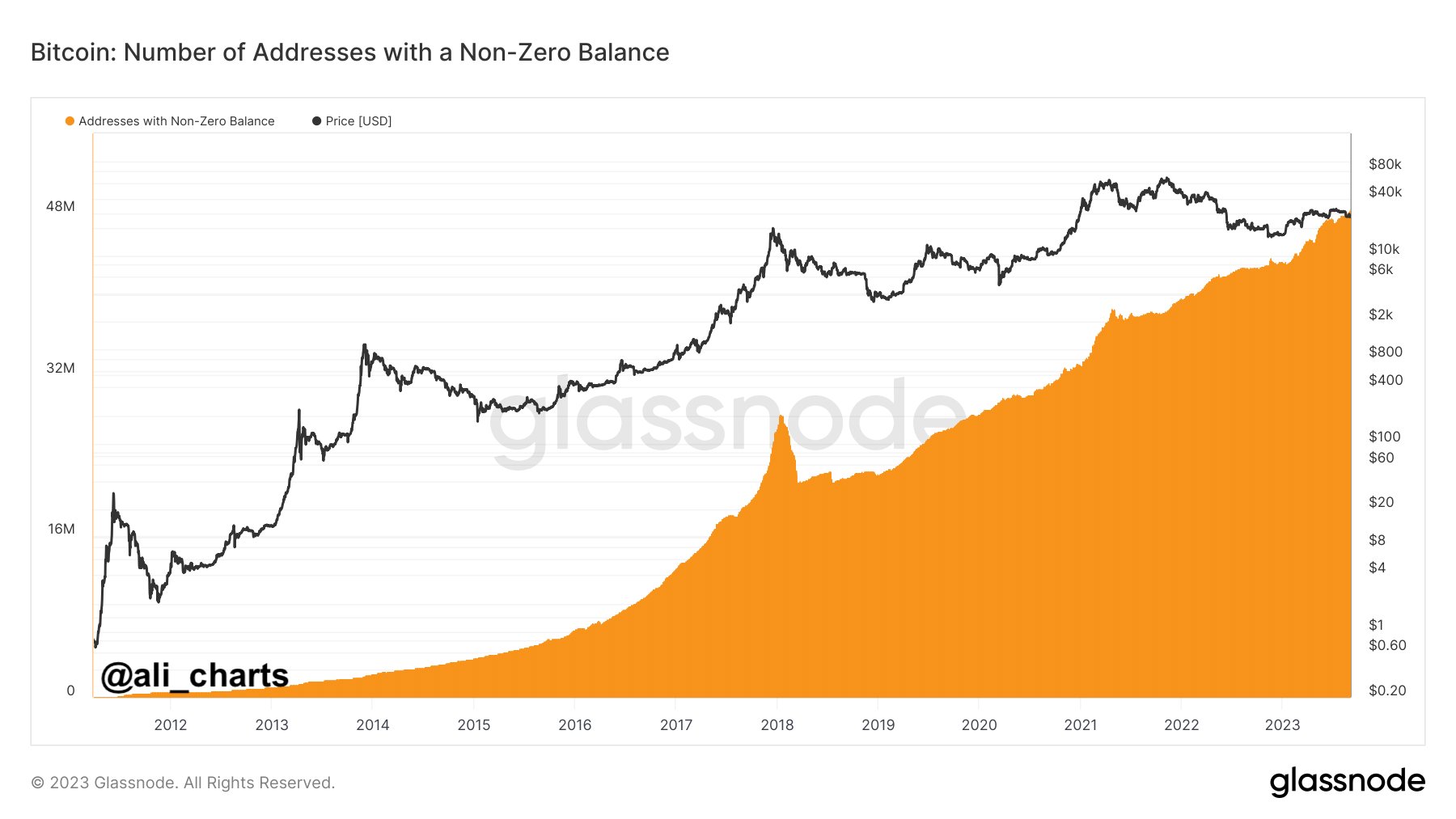

According to cryptocurrency market analysis firm Into the Block, more than 97% of all addresses now have an average entry point lower than today’s price. The company’s ‘In the Money’ indicator shows that owners of 31.88 million addresses could currently sell their holdings for a profit.

For any address with a positive balance, @intotheblock identifies avg price at which tokens were acquired, indicating if the address is at profit or loss.

Addresses at profit:$BTC 97%$ETH 88%$LINK 85%$LTC 73%$YFI 54%$AAVE 62%$WBTC 80%$ADA 79%$MKR 70%$SNX 62% pic.twitter.com/jHk17HEJHC

Into the Block also claims that just 0.11% of the analyzed addresses received BTC at a higher average price. With bitcoin now trading around $1,000 lower than its 2017 all-time high, that represents just 35,730 addresses.

The indicator also shows that 2.67% of addresses acquired their bitcoin when the price was between $17,945 and $18,771. The firm deems these 874,760 addresses as being ‘in the money.’

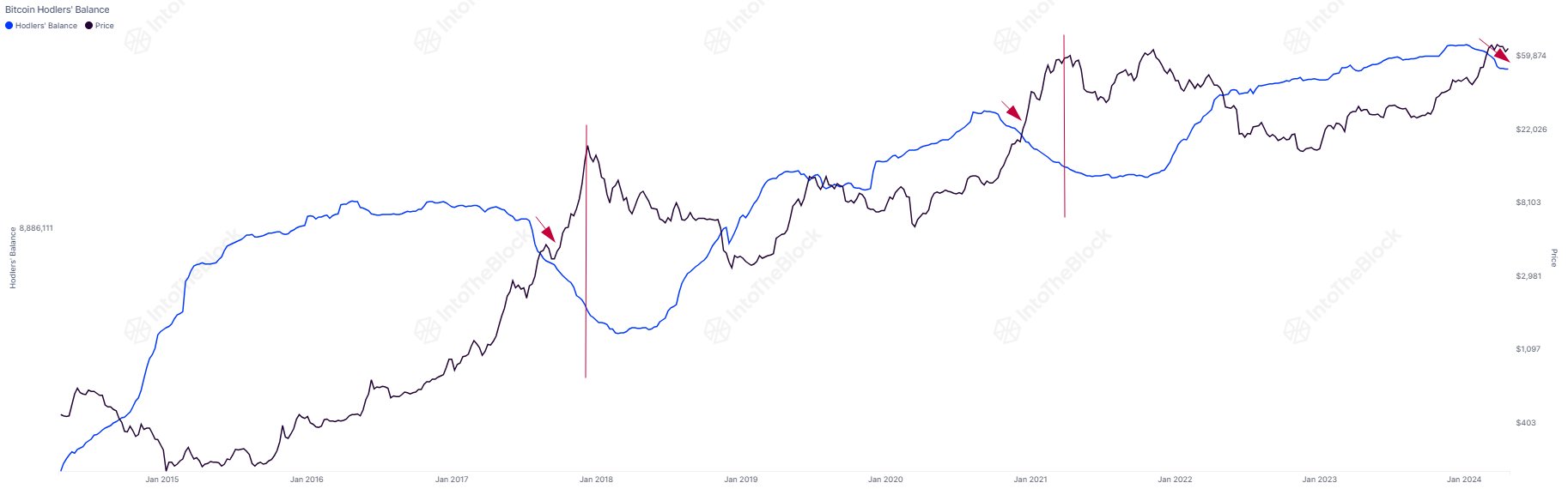

Many DeFi Holders Still Under WaterThe Into the Block figures show that a greater percentage of holders of other cryptocurrencies are still ‘out of the money.’ ETH, LINK, ADA, and LTC wallets, for example, are 88%, 85%, 79%, and 73% ‘in the money’ respectively.

The much hyped DeFi sector is, on the other hand, showing some notable laggards. Only 62% of SNX and AAVE wallets would sell at a profit today. Meanwhile, only 54% of YFI wallets are ‘in the money.’

With the DeFi sector having experienced its own bubble of sorts this summer, and most protocol tokens launching after the 2017 bull run, many now trade well below their all-time highs. For example, YFI hit its high price of around $43,300 on Sept. 13.

Following its peak, Yearn.Finance traded down to a low of around $8,500. Despite a recent rebound, its current price of $25,250 still has many holders ‘out of the money.’

The post 97% of Bitcoin Addresses in Profit, but Many DeFi Holders Still Down appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|